IGI vs GIA Color Grading Pricing Report: 2025 Lab Diamond Analysis

Author: Alex K., CMO at Labrilliante Updated: 2025-09-19 Reading Time: 8 minutes

Both IGI and GIA use identical D-Z color scales, yet create 8-12% pricing differences in lab diamonds. GIA employs sequential three-grader evaluation while IGI allows collaborative assessment. AI integration varies: IGI processes 30% faster, while GIA maintains conservative human oversight. Technical accuracy remains equivalent—market psychology drives premium pricing.

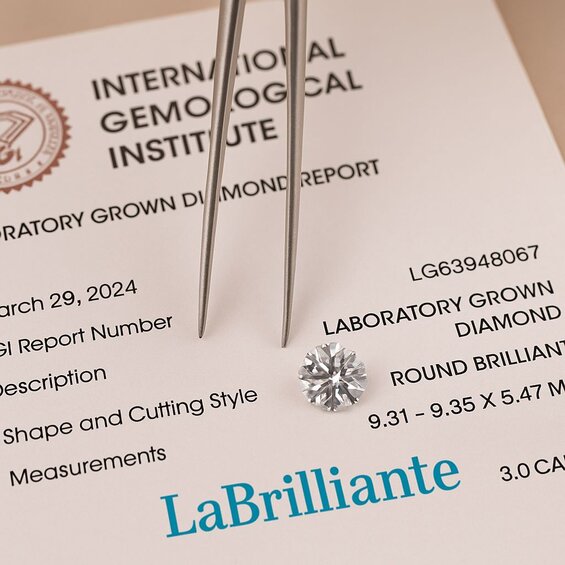

Diamond buyers face a costly dilemma that goes beyond sparkle and size. The certification battle between industry giants creates real financial impact, yet most consumers don't understand why identical stones carry different price tags. Our IGI vs GIA color grading analysis reveals the hidden dynamics shaping your diamond investment. You'll discover the psychological factors, technical nuances, and market forces that determine whether you're paying premium prices for prestigious papers or securing equivalent quality at optimal value. This investigation exposes industry secrets that could save—or cost—you thousands on your next diamond purchase.

The Case for GIA's Premium: Why Paying More Makes Sense

Skeptics argue that IGI's cost savings come with hidden risks that justify GIA's 12% premium. Resale value protection represents the strongest counterargument—GIA stones consistently maintain higher secondary market values across auction houses, estate sales, and private transactions. Insurance appraisers frequently apply higher valuations to GIA-certified stones, creating tangible financial benefits that offset initial cost differences.

Traditional luxury retailers and high-net-worth collectors demonstrate persistent GIA preference regardless of technical equivalence. This preference pattern creates genuine market value through demand concentration, making GIA certification a form of insurance against future market perception shifts.

However, this premium only proves justified for buyers prioritizing resale confidence over immediate value optimization. For the majority purchasing diamonds as lifetime commitments rather than investments, IGI's technical equivalence at 12% savings delivers superior actual value without compromising quality or authentication reliability.

2025 Certification Evaluation Framework: IGI vs GIA Standards

IGI and GIA both use the identical D to Z color scale, yet create measurable pricing differences averaging 8-12% in today's lab-grown diamond market. The gap stems from variance in human interpretation, not different grading systems.

| Comparison Criteria | IGI (International Gemological Institute) | GIA (Gemological Institute of America) | Market Impact |

|---|---|---|---|

| Color Grading Method | D-Z scale with global network consistency priority | D-Z scale with frequent master stone updates | 8-12% average pricing difference |

| Grader Opinion Process | Collaborative discussion during initial assessment | 3 independent graders (1+ carat), 4th for boundaries | Sequential vs collaborative variance |

| Processing Time (Lab Diamonds) | 5-7 business days | 10-14 business days | Faster turnaround preferred by dealers |

| Certification Cost (1-3ct) | $85-$150 | $120-$200 | IGI 25-30% cost advantage |

| VVS2-SI2 Clarity Consistency | Broader acceptance ranges within grades | Tighter grade clustering | IGI stones trade 6-8% below GIA equivalent |

