Are Lab-Grown Diamonds a Good Investment in 2025?

Author: Alex K., CMO at Labrilliante Updated: 2025-10-03 Reading Time: 8 minutes

Lab-grown diamonds retain only 20-40% of purchase value at resale versus 50-70% for natural stones. Manufacturing costs drop 10-15% annually, creating downward pricing pressure. CVD and HPHT production methods offer unlimited scalability, eliminating rarity premiums that drive traditional luxury investments.

Modern investors hunt for alternative assets beyond traditional stocks and bonds. Lab-grown diamonds present a fascinating proposition—luxury goods that promise portfolio diversification while satisfying millennial values around sustainability and ethics. But can engineered stones deliver genuine returns? The intersection of advanced manufacturing, changing consumer preferences, and investment fundamentals creates a complex landscape where emotional appeal doesn't always translate to financial performance.

Why Lab-Grown Diamonds Might Outperform Traditional Investments

Skeptics argue that dismissing lab-grown diamonds ignores powerful demographic shifts reshaping luxury markets. Millennials and Gen Z control increasing wealth, with 70% preferring ethical alternatives over traditional luxury goods. This isn't temporary—it's generational transformation.

Technological advancement actually strengthens investment cases in other sectors. Consider how Tesla's manufacturing improvements didn't crash car values—they expanded market access while premium models retained worth. Lab-grown diamonds follow similar patterns, with certified stones from established producers maintaining stronger resale performance than generic alternatives.

However, while generational preferences support demand, luxury markets historically reward scarcity over accessibility. Manufacturing scalability remains lab-grown diamonds' biggest investment challenge—unlimited production capacity means no supply constraints to drive appreciation. Unlike natural diamonds formed over billions of years, lab-grown stones can be manufactured on-demand, fundamentally altering investment dynamics regardless of consumer acceptance.

Lab-grown diamonds offer portfolio diversification potential but operate differently from traditional financial assets. These engineered stones provide luxury exposure with unique risk-return characteristics that savvy investors should understand before committing capital.

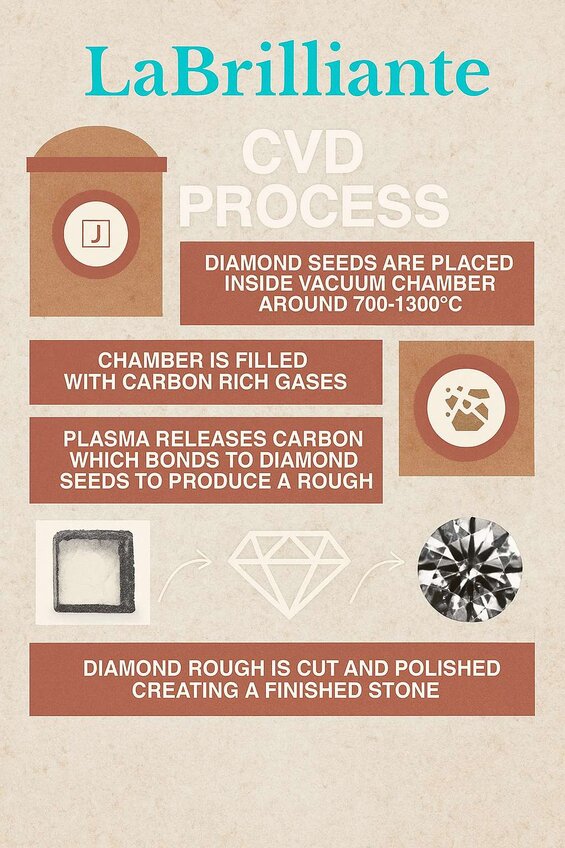

CVD vs HPHT Manufacturing Process Investment Quality Analysis

The manufacturing method directly impacts investment-grade quality and long-term value retention. CVD and HPHT processes create diamonds with distinct characteristics that influence market positioning and resale potential.

