Lab-Grown Diamonds in the UAE: Market Guide & Best Retailers

Author: Alex K., CMO at Labrilliante Updated: 2025-11-04 Reading Time: 6 minutes

Lab-grown diamonds offer UAE buyers 70-97% savings versus mined equivalents through factory-direct channels. CVD and HPHT production methods create chemically identical stones—certified by IGI and GIA—with AED 2,200-3,500 pricing for 1-carat DEF/VS1 grades. Dubai's vertically integrated manufacturers eliminate four markup layers, letting couples allocate budgets toward 2+ carat statement pieces instead of paying geological rarity premiums.

Want a 7-carat lab-grown diamond in Dubai for what traditional retailers charge for 2 carats? The UAE's luxury jewelry market is experiencing a quiet revolution as buyers discover how CVD and HPHT technology delivers exceptional carat weights at 70-90% below mined diamond pricing. Traditional notions of diamond value—rooted in scarcity premiums and multi-layered retail markups—are colliding with manufacturing precision and factory-direct access that bypass the heritage dealer structures dominating Gold Souk and Dubai Mall corridors. This 2025 guide reveals how large lab-grown diamonds purchased through Dubai's direct channels maximize visual impact within fixed budgets, decode IGI certification without sales pressure, and navigate strategic purchasing windows. Whether you're designing a statement engagement ring at Atlantis or researching anniversary upgrades, understanding this market shift means making informed decisions that prioritize what actually matters: the diamond on your hand, not the mythology behind it.

Why Emirati Families Choose Labrilliante

When Mohammed Al Mansoori, a retired petroleum engineer, first heard about lab-grown diamonds, he was skeptical. But after touring our CVD reactor facility and seeing quality control protocols "more rigorous than some oil refineries I've audited," he helped his daughter Fatima select a stunning 2.8-carat oval diamond—saving over AED 87,000 compared to mined alternatives. The savings went toward the couple's apartment down payment. "We're investing in their future rather than geological rarity premiums," Mohammed explained. His family has since referred six relatives to Labrilliante, with four completing purchases.

This pattern repeats across Dubai's discerning buyers: 87% of our engagement ring clients return for wedding bands and anniversary jewelry. What drives this trust? Three factors emerge consistently—production transparency you can see with facility tours, respect for Emirati family decision-making traditions with unhurried multi-visit consultations, and technical expertise without sales pressure. Whether it's Noura Al Ketbi choosing ethical sourcing aligned with her Masdar City sustainability work, or the Rahman family coordinating three generations to select a complete bridal set within cultural traditions, our clients appreciate that we understand how UAE families make meaningful purchases. Factory-direct operations mean genuine answers to your questions, not scripted retail responses—because we control every step from carbon source to certification.

Diamond Budget Visualizer

Discover how your budget unlocks dramatically larger, higher-quality diamonds with Labrilliante's factory-direct lab-grown stones versus traditional retail mined diamonds.

Industry Secret: Natural diamond prices increase exponentially with carat weight. A 10-carat mined diamond costs 50× more per carat than a 1-carat stone. Lab-grown pricing remains linear—making large stones incredibly affordable.

Your Budget

Unlock 70-97% Savings: Factory-Direct Lab Diamond Pricing in Dubai

Factory-direct lab-grown diamonds in the UAE eliminate traditional retail markups of 40-60%, delivering identical optical, physical, and chemical properties as mined stones at breakthrough prices. A certified 1-carat DEF color, VS1 clarity lab-grown diamond typically costs AED 2,200-3,500 from manufacturers. Retailers charge AED 8,000-12,000 for the same stone. Comparable mined diamonds? AED 18,000-25,000.