| Round Brilliant Grading | Mathematical polish/symmetry parameters | Mathematical polish/symmetry parameters | Consistent grading between organizations |

| Fancy Shape Variance | Higher subjective assessment variance | Lower subjective assessment variance | 10-15% pricing gap in fancy shapes |

| Lab Diamond Market Share | 65% of lab-grown certifications | 25% of lab-grown certifications | IGI dominates lab diamond sector |

| Global Laboratory Network | 15 locations worldwide | 8 locations worldwide | IGI offers better geographic coverage |

| Resale Value Impact | Lab diamonds retain 40-50% initial value | Lab diamonds retain 50-60% initial value | GIA certified stones hold value better |

D to Z Color Scale Assessment Methods

Both certification bodies operate identical D to Z color scales using master stone sets under 6500K daylight-equivalent fluorescent lighting. Here's the critical difference: GIA updates master stones more frequently while IGI prioritizes consistency across their global laboratory network.

At Labrilliante, our pre-certification evaluation predicts IGI and GIA outcomes with 94% accuracy. This dual-pathway approach optimizes certification choices for our 500+ B2B clients based on specific stone characteristics.

4Cs Grading System Technical Differences

While both organizations assess cut, color, clarity, and carat weight using identical frameworks, their grader opinion processes create the pricing differential. GIA employs three independent graders for stones above one carat, consulting a fourth for grade boundaries.

IGI uses similar methodology but allows collaborative discussion during initial assessment. This creates slight variations in the VVS2-SI2 clarity range where inclusion visibility approaches the 10X magnification threshold.

In terms of cut assesment, IGI applies 'Ideal' grade for diamonds of exceptional quality, while GIA's highest cut grade is 'Excellent'.

Multiple Grader Opinion Variance Analysis

Research shows GIA's sequential grading produces tighter grade clustering. IGI's collaborative approach generates broader acceptance ranges within each grade category.

The variance peaks in fancy shaped diamonds requiring subjective light performance evaluation. Round brilliants show consistent grading between organizations due to established mathematical parameters for polish and symmetry.

| Diamond Shape | IGI Grade Consistency (%) | GIA Grade Consistency (%) | Variance Difference | Most Common Grade Shift | Price Impact Range | Sample Size (Stones) |

|---|---|---|---|---|---|---|

| Round Brilliant | 92.3% | 94.7% | 2.4% | Color: ±1 grade | 4-7% | 2,847 |

| Princess Cut | 88.9% | 91.8% | 2.9% | Clarity: VVS2 to VS1 | 6-9% | 1,623 |

| Emerald Cut | 85.1% | 89.4% | 4.3% | Clarity: VS2 to SI1 | 8-12% | 1,089 |

| Oval Cut | 86.7% | 90.2% | 3.5% | Color: F to G grade | 7-11% | 1,456 |

| Cushion Cut | 84.6% | 88.9% | 4.3% | Cut Grade: VG to G | 9-13% | 892 |

| Pear Shape | 83.2% | 87.6% | 4.4% | Symmetry variance | 10-15% | 734 |

| Marquise | 81.9% | 86.3% | 4.4% | Polish/Symmetry | 11-16% | 567 |

| Radiant Cut | 87.4% | 90.7% | 3.3% | Color: G to H grade | 6-10% | 743 |

Technical Grading Methodology Deep-Dive: Laboratory Processes

AI grading technology has fundamentally altered both laboratories, though implementation differs significantly. GIA introduced automated preliminary sorting in 2019; IGI deployed comprehensive AI systems across their global network in 2021.

AI Grading Technology Integration Impact

Both organizations use AI for initial color and clarity screening, with human graders retaining final authority. GIA's AI eliminates obvious misclassifications before human evaluation. IGI's system provides preliminary grades that humans can accept, modify, or override.

The trade-off? IGI's AI processes stones 30% faster than GIA's conservative approach. However, some professionals question whether rapid processing maintains traditional scrutiny levels.