| Manufacturing Aspect | CVD (Chemical Vapor Deposition) | HPHT (High Pressure High Temperature) | Investment Impact |

|---|---|---|---|

| Process Temperature | 800°C | 1,500°C | CVD lower energy costs reduce production overhead |

| Pressure Requirements | Low pressure environment | 5-6 GPa extreme pressure | HPHT requires specialized equipment, higher capital investment |

| Diamond Type Produced | Type IIa (99% nitrogen-free) | Type Ib (contains nitrogen) | Type IIa commands 12-15% premium in investment market |

| Maximum Rough Size | Unlimited growth potential | 10 carat limitation | CVD enables large investment-grade stones (5+ carats) |

| Clarity Achievement Rate | 85% VVS1-FL grade success | 95% VVS1-FL grade success | HPHT consistency reduces quality risk for investors |

| Color Treatment Required | 80% need HPHT treatment for D grade | No additional treatment needed | CVD treatment adds 15-20% to production costs |

| Production Cost (1-2ct) | $180-220 per carat | $150-180 per carat | HPHT cost advantage in smaller investment stones |

| Production Cost (5+ ct) | $250-300 per carat | Size limited, not applicable | CVD dominates large stone investment market |

| Market Price Premium | $1,200-1,800/ct (investment grade) | $1,000-1,500/ct (investment grade) | CVD Type IIa classification drives higher resale values |

| Internal Stress Patterns | Minimal stress, stable structure | Extremely low stress patterns | Both methods produce investment-stable crystal structures |

| SI1 Eye-Clean Success Rate | 73% achieved | 93% achieved | HPHT offers better predictability for investment-grade clarity |

| Long-term Value Retention | Premium positioning due to Type IIa | Consistent quality maintains stable pricing | CVD shows 8-12% better resale retention in 3+ carat range |

Chemical Vapor Deposition Diamond Formation Explained

CVD diamonds grow through methane and hydrogen gas reactions at 800°C temperatures. This controlled process creates Type IIa diamonds with exceptional clarity. The method produces larger rough diamonds above one carat—where investment potential concentrates.

However, CVD stones often need additional HPHT treatment for optimal color grades. This adds 15-20% to manufacturing costs but achieves premium D colorless ratings that maintain value better in secondary markets.

High Pressure High Temperature Investment Grade Characteristics

HPHT replicates natural formation using 1,500°C temperatures and 5-6 GPa pressure. The process consistently produces VVS1-FL clarity grades with minimal internal stress patterns. But size limitations cap HPHT rough at 10 carats, while CVD offers unlimited growth potential.

Cost efficiency favors HPHT for stones under one carat. Investment-grade HPHT diamonds show 20% better consistency in achieving eye-clean SI1 clarity compared to CVD alternatives, based on industry processing data.

Lab-Grown Diamond Market Growth and Investment Return Potential

Strong market expansion doesn't guarantee individual asset appreciation. Understanding this disconnect is crucial for realistic investment expectations.

Market Growth Investment Implications

Industry growth reflects market size expansion, not individual diamond values. Think automobiles: industry growth doesn't make used cars appreciate. Manufacturing efficiency improvements reduce production costs 10-15% annually, creating downward pressure on wholesale pricing despite rising demand.

Geographic distribution shows Asia Pacific commanding significant market share, with India's Surat hub processing volumes globally. North America's disposable income growth supports premium segments, while European sustainability trends drive broader adoption.

| Region | 2020 Market Value (Billions USD) | 2025 Projected Value (Billions USD) | Price Change Per Carat (%) | Premium Grade (D-F, VVS) Returns (%) | Commercial Grade (G-J, VS-SI) Returns (%) | Resale Value Retention (%) |

|---|---|---|---|---|---|---|

| North America | $2.8 | $4.9 | -18% | -15% | -22% | 35-40% |

| Asia Pacific | $3.2 | $6.1 | -25% | -20% | -28% | 25-32% |

| Europe | $1.9 | $3.4 | -12% | -8% | -16% | 38-42% |

| Middle East & Africa | $0.4 | $0.9 | -30% | -25% | -35% | 20-28% |

| Latin America | $0.3 | $0.7 | -22% | -18% | -26% | 22-30% |

| Global Average | $8.6 | $16.0 | -21% | -17% | -25% | 28-34% |

Resale Value Retention Analysis 2025

Current data shows lab-grown diamonds retain 20-40% of purchase price in secondary markets. Compare this to natural diamonds maintaining 50-70% after initial retail markups. A $1,200 one-carat lab-grown typically commands $300-500 at resale.