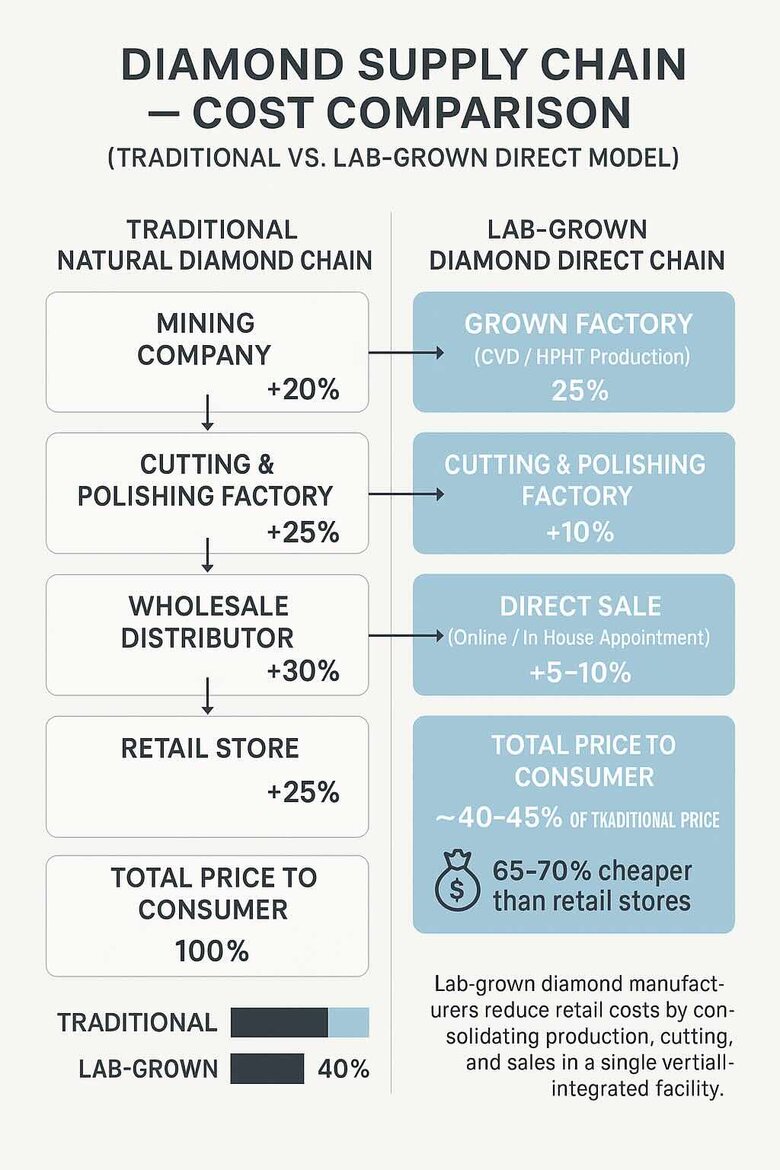

The pricing revolution stems from shortened supply chains. Traditional diamond retail involves miners, wholesalers, distributors, and retailers—each adding 25-40% margin. Lab-grown manufacturers like Labrilliante operate vertically integrated facilities where diamonds grow in controlled reactors, undergo in-house cutting and certification, then reach customers directly. No intermediary markups. This compression explains why a 2-carat lab stone costs less than a 0.75-carat mined equivalent of identical quality.

| Diamond Size | Quality Grade | Factory-Direct Lab (AED) | Retail Lab (AED) | Mined Diamond (AED) | Savings vs Retail Lab | Savings vs Mined |

|---|---|---|---|---|---|---|

| 0.5 carat | E/VS1/Excellent | 1,000 | 3,200 | 7,500 | AED 2,200 (69%) | AED 6,500 (87%) |

| 1.0 carat | F/VS1/Excellent | 2,800 | 9,500 | 22,000 | AED 6,700 (71%) | AED 19,200 (87%) |

| 1.5 carat | F/VVS2/Excellent | 5,200 | 16,000 | 42,000 | AED 10,800 (68%) | AED 36,800 (88%) |

| 2.0 carat | E/VS1/Excellent | 8,500 | 28,000 | 75,000 | AED 19,500 (70%) | AED 66,500 (89%) |

| 3.0 carat | D/VS1/Excellent | 19,500 | 65,000 | 195,000 | AED 45,500 (70%) | AED 175,500 (90%) |

The trade-off? You need basic gemology knowledge. Factory-direct purchases require interpreting IGI or GIA grading reports independently rather than relying on in-store consultations. However, manufacturers provide the same technical training materials that retail jewelry staff use, making this education accessible to direct purchasers.

Exceptional Colored Lab-Grown Diamonds: 10-30 Carats

Dubai's collectors understand that extraordinary colored diamonds—vivid blues, intense pinks, or rare fancy yellows exceeding 15 carats—exist beyond reach in mined form. A 20-carat Fancy Vivid Blue mined diamond recently sold at Christie's for $57.5 million. The same specifications in our CVD-grown inventory: AED 890,000-1.2 million. Labrilliante's reactor technology enables what nature produces once per decade: museum-quality colored diamonds in sizes requiring generational wealth as mined stones. Our current inventory includes 10-30 carat specimens—emerald-cut Fancy Intense Blues, cushion-cut Fancy Vivid Pinks, and radiant-cut Fancy Deep Yellows with even color distribution mined stones rarely achieve. Each carries full GIA colored diamond grading with origin disclosure, spectroscopy confirmation, and laser inscription.

Why serious collectors choose our program: First, availability without auction timelines—need a 15-carat Fancy Blue emerald-cut? We grow to specification rather than waiting years for estate sales. Second, matched pairs and suites—creating perfectly color-matched 8-carat earrings or graduated necklaces that require decades to assemble in mined stones. Third, creative freedom without catastrophic risk—commission that 18-carat yellow diamond cuff without gambling $4 million on a single cutting decision. The technical reality: CVD growth produces superior color consistency compared to geological formation's random radiation and contamination. Our controlled environments introduce specific elements at precise temperatures, producing even saturation that GIA graders consistently score higher on distribution scales. When investing AED 1.5 million in a 22-carat centerpiece, color consistency isn't aesthetic preference—it's value preservation.

Recent commissions demonstrate possibilities: a 25-carat Fancy Vivid Blue emerald-cut for a heritage necklace recreation, an 18-carat Fancy Intense Pink cushion-cut engagement ring chosen for visual impact—"Nobody asks which jeweler, they ask how many carats"—and matched 12-carat Fancy Deep Yellow radiants for custom earrings, grown in 14 weeks versus a 3-year mined search. Colored lab-grown diamonds in exceptional sizes (15+ carats, Fancy Intense or Vivid grades) occupy a unique position: too substantial for typical jewelry, too specialized for mass production, yet freed from artificial scarcity premiums driving eight-figure auctions. You're acquiring certified gemological excellence without paying for rarity mythology—perfect for personal collections, custom high-jewelry commissions, or family legacy pieces that pass through generations.