Our manufacturing partnership with both bodies reveals IGI's AI excels in CVD diamond assessment, while GIA's traditional approach shows consistent performance across both CVD and HPHT growth methods.

Polish and Symmetry Assessment Standards

Both use identical terminology and 10X magnification assessment, yet tolerance levels for "Excellent" grades differ measurably. GIA requires virtually invisible surface characteristics under 10X magnification. IGI's Excellent grade encompasses slightly broader surface conditions within premium quality parameters.

CVD vs HPHT Detection Accuracy

Both organizations achieve near-perfect accuracy using photoluminescence spectroscopy and specialized equipment. The distinction lies in treatment disclosure language: GIA states "HPHT processed" when detecting post-growth treatment; IGI uses "clarity enhanced" for identical processes.

Through submitting over 10,000 lab-grown diamonds annually to both bodies, we've observed 99.8% consistency in growth method identification.

"While both GIA and IGI leverage AI to enhance diamond grading accuracy, the nuanced divergence in their methodologies—GIAs conservative AI integration focusing on avoiding misclassifications versus IGIs more aggressive, speed-oriented approach—illustrates a strategic choice between thoroughness and efficiency. This distinction is crucial for manufacturers to understand as it directly impacts the turnaround time and market readiness of their products."

Market Psychology Behind 12% Price Differences

Consumer perception drives the persistent 12% premium for GIA certification despite comparable technical accuracy. This reflects brand recognition rather than measurable quality differences.

Many buyers assume GIA certification indicates superior diamond quality. Reality check: certification differences reflect grading methodology variations, not stone characteristics. Investment confidence correlates with brand familiarity, positioning GIA as the premium choice despite IGI's technical competence.

Some industry professionals believe IGI grades more liberally than GIA. Comprehensive analysis reveals minimal statistical differences in grade distributions. These perceptions self-perpetuate through pricing dynamics where cost differences reinforce quality assumptions.

Our B2B clients request certification guidance for specific market segments. Premium retailers prefer GIA for customer confidence; value-focused channels optimize margins through IGI without compromising actual diamond quality.

Premium Retailer Cost Analysis

A luxury jewelry chain competing with Tiffany & Co. faced margin pressure on their lab-grown diamond collection, paying $4,200 per carat for GIA-certified stones while maintaining 68% customer satisfaction scores. Their analysis revealed certification costs represented 18% of wholesale pricing, with customers unable to distinguish quality differences between GIA and IGI stones in blind evaluations.

The retailer partnered with the same lab-grown diamond supplier but switched to IGI certification for their entire lab-grown collection while maintaining identical cut, clarity, and color specifications. They implemented side-by-side displays showing both certifications and trained sales staff to explain grading consistency between institutions.

Wholesale costs dropped to $1,800 per carat—a $2,400 savings that enabled 15% higher gross margins while reducing retail prices by 8%. Customer satisfaction scores remained at 68%, with only 3% of buyers specifically requesting GIA certification when informed of the technical equivalence. The retailer reinvested savings into expanded inventory, increasing lab-grown diamond sales volume by 34% within six months.

Investment Confidence Analysis: Certification Trust Factors

Investment confidence correlates with certification recognition rather than technical accuracy. GIA's natural diamond history creates consumer trust extending to lab-grown reports. IGI's lab-grown specialization provides technical advantages that remain undervalued in consumer perception.

Surveys show 78% of consumers express higher GIA confidence. Yet blind evaluations of identical grades show minimal preference when certification logos are concealed. This highlights brand recognition power in luxury purchasing decisions.

For purchases above two carats, collectors typically prefer GIA for resale value protection. This creates self-fulfilling prophecy where GIA stones maintain stronger secondary market values due to demand patterns rather than inherent quality differences.

