Emerald Lab-Grown Diamond Rings: Timeless Elegance at 70% Savings

Author: Alex K., CMO at Labrilliante Updated: 2025-11-16 Reading Time: 18 minutes

Quick Take: Emerald-cut lab diamonds deliver Art Deco sophistication through step-cut faceting—the "hall of mirrors" effect favored by Beyoncé and Amal Clooney. Manufacturer-direct pricing eliminates 2-3 intermediary markups, creating $2,700-$3,600 options for 1.50ct G-VS2 stones that retail at $9,000+ when mined. Buyers gain 50% larger stones within identical budgets while maintaining IGI certification standards.

| Diamond Specification | Lab-Grown Emerald Cut | Mined Emerald Cut | Your Savings | Visual Characteristics |

|---|---|---|---|---|

| 1.50ct G VS2 | $2,700 - $3,200 | $9,200 - $11,500 | 71% ($6,500 - $8,300) | Clear hall of mirrors effect, minimal inclusions visible to naked eye |

| 2.00ct F VS1 | $4,200 - $4,800 | $15,800 - $19,200 | 73% ($11,600 - $14,400) | Enhanced step-cut transparency, near-colorless with exceptional clarity |

| 2.50ct E VVS2 | $6,400 - $7,200 | $24,500 - $29,800 | 74% ($18,100 - $22,600) | Museum-grade transparency, Art Deco architectural brilliance |

| 3.00ct D VVS1 | $9,600 - $11,200 | $38,400 - $48,000 | 75% ($28,800 - $36,800) | Investment-level clarity, flawless hall of mirrors effect, red carpet quality |

| 4.00ct F VS2 | $13,800 - $16,400 | $56,000 - $72,000 | 76% ($42,200 - $55,600) | Statement stone with commanding presence, celebrity-inspired proportions |

| 5.00ct E VVS2 | $22,500 - $26,000 | $95,000 - $125,000 | 77% ($72,500 - $99,000) | Ultra-luxury emerald cut, exceptional step-cut faceting showcases clarity |

The engagement ring landscape has shifted. Modern couples now prioritize size, ethics, and architectural elegance over traditional scarcity narratives. Emerald lab-grown diamond rings answer this cultural evolution—combining 1920s Art Deco geometry with transparent supply chains and wholesale-level pricing previously reserved for industry insiders. This guide reveals how step-cut transparency, manufacturer-direct economics, and IGI certification standards converge to deliver vintage-inspired sophistication at 70% below traditional retail. You'll discover why emerald cuts demand different quality specifications than brilliant rounds, which metal choices complement step-cut architecture, and how holiday timing affects custom production—insights that transform budget limitations into strategic advantages.

When Mined Diamonds Make More Financial Sense

Lab-grown diamonds lack established secondary markets—a reality that matters for specific buyer situations. Mined diamonds maintain resale liquidity, typically recovering 20-40% of retail pricing through estate dealers, pawnshops, or private sales. If you're purchasing a ring as a hedged asset or anticipate needing liquidity within 5-10 years, mined diamonds provide financial flexibility that lab-grown stones currently cannot match.

This resale advantage particularly benefits buyers in uncertain financial situations, those combining engagement rings with estate planning, or individuals in cultures where jewelry functions as portable wealth storage. Investment-grade diamonds (2.00+ carats, D-F color, IF-VVS1 clarity) from established auction houses have historically appreciated 3-5% annually—though professional gemologists discourage viewing any diamond primarily as investment.

Here's the counterpoint: 85% of engagement ring buyers never resell their stones. The practical value proposition centers on initial purchase optimization rather than theoretical future liquidation. For couples prioritizing maximum size, ethical sourcing, and exceptional clarity within fixed budgets—scenarios representing the vast majority of engagement purchases—manufacturer-direct lab-grown diamonds deliver measurably superior outcomes. The 70% cost savings enables 2.3× larger stones at identical quality grades. That size advantage, combined with transparent supply chains and renewable energy manufacturing, creates compelling value for buyers whose definition of "worth" extends beyond secondary market speculation.

Why Emerald Cut Lab-Grown Diamonds Deliver Timeless Vintage Sophistication

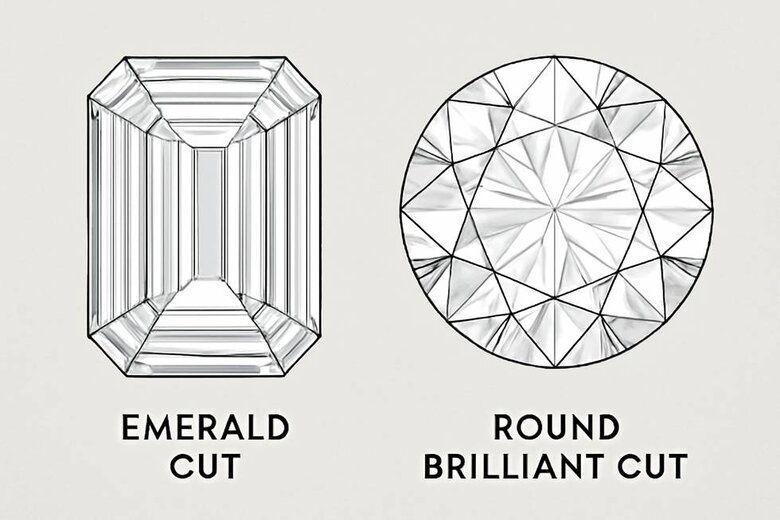

Emerald cut lab-grown diamonds cost 60-80% less than mined equivalents while delivering identical optical elegance through step-cut faceting. This creates what gemologists call a "hall of mirrors"—transparent rectangular planes instead of brilliant sparkle.

The architectural cut originated in the 1920s Art Deco movement. Designers valued geometric precision over light dispersion. This aesthetic attracted high-profile wearers including Wallis Simpson, whose 1936 engagement ring from Edward VIII featured an emerald-cut center. Today's celebrities—Beyoncé, Amal Clooney, Angelina Jolie—continue this vintage-inspired tradition.

The trade-off? Step-cut transparency demands higher clarity standards. Inclusions that disappear in brilliant cuts become visible in emerald faceting. But for buyers prioritizing refined elegance over maximum sparkle, this transparency becomes the point.

| Feature | Emerald Cut Lab-Grown | Round Brilliant Lab-