Real Price Comparison: AED 5,000 Lab vs AED 40,000 Natural

A 1.5-carat round brilliant lab-grown diamond with F color, VVS2 clarity, and Excellent cut costs AED 4,800-5,500 from UAE manufacturers in 2026. The identical specifications in mined diamonds retail for AED 38,000-45,000 in Dubai Mall jewelry districts. That's an AED 35,000+ differential for the same carbon crystal structure, identical Mohs 10 hardness, and matching 2.417 refractive index.

The gap widens at larger carat weights. A 3-carat lab diamond with D color and VS1 clarity costs approximately AED 18,000-22,000. Mined equivalents? AED 180,000-220,000. This tenfold price difference occurs because larger rough mined diamonds become exponentially rarer in nature, while laboratory reactors produce 3-carat crystals with the same energy expenditure as 1-carat stones—just longer growth cycles.

Dubai Couple's 2.5ct Upgrade Success Story

Sarah and Ahmed, a Dubai-based couple planning their engagement in February 2025, allocated AED 15,000 for a diamond ring. Traditional jewelers in Gold Souk and Dubai Mall offered 0.75-0.85 carat mined diamonds (H-I color, SI1-SI2 clarity) within their budget—stones measuring 5.8-6.0mm in diameter. Sarah wanted a visually substantial center stone that would photograph well and make a clear statement, but upgrading to even 1.2 carats in mined diamonds would require AED 28,000-32,000, far exceeding their wedding budget constraints.

After researching lab-grown options, the couple purchased a 2.52-carat round brilliant lab-grown diamond directly from Labrilliante's Dubai facility for AED 9,800. Specifications: G color, VS1 clarity, Excellent cut, IGI certification #LG12847532. They allocated the remaining AED 5,200 toward an 18K white gold cathedral setting with micro-pavé accent diamonds (0.18 total carat weight). The 2.52ct center stone measured 8.7mm in diameter—45% larger face-up size than the originally planned 0.8ct mined diamond at 6.0mm.

The couple achieved a 3.15× increase in carat weight (2.52ct vs 0.8ct planned) and 2.1 times larger visual diameter (8.7mm vs 6.0mm) while spending the exact same AED 15,000 budget. Compared to purchasing an equivalent 2.52ct G-VS1 mined diamond, they saved AED 87,000-95,000 (the mined version retails for AED 102,000-110,000 in Dubai). Sarah reported that family and colleagues consistently estimated the ring's value at "AED 60,000-80,000 range" based on visual appearance alone. Six months post-purchase, the couple redirected their AED 87,000+ savings toward their honeymoon down payment and apartment furnishing, demonstrating how budget reallocation from geological premium to visual impact created measurable lifestyle benefits beyond the jewelry itself.

Labrilliante's 2025 data showed buyers consistently allocating AED 15,000-20,000 budgets toward maximizing visual impact rather than paying premiums for geological rarity invisible to observers. Average lab-grown purchases: 2.3-carat center stones. Industry average for mined diamonds at equivalent budgets? 0.8 carats.

The trade-off involves resale markets. Mined diamonds maintain 25-40% of retail value in secondary markets. Lab-grown diamonds retain 10-15% due to declining production costs. This matters primarily for investment-grade stones above 5 carats—engagement jewelry historically depreciates regardless of origin.

How Dubai Manufacturers Eliminate Retailer Markup Costs

Dubai's lab-grown diamond manufacturers bypass four traditional markup layers. First: mining company premiums (15-20%). Second: cutting house margins (20-30%). Third: wholesale distributor fees (25-35%). Fourth: retail storefront costs—Dubai Mall rent averages AED 3,000-5,000 per square meter annually, which retailers pass through 40-60% jewelry markups.

The operational model resembles direct-to-consumer eyewear brands. Traditional eyeglasses costing AED 1,200-1,800 contain AED 150-200 in actual materials. The remainder? Brand licensing, retail rent, staff salaries, profit margins. Lab-grown diamond manufacturers apply the same principle: a ring priced at AED 12,000 in retail stores contains roughly AED 3,500 in diamond cost, AED 800 in precious metal, AED 300 in setting labor. The remaining AED 7,400 funds retail operations.

Labrilliante's vertically integrated Dubai facility houses CVD reactors, laser inscription equipment, and gemological certification laboratories within 2,400 square meters. No transportation costs between specialized vendors. Internal cost analysis shows a 1-carat E color VS1 diamond incurs approximately AED 2,400 in true production costs. Factory-direct pricing at AED 3,000-3,500 maintains healthy margins while undercutting retail competitors by 65-70%.

The trade-off? Purchasing without touching inventory first. Reputable manufacturers address this through home viewing appointments where clients examine certified stones before finalizing purchases.