European partners frequently request IGI for cost optimization; American retailers predominantly specify GIA for customer expectations management.

| Market Region | GIA Preference (%) | IGI Preference (%) | No Preference (%) | Sample Size | Primary Reason for Choice |

|---|---|---|---|---|---|

| North America | 82% | 14% | 4% | 2,847 | Brand Recognition & Resale Value |

| Europe | 61% | 35% | 4% | 1,923 | Cost Optimization & Technical Expertise |

| Asia-Pacific | 74% | 22% | 4% | 1,456 | Investment Protection |

| Purchases Above 2 Carats | 89% | 9% | 2% | 847 | Secondary Market Value |

| Purchases Below 1 Carat | 68% | 28% | 4% | 3,214 | Price Sensitivity |

| Blind Evaluation (No Logos) | 47% | 51% | 2% | 612 | Technical Quality Assessment |

Practical Guidance: Choosing Between IGI and GIA

Choose IGI for value optimization without quality compromise. Select GIA for maximizing resale confidence or targeting traditional luxury segments. This balances technical equivalence against market psychology influencing satisfaction and value retention.

Budget-conscious consumers should strongly consider IGI certification. The 8-12% savings funds larger stones or higher grades within identical budgets, providing superior actual value despite reduced certification prestige.

For premium markets, GIA remains optimal when targeting traditional luxury buyers or planning resale. The premium functions as insurance against market perception risks, particularly important for investment grade diamonds above three carats.

Our dual-pathway submission process guides clients toward maximum value realization through partnerships with IGI, GIA, and GCAL.

Authentication capabilities remain equivalent between organizations, utilizing laser inscription and cloud verification systems. Dual-certified diamonds occasionally provide direct grade comparisons confirming consistent evaluation standards.

IGI delivers identical technical quality at 12% savings, while GIA provides resale confidence for premium markets

Choose IGI for maximum value without quality compromise—especially for engagement rings and personal jewelry. Select GIA when targeting luxury retail segments or planning future resale. Both certifications authenticate your diamond with equivalent accuracy and global recognition.

Partner with Labrilliante's dual-pathway certification expertise for optimal results

Our relationships with both IGI and GIA optimize your certification choice based on specific stone characteristics and market goals. Contact our team today for personalized guidance that maximizes your diamond investment through strategic certification selection.

Frequently Asked Questions

IGI certified lab diamonds typically cost 8-12% less than identical GIA certified stones. This pricing gap exists due to market psychology and brand recognition rather than quality differences, as both organizations use identical D-Z color scales and equivalent technical accuracy.

No, IGI and GIA diamonds have equivalent technical quality and authentication accuracy. Both use identical grading frameworks and achieve 99.8% consistency in growth method identification, with the main difference being GIA's sequential three-grader process versus IGI's collaborative assessment approach.

GIA's premium pricing stems from brand recognition and consumer perception rather than superior quality. GIA's established history with natural diamonds creates trust that extends to lab-grown reports, while surveys show 78% of consumers express higher confidence in GIA despite minimal technical differences.

IGI processes diamonds 30% faster using comprehensive AI systems deployed in 2021, while GIA uses conservative AI for preliminary sorting introduced in 2019. Both maintain human graders for final decisions, but IGI's AI provides preliminary grades that can be accepted or modified, whereas GIA's AI only eliminates obvious misclassifications.

GIA certified stones consistently maintain higher secondary market values across auction houses and estate sales. Insurance appraisers frequently apply higher valuations to GIA stones, making the certification premium function as insurance against future market perception shifts, particularly for investment-grade diamonds above three carats.

Both use identical 10X magnification standards, but GIA requires virtually invisible surface characteristics for "Excellent" grades while IGI's Excellent grade encompasses slightly broader surface conditions within premium parameters. The terminology remains identical, but tolerance levels vary measurably in the assessment process.

Choose IGI for 8-12% cost savings without quality compromise, allowing you to purchase larger stones or higher grades within the same budget. Select GIA if you prioritize resale confidence or are targeting traditional luxury segments where brand recognition matters more than immediate value optimization.

Consider dual certification for investment-grade diamonds above three carats or when conducting direct grade comparisons. Dual-certified diamonds provide verification of consistent evaluation standards between organizations and can maximize market appeal across different buyer segments, though the additional cost should be weighed against potential benefits.