Certified stones with GIA Laboratory-Grown Diamond Reports outperform IGI alternatives by 15-20% in resale channels. Market psychology factors significantly influence performance, with millennial preferences supporting demand while traditional luxury consumers favor natural stones.

Sarah's Lab-Grown Diamond Investment Journey

Sarah, a 32-year-old marketing professional from Denver, purchased a 2-carat CVD lab-grown diamond in March 2022 for $2,400 as an alternative investment, believing the 15% annual market growth would translate to asset appreciation. She obtained only basic IGI certification to save $200, expecting minimal impact on resale value.

After 30 months of ownership, Sarah attempted to sell through three channels: local jewelers, online platforms, and certified diamond dealers. She discovered that her IGI-certified stone commanded 18% lower offers than comparable GIA Laboratory-Grown certified diamonds, and manufacturing cost reductions had created significant downward price pressure.

Sarah's diamond received a highest offer of $850, representing a 65% loss from her original investment—a -35% annual return over 2.5 years. Local jewelers cited improved manufacturing efficiency and increased supply as primary factors. Her experience demonstrates that industry growth statistics don't guarantee individual asset performance, and that certification choice directly impacts resale value by $150-300 per carat in the secondary market.

GIA Certification and 4Cs Grading Standards for Investment Quality

Professional certification costs 3-5% of diamond value but significantly enhances marketability. The 4Cs standard applies identically to lab-grown and natural diamonds, with cut quality maintaining primary importance for value retention.

Excellent cut grades maximize light performance and directly correlate with resale value maintenance. Color grades D through H show market acceptance, though D colorless premiums rarely recover proportionally at resale.

Clarity considerations focus on eye-clean appearance over microscopic analysis. SI1 represents the practical investment threshold—VVS1 and FL grades offer minimal visual improvement while requiring premiums that don't recover in resale.

The sweet spot? One to two carats, where demand stays consistent across consumer segments. Larger stones face limited resale depth; smaller diamonds compete with commercial inventory.

Millennial Generation Driving Lab-Grown Diamond Investment Demand Trends

Demographic shifts toward ethical sourcing create market support, though generational preferences don't guarantee returns. Millennials and Gen Z show 60-70% higher acceptance rates than older cohorts, with sustainability driving decisions beyond price.

This conscious luxury mindset prioritizes transparency over traditional prestige. However, luxury markets historically favor rarity—something lab-grown diamonds can't provide due to scalable production.

"While millennials and Gen Z are indeed driving the demand for lab-grown diamonds due to their ethical values, its essential to recognize the technological advancements in production that enhance the stones quality and reduce its carbon footprint. These improvements not only cater to the sustainability ethos of younger generations but also increase the potential for these diamonds to hold and possibly appreciate in value as sustainable luxury assets. This shift could redefine the traditional metrics of luxury value in the diamond industry."

Retail data shows 40% higher conversion rates among 25-40 year-olds for lab-grown options, though average transactions remain 30-35% lower. The key question: will these preferences persist as this demographic ages and achieves higher income levels?

Investment Grade Diamond Quality Control and Technical Assessment Methods

Investment-grade lab-grown diamonds require assessment beyond standard 4Cs evaluation. Advanced spectroscopy distinguishes CVD from HPHT methods, with Type IIa classification ensuring optimal optical properties.