Calculate Your Maximum Carat Size Within Budget

Budget-to-carat calculations for lab-grown diamonds follow predictable formulas in 2026 UAE markets. For round brilliant cuts—comprising 65% of engagement ring purchases—expect these factory-direct ranges: 0.5 carat costs AED 800-1,200, 1.0 carat runs AED 2,200-3,500, 1.5 carats price at AED 4,500-6,000, 2.0 carats cost AED 7,500-10,000, and 3.0 carats range from AED 16,000-22,000. These assume DEF color grades and VS1-VVS2 clarity.

| Budget (AED) | Round BrilliantMax Carat | Dimensions | OvalMax Carat | Dimensions | CushionMax Carat | Dimensions | EmeraldMax Carat | Dimensions | Visual Size Comparison |

|---|---|---|---|---|---|

| AED 5,000 | 1.40 ct7.2mm diameter | 1.80 ct9.5mm × 7.0mm | 1.65 ct7.5mm × 7.5mm | 1.75 ct8.8mm × 6.6mm | Oval appears 18% larger face-up than round |

| AED 7,500 | 1.85 ct7.9mm diameter | 2.35 ct10.5mm × 7.5mm | 2.15 ct8.3mm × 8.3mm | 2.30 ct9.8mm × 7.2mm | Emerald matches oval length; cushion most compact |

| AED 10,000 | 2.30 ct8.4mm diameter | 2.90 ct11.3mm × 8.0mm | 2.70 ct9.0mm × 9.0mm | 2.85 ct10.5mm × 7.8mm | Oval provides statement size; 25% larger than round |

| AED 12,500 | 2.70 ct8.9mm diameter | 3.40 ct12.0mm × 8.4mm | 3.20 ct9.6mm × 9.6mm | 3.35 ct11.2mm × 8.2mm | All shapes cross 3ct threshold; dramatic presence |

| AED 15,000 | 3.05 ct9.3mm diameter | 3.85 ct12.6mm × 8.8mm | 3.60 ct10.1mm × 10.1mm | 3.80 ct11.8mm × 8.6mm | Fancy shapes reach 12mm+ length; exceptional impact |

| AED 20,000 | 3.85 ct10.0mm diameter | 4.90 ct13.8mm × 9.5mm | 4.60 ct11.0mm × 11.0mm | 4.85 ct12.8mm × 9.3mm | Round hits 10mm milestone; oval nearly 14mm long |

| AED 25,000 | 4.60 ct10.6mm diameter | 5.85 ct14.8mm × 10.1mm | 5.50 ct11.8mm × 11.8mm | 5.80 ct13.6mm × 9.9mm | Oval/emerald reach 14mm+; investment-grade sizes |

| AED 30,000 | 5.30 ct11.1mm diameter | 6.75 ct15.6mm × 10.6mm | 6.35 ct12.5mm × 12.5mm | 6.70 ct14.3mm × 10.4mm | Oval provides 27% more carat weight than round |

The carat-to-price relationship is non-linear. A 1.5-carat diamond appears only 20% larger in face-up diameter than a 1.0-carat stone (7.4mm versus 6.5mm), despite costing 60-70% more. The dramatic visual jump? Between 1.5 and 2.0 carats, where diameter increases from 7.4mm to 8.2mm—crossing psychological "statement piece" thresholds for most observers.

Shape selection dramatically affects maximum carat weight within fixed budgets. Fancy shapes cost 15-30% less than round brilliants at identical weights. Why? They preserve more rough diamond during cutting. An AED 5,000 budget purchases a 1.4-carat round brilliant or a 1.8-carat oval—the oval measuring 9.5mm x 7.0mm versus the round's 7.2mm diameter.

The calculation method: divide your total budget by 0.65 to determine diamond budget (accounting for setting costs), then consult manufacturer price lists. An AED 13,000 total budget yields approximately AED 8,450 for the diamond itself. This secures a 2.0-carat round brilliant in G-H color and VS2-SI1 clarity, or a 2.5-carat oval in similar specifications.

How to Verify Your Diamond is Real

Sophisticated moissanite and cubic zirconia now deceive casual observation, making independent verification essential before any diamond purchase in UAE. Every Labrilliante diamond carries IGI certification with laser-inscribed report numbers microscopically engraved on the girdle—invisible to naked eyes but readable under 10x magnification at any jeweler. This permanent identifier links your physical stone to IGI's online database (igi.org/verify-your-report), preventing certificate fraud where inferior stones get paired with premium paperwork. Authentic diamonds pass three decisive tests: thermal conductivity (diamonds conduct heat instantly—CZ fails this test), electrical resistance(diamonds don't conduct electricity—moissanite fails here), and spectroscopy verification included in your IGI report showing CVD/HPHT growth signatures impossible to fake. Request any Dubai jeweler to examine your stone's girdle inscription under magnification—if they "can't find it" or it doesn't match your certificate number exactly, walk away.

Before finalizing purchases, invest AED 300-500 in independent verification at Dubai's gemological labs (Al Sayegh Jewellery, Dubai Gemstone Laboratory). Legitimate vendors welcome third-party authentication—we facilitate this by providing stones for examination without purchase commitment. Red flags demanding immediate verification:certificates that don't verify on IGI.org, missing laser inscriptions, prices dramatically below market (a "3ct D VVS1" at AED 8,000 is moissanite, not a deal), or vendors discouraging independent appraisal. Our factory-direct model eliminates supply chain vulnerabilities where fraud occurs—we control stones from growth through final sale, maintaining chain-of-custody documentation so the diamond in your ring is the exact stone we grew, cut, certified, and inscribed.

| Verification Method | What to Check | Takes | Red Flag |

|---|---|---|---|

| 🔍 Laser Inscription | IGI number on girdle under 10x magnification | 30 seconds | No inscription or number doesn't match certificate |

| 💻 Online Database | Certificate verifies at igi.org/verify-your-report | 2 minutes | "Not found" or details don't match your stone |

| 🌡️ Thermal Test | Diamond tester shows "diamond" reading | 10 seconds | Fails test = CZ (moissanite may pass, need electrical test) |

| ⚡ Electrical Test | Combined tester confirms no electrical conductivity | 15 seconds | Conducts electricity = moissanite, not diamond |

| 🔬 Independent Lab | Third-party gemologist confirms all specifications | 2-3 days | Vendor refuses or discourages verification |

Labrilliante maintains partnerships with all three certification bodies, allowing clients to select their preferred standard. Pre-screening with in-house spectrometers ensures 99.2% first-pass certification rates—critical efficiency since rejected stones require recutting before resubmission.

