Are Lab-Grown Diamonds a Good Investment?

Over centuries, diamonds have been admired for their association with prestige and wealth.

Much like other commodities such as gold, silver, and platinum, the market value of diamonds fluctuates based on their demand as a commodity. When new diamond mines are discovered, prices can dip due to increased supply, but value surges when demand rises, adhering to the fundamental law of supply and demand.

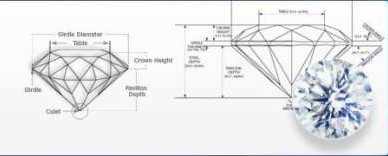

Mined gemstones, due to their limited supply on Earth, tend to maintain their value or appreciate over time, making them an appealing investment option. In contrast, lab-grown diamonds, though physically and optically indistinguishable from mined counterparts, lack the same scarcity factor, impacting their resale value.

As for lab-grown diamonds, their investment potential is less predictable, primarily because they don't share the same scarcity as mined diamonds. While they may not offer significant resale value, they come with their unique advantages. These man-made gems, created using responsibly sourced materials in a socially responsible manner, are not associated with the ethical concerns often tied to mined diamond mining. Moreover, they tend to cost around 30% less than mined stones of similar quality and size, making them an attractive choice for many buyers.

The lab-grown diamond is never a financial investment. It is a luxurious item that symbolizes meaningful connections and commitment.

In summary, the value of diamonds extends beyond their financial worth, but for those considering them as investments, mined diamonds have historically demonstrated better potential for retaining or appreciating in value. Lab-grown stones, while lacking the same resale value, offer a host of advantages that align with modern preferences and ethical considerations, often making them a compelling choice for buyers.