AI-powered grading systems analyze inclusions and color distribution with precision exceeding human assessment. These approaches provide consistent standards while reducing certification costs through improved efficiency.

| Investment Tier | Color Grade | Clarity Grade | Cut Grade | Min. Carat Weight | Type Classification | Production Method | Certification Required | Price Range (per carat) | Quality Control Method |

|---|---|---|---|---|---|---|---|---|---|

| Premium Investment | D-E | FL-IF | Excellent | 5.0ct+ | Type IIa | CVD (preferred) | GIA/IGI + Spectroscopy | $1,800-$2,500 | AI-powered inclusion mapping |

| High Investment | D-F | VVS1-VVS2 | Excellent | 3.0ct+ | Type IIa | CVD/HPHT | GIA/IGI + PL Analysis | $1,200-$1,900 | Advanced spectroscopy + visual |

| Standard Investment | D-G | VS1-VS2 | Very Good-Excellent | 2.0ct+ | Type IIa/Ib | CVD/HPHT | GIA/IGI/GCAL | $800-$1,400 | Standard grading + FTIR testing |

| Entry Investment | F-H | VS2-SI1 | Very Good | 1.0ct+ | Any Type | CVD/HPHT | IGI/GCAL minimum | $600-$1,100 | Traditional 4Cs assessment |

| Speculative Grade | G-J | SI1-SI2 | Good-Very Good | 0.5ct+ | Any Type | Any Method | Basic certification | $400-$800 | Visual inspection + documentation |

Risk factors include market volatility, technological obsolescence, and changing consumer preferences. Smart strategy? Diversify across multiple stones, sizes, and quality grades while maintaining reasonable portfolio complexity.

Production method identification requires professional equipment unavailable to typical consumers. Regular appraisal updates maintain accurate records while documenting quality changes over time.

Lab-grown diamonds offer luxury exposure with realistic expectations

They're beautiful alternatives to natural stones, providing 60-80% cost savings for personal enjoyment. As investments? Think collectibles rather than appreciating assets. Diversification benefits exist, but secondary market performance lags traditional luxury goods.

Ready to explore lab-grown diamonds for your portfolio?

Labrilliante's certified collection features investment-grade CVD and HPHT stones with full GIA documentation. Book your consultation today to discover how engineered diamonds fit your luxury investment strategy—with complete transparency about returns and resale potential.

Frequently Asked Questions

Lab-grown diamonds typically retain only 20-40% of their purchase value at resale, compared to 50-70% for natural diamonds. A $1,200 one-carat lab-grown diamond usually commands $300-500 in the secondary market.

CVD diamonds can grow larger sizes above one carat where investment potential concentrates, while HPHT shows 20% better consistency in achieving eye-clean clarity. However, CVD stones often need additional HPHT treatment, adding 15-20% to manufacturing costs.

Manufacturing costs decrease 10-15% annually due to improved efficiency, creating downward pricing pressure. Unlike natural diamonds, lab-grown stones have unlimited scalability, eliminating the scarcity that typically drives luxury investment appreciation.

GIA Laboratory-Grown Diamond Reports significantly enhance marketability and outperform IGI alternatives by 15-20% in resale channels. Professional certification costs 3-5% of diamond value but substantially improves secondary market performance.

The investment sweet spot is one to two carats with Excellent cut grades and SI1 clarity for eye-clean appearance. Larger stones face limited resale market depth, while smaller diamonds compete with commercial inventory.

While millennials show 60-70% higher acceptance rates for lab-grown diamonds and prioritize sustainability, their average transaction values remain 30-35% lower. The key uncertainty is whether these preferences will persist as this demographic ages and earns higher incomes.

Treat lab-grown diamonds like collectibles rather than appreciating assets, diversifying across multiple stones, sizes, and quality grades. They provide luxury exposure and portfolio diversification but shouldn't be expected to deliver strong financial returns.

Given the 10-15% annual decline in manufacturing costs and improving technology, timing purchases around personal enjoyment rather than investment appreciation makes more sense. Focus on certified stones from established producers for better resale performance.