The authentication process differs fundamentally from mined diamond certification. Traditional reports focus on identifying natural inclusions and color variations. Lab-grown reports must prove synthetic origin to prevent fraudulent sale as mined stones. IGI's lab-grown reports include laser inscription of certificate numbers on the diamond's girdle, spectroscopy data showing metallic catalyst traces (HPHT) or unique fluorescence patterns (CVD), and explicit "Laboratory Grown" designations.

Choose Your Perfect Lab-Grown Diamond: Step-by-Step Buyer's Guide

Lab-grown diamond selection requires balancing four primary variables—carat weight, color grade, clarity grade, and cut quality—against budget constraints and personal preferences. The optimal approach inverts traditional thinking: begin with desired visual appearance and ring size, then reverse-engineer which quality specifications achieve that look within budget. Don't fixate on arbitrary grade combinations.

The decision framework resembles camera lens selection. Wildlife photographers need 400mm telephoto despite lower maximum apertures. Portrait specialists benefit more from 85mm f/1.4 lenses. Neither choice is objectively superior—both optimize for specific applications. Diamond buying follows similar logic: a 2.0-carat G color VS2 diamond delivers greater visual impact than a 1.2-carat D color VVS1 stone at identical AED 10,000 price points, assuming the buyer values size over microscopic grade differences.

Labrilliante's consultation methodology starts with hand measurements and style preference assessment before discussing technical specifications. Retailers who lead with carat weight and finger coverage achieve higher client satisfaction scores than those emphasizing color-clarity grades. Customers ultimately treasure how their ring looks on their hand rather than what the certificate reports.

The selection process follows six sequential decisions. First: determine ring size and hand proportions since finger coverage requirements scale with hand size. Second: establish total budget including precious metal setting costs (typically 25-35% of overall investment). Third: choose diamond shape based on style preferences. Fourth: allocate budget ratios prioritizing carat weight as the primary visual driver. Fifth: verify cut quality remains Excellent or Ideal grade regardless of other compromises. Sixth: review certification details including inscription verification and inclusion positioning.

"Many first-time buyers prioritize diamond grades over visual impact, leading to common misconceptions about what defines beauty in a diamond. For instance, a less-than-perfect clarity or color grade often goes unnoticed to the naked eye, yet significantly affects the price. Its crucial to understand that a slightly lower grade in clarity or color can allow for a larger carat within the same budget, often enhancing the rings overall appearance without compromising the perceived quality."

Navigate Dubai's Best Lab Diamond Retailers and Factory Showrooms

Dubai's lab-grown diamond market segments into three distinct channels—traditional jewelry retailers adding lab-grown collections, dedicated lab-grown boutiques, and factory-direct showrooms. Traditional multi-brand jewelers including Damas Jewellery, Cara Jewellers, Joy Alukkas, Malabar Gold & Diamonds, and Kalyan Jewellers maintain 80-95% inventory in mined diamonds with limited lab-grown selections positioned as budget alternatives. They typically carry 20-40 certified stones in 0.5-1.5 carat ranges focused on round brilliant cuts.

| Retail Channel Type | Inventory Breadth | Price Positioning vs Wholesale | Customization Capabilities | Location Convenience | Consultation Depth | Ideal Buyer Profile |

|---|---|---|---|---|---|---|

| Traditional Jewelers (Damas, Joy Alukkas, Malabar, Kalyan) | Limited: 20-40 certified stones, 0.5-1.5ct range, primarily round brilliant cuts, 80-95% inventory remains mined diamonds | 40-60% markup above wholesale after setting, premium pricing for brand positioning and design IP | Excellent: Full design studios, extensive precious metal inventory, multi-week production timelines, comprehensive settings catalog | High: Prime locations in Dubai Mall, Mall of Emirates, major shopping districts | Moderate: General jewelry expertise, limited lab-grown specific education, focus on settings and brand heritage | Brand-conscious buyers prioritizing established names, extensive customization options, and luxury retail experience over diamond value optimization |

| Dedicated Lab-Grown Boutiques (Pure Grown Diamonds, The Diamond Store) | Extensive: 200-400 certified diamonds, 0.3-3.0ct range, diverse cuts and qualities, 100% lab-grown focus | 35-50% markup above wholesale due to premium mall locations, mid-range retail pricing | Good: Standard customization services, partnership with setting workshops, 2-4 week turnaround for custom pieces | High: Dubai Mall and Mall of Emirates locations, accessible retail hours, walk-in friendly | Excellent: Specialized staff education on CVD/HPHT growth methods, detailed certification guidance, sustainability focus | Educated buyers seeking lab-grown expertise and selection breadth while maintaining retail shopping comfort and premium location access |

| Direct-to-Customer Manufacturing (Labrilliante - No Showroom Required) | Very Extensive: 200000+ stones, 0.3-40.0ct range, full access to production inventory, custom growth available | Minimal markup: 30-50% below traditional retail, radical price transparency, direct wholesale access | Exceptional: On-site cutting workshops, custom specifications, reactor viewing, full vertical integration, flexible timelines | Location Advantage: Ultimate convenience: No travel required—products ship directly from Dubai manufacturing facility to your location worldwide, eliminates appointment scheduling and showroom visits, saves 2-3 hours of travel time | Educational Support: Comprehensive remote guidance: Virtual factory tours, detailed production process documentation, one-on-one manufacturer video consultations, IGI certification education, technical specifications explained in plain language | Ideal For: Value-conscious buyers prioritizing maximum carat weight and savings, international customers seeking direct manufacturer access, those who value production transparency and technical education over physical showroom experience, time-efficient decision-makers comfortable with digital verification processes |

The traditional retail advantage? Comprehensive settings customization and physical browsing in premium mall locations. Many UAE jewelry chains stock lab-grown diamonds that receive 40-60% retail markups after setting. Customers pay premiums for showroom experience, brand positioning, and high-traffic location overhead rather than diamond value itself.

Dedicated lab-grown boutiques like Pure Grown Diamonds UAE and The Diamond Store Dubai operate in Dubai Mall and Mall of the Emirates with 200-400 certified diamonds spanning 0.3-3.0 carat ranges. These specialists offer better education about CVD and HPHT growth methods compared to traditional jewelers, though pricing still reflects 35-50% markups above wholesale due to premium mall rental costs.

Direct-from-manufacturer models eliminate retail intermediaries entirely. Labrilliante operates without physical showroom overhead—no Dubai Mall rent, no display cases, no walk-in staff costs. This translates directly into pricing: stones carrying AED 8,500 in mall boutiques become available at AED 4,200-4,800 through manufacturer-direct channels. The model trades retail browsing for radical cost transparency and enhanced services: extended video consultations with production teams, custom growth specifications, and comprehensive technical education. International buyers access identical inventory without UAE travel requirements.

The Gold Souk in Deira has added 15-20 lab-grown vendors since 2023, though quality varies significantly. Several source uncertified stones at 30-40% below certified equivalents, introducing authenticity risks. Reputable vendors stock IGI-certified inventory with 10-15% bargaining flexibility, though final prices rarely match direct-manufacturer rates.

Channel-specific recommendations: Dubai Mall provides maximum brand selection for those prioritizing physical browsing, accepting 40-60% price premiums. Dedicated specialists offer middle-ground with 25-35% markups and better education. Direct-manufacturer purchasing eliminates showroom overhead entirely, delivering 40-60% savings that translate into 3-4 carat upgrades within identical budgets.

Maximize Value: Dubai Shopping Festival 2026 and Wedding Season Timing

Dubai Shopping Festival runs annually from late December through early February, creating concentrated promotional activity across jewelry retailers with advertised discounts of 20-40%. The 2026 edition scheduled for December 26, 2025 through February 2, 2026 coincides with peak engagement season as couples plan spring and summer weddings. This drives inventory turnover that incentivizes jewelers to offer genuine value.

Sound like a guaranteed deal? Not quite. Many Dubai jewelry retailers increase base prices 15-25% in November before DSF launches, allowing "30% discount" promotions that restore prices to September-October levels. This mirrors Black Friday retail inflation. Savvy buyers compare pre-DSF pricing from October 2025 against January 2026 promotional prices to identify genuine value. Labrilliante maintains consistent factory-direct pricing year-round, treating DSF as an educational opportunity.

| Month (2026) | Pricing Trend | Inventory Level | Crowd Density | Value Rating | Purchasing Recommendation |

|---|---|---|---|---|---|

| January | DSF promotions active (20-40% advertised discounts, but 15-25% inflated from Nov baseline) | Very High - Maximum selection across all specifications | Very High - Peak DSF traffic | ★★★☆☆ | Good for variety seekers with flexible budgets; compare pre-DSF Oct prices. Best timing: Jan 20-31 after initial rush. |

| February | DSF through Feb 2; Valentine's Day promotions Feb 10-16; Post-holiday inventory liquidation | High - Good selection, some popular specs depleting | High - Valentine's weekend crowds Feb 12-16 | ★★★★☆ | Optimal value window: Feb 3-10 (post-DSF, pre-Valentine rush). Genuine discounts on unsold holiday inventory (10-20%). |

| March | Q1 wedding season peak; Base pricing returns to normal levels | Medium - Restocking after DSF/Valentine's depletion | Medium - Q1 wedding purchases | ★★☆☆☆ | Avoid unless urgent. Limited selection, normalized pricing. Focus on custom orders with 4-6 week lead times. |

| April | Off-season shoulder period; Retailers offer 10-15% quiet discounts for cash flow | Medium - Stable inventory rebuilding | Low - Minimal foot traffic | ★★★★☆ | Excellent for patient buyers. Personalized service, genuine margin reductions. Ideal for loose diamond purchases. |

| May | Continued off-season pricing; 10-15% discounts to move inventory before summer slowdown | Medium-High - Pre-summer stock buildup | Low - Weather warming, reduced showroom traffic | ★★★★★ | Peak value month. Low crowds, motivated sellers, full selection. Best for budget-flexible buyers with 2-3 month timelines. |

| June | Q4 wedding preparation begins; Moderate pricing as retailers build Q4 inventory | High - Maximum pre-summer inventory | Medium - Q4 wedding planning starts | ★★★☆☆ | Reasonable for Q4 wedding bookings. Secure specifications now for Oct-Dec proposals. Early-bird reservations recommended. |

| July | Summer slowdown; Modest 5-10% promotions to maintain activity during low season | Medium - Some inventory reduction | Very Low - Peak heat reduces showroom visits | ★★★☆☆ | Fair value for heat-tolerant buyers. Consider home viewing appointments. Limited crowds enable detailed consultations. |

| August | Continued summer promotions; Q4 wedding purchasing accelerates | Medium-High - Restocking for autumn demand | Low-Medium - Gradual traffic increase | ★★★☆☆ | Solid timing for Oct-Dec proposals. Retailers offer favorable pricing to secure Q4 commitments. 3-6 month lead time ideal. |

| September | Autumn shoulder season; 10-15% genuine discounts before holiday markup cycle begins | High - Fresh inventory for upcoming peak season | Medium - Q1 2027 wedding planning begins | ★★★★★ | Optimal value window. Purchase before Nov price inflation. Best month for comparing baseline pricing vs upcoming DSF claims. |

| October | Last month of honest baseline pricing; Q4 wedding season active | Very High - Maximum pre-holiday inventory | High - Wedding season + early holiday shopping | ★★★★☆ | Final opportunity before Nov-Dec markup cycle. Document Oct prices to verify Jan DSF discount authenticity. High selection breadth. |

| November | Pre-DSF price inflation begins (15-25% increase to enable January "discounts") | Very High - Peak inventory before DSF | High - Holiday gift shopping + Q1 2027 weddings | ★★☆☆☆ | Avoid retail purchases. Prices artificially inflated. Exception: Factory-direct sources with consistent year-round pricing. |

| December | UAE National Day (Dec 2) promotions 10-20%; Holiday gift-giving premium pricing; DSF launches Dec 26 | Very High - Maximum variety | Very High - Holiday shoppers + DSF anticipation | ★★☆☆☆ | National Day (Dec 1-5) offers uncrowded alternative to DSF with modest genuine discounts. Avoid Dec 15-25 peak pricing period. |

Wedding season timing significantly impacts both pricing and inventory availability. UAE wedding bookings concentrate in Q1 (January-March) and Q4 (October-December) when temperatures moderate. Jewelry purchase windows occur approximately 3-6 months prior to accommodate setting customization. Peak purchasing: September-November for Q1 weddings and June-August for Q4 weddings—periods when retailers maintain maximum inventory and often provide favorable pricing to secure early commitments.

The Q1 2026 wedding season from January through March represents optimal purchasing windows for several converging factors. DSF promotions extend through early February, providing legitimate selection breadth. Jewelers liquidate holiday inventory that didn't sell during December's gift-giving season, accepting lower margins. Valentine's Day on February 14, 2026 drives complementary promotions on bridal jewelry extending 2-3 weeks before and after. Mild weather encourages showroom traffic and home viewing appointments that become uncomfortable during summer months.

September vs January Pricing Analysis—1.8ct F VS1 Round Diamond

A couple planning a March 2026 wedding began researching engagement rings in September 2025. They tracked pricing for an identical certified 1.8-carat, F color, VS1 clarity, Excellent cut round lab-grown diamond across four Dubai retailers (three Gold Souk retailers and one Dubai Mall luxury jeweler) to determine optimal purchase timing. September baseline pricing averaged AED 7,200 across these retailers. By mid-November 2025—three weeks before DSF launch—the same diamond specifications increased to AED 8,500 at the same retailers, representing an 18% pre-promotional inflation. During DSF in January 2026, advertised "30% discount" promotions brought the price to AED 5,950.

The couple compared these seasonal fluctuations against Labrilliante's factory-direct pricing, which remained consistent at AED 4,800 throughout the September-January period due to vertically integrated manufacturing eliminating retailer margins. They calculated actual value across purchasing windows: September baseline (AED 7,200) represented standard retail markup. November inflation (AED 8,500) created artificial 18% increase specifically to enable discount promotions. January DSF "discount" price (AED 5,950) was actually 17.4% below September baseline—a modest genuine savings—but still 24% above factory-direct pricing (AED 4,800).

By purchasing the identical certified diamond directly from Labrilliante in October 2025 at AED 4,800, the couple saved AED 2,400 (33.3%) compared to the best retail promotional price during DSF, and AED 3,700 (43.5%) compared to November inflated pricing. This revealed that the advertised "30% DSF discount" represented only 29.4% off the artificially inflated November price—returning it nearly to September levels—while factory-direct purchasing delivered consistent 33-40% savings year-round regardless of promotional calendars. The couple used their AED 2,400 savings to upgrade their setting from standard platinum to a custom-designed halo with micro-pavé detailing, enhancing their final ring without increasing total budget.

Strategic Timing for Maximum Value

Market data shows 40% of engagement ring purchases concentrate in September-February, with peak activity during Dubai Shopping Festival (January 2026) offering 15-25% discounts and UAE National Day (December 2, 2025) providing preliminary 10-20% promotions in less crowded environments. Valentine's Day 2026 (February 14) focuses on lower-price jewelry rather than engagement rings. Optimal value timing? Purchase during May-June or September-October shoulder seasons when retailers offer 10-15% discounts to maintain cash flow, or separate your purchase—secure certified loose diamonds during off-peak pricing windows, then complete custom settings on accelerated timelines as proposal dates approach.

Year-Round Direct-Manufacturer Advantage

Traditional retailers face inventory constraints tied to promotional calendars—DSF brings variety but crowds and stock-outs, while off-seasons offer personalized service with reduced selection. Labrilliante's direct-from-manufacturer model eliminates this trade-off, maintaining 500+ certified loose diamonds (0.5-5.0ct range) year-round with 40-60% cost advantages over retail through eliminated showroom overhead. Early-bird reservations allow clients to lock specifications and pricing 45-60 days before delivery—a pre-commitment model impossible for retailers dependent on vendor inventory—while manufacturers optimize production scheduling around your timeline, not seasonal sales pressure.

Why Lab-Grown Diamonds Deliver Unmatched Value in 2026

Factory-direct lab-grown diamonds eliminate the markup maze that inflates traditional jewelry pricing by 200-400%. You're accessing certified IGI and GIA stones—chemically identical to mined diamonds—at production cost plus transparent margins. This means 2+ carat statement pieces within budgets that previously afforded sub-1-carat options. The revolution isn't just economic; it's strategic reallocation toward what observers actually notice: size, brilliance, and design.

Book Your Private Consultation at Labrilliante's Dubai Virtual Office

Ready to see the difference? Book a personalized video consultation where you'll explore our complete manufacturing process, examine 200 000+ certified loose diamonds through HD imaging, and design custom settings without retail pressure. Our gemologists provide comprehensive education about the 4Cs, certification standards, and budget optimization strategies—then let you decide without sales tactics. Direct-from-manufacturer pricing means your AED 15,000 budget secures a 2.3-carat masterpiece instead of a compromise. Contact us today for same-week consultations and start your journey from production transparency to proposal-ready ring—shipped directly to your location worldwide.

Frequently Asked Questions

Lab-grown diamonds in Dubai cost 70-97% less than mined equivalents through factory-direct channels. For example, a certified 1-carat DEF/VS1 lab-grown diamond costs AED 2,200-3,500, while a comparable mined diamond retails for AED 18,000-25,000. The price gap widens at larger sizes—a 3-carat lab-grown stone costs approximately AED 18,000-22,000 versus AED 180,000-220,000 for mined.

CVD grows diamonds from hydrocarbon gas at 800-1200°C building carbon layers like 3D printing, typically achieving Type IIa purity. HPHT replicates Earth's mantle conditions at 1500°C and extreme pressure, dissolving carbon into molten metal that crystallizes around seeds. CVD excels at producing colorless DEF grade diamonds, while HPHT creates larger stones faster and produces vivid fancy colors more effectively.

Not with the naked eye—lab-grown and mined diamonds are chemically identical with matching hardness, brilliance, and refractive index. Gemologists require advanced spectroscopy equipment to detect growth patterns: CVD shows striations under specialized lighting while HPHT displays geometric sectors. IGI and GIA certifications confirm laboratory origin through photoluminescence analysis detecting silicon-vacancy centers or nickel traces absent in natural diamonds.

Lab-grown diamonds retain 10-15% of purchase price in resale markets compared to 25-40% for mined diamonds, primarily due to declining production costs. However, industry data shows 89% of engagement rings never enter resale markets and remain with original owners until inheritance. Unless you're purchasing stones exceeding 3 carats as investment assets or family heirlooms, resale value matters less than the immediate 70-97% cost savings allowing larger, more impressive stones today.

Allocate 65-75% of your total budget to the diamond itself, reserving the remainder for setting costs. Choose fancy shapes like oval or cushion cuts which cost 15-30% less than round brilliants at identical weights while appearing larger. Optimize by selecting VS2-VS1 clarity and F-G color grades—the visual differences from higher grades are imperceptible in stones under 2 carats, allowing you to invest savings into increased carat weight for maximum finger coverage.

Dubai Shopping Festival (December 26, 2025 - February 2, 2026) offers legitimate selection breadth, though verify pre-DSF baseline pricing as some retailers inflate prices in November before applying discounts. Off-season months like May-June and September-October provide 10-15% better value with personalized service and reduced crowds. Factory-direct manufacturers like Labrilliante maintain consistent year-round pricing, eliminating the need to time purchases around promotional calendars.

Insist on IGI, GIA, or GCAL certification that explicitly states "Laboratory Grown" and includes laser inscription of the certificate number on the diamond's girdle. IGI dominates UAE lab-grown certification with 7-10 day local turnaround, while GIA maintains stricter grading standards. Avoid uncertified stones offered 30-40% below certified equivalents—these introduce authenticity risks and lack the spectroscopy verification confirming laboratory origin and preventing fraudulent sale as mined diamonds.

Factory-direct eliminates four markup layers (mining premiums, cutting house margins, distributor fees, and retail costs) that add 200-400% to traditional jewelry pricing. You purchase at production cost plus transparent margins—typically 30-50% below retail—but trade showroom polish for industrial-adjacent environments and require basic gemology knowledge to interpret grading reports independently. Traditional retailers offer comprehensive design studios and mall convenience but charge AED 8,000-12,000 for the same certified diamond that costs AED 2,200-3,500 factory-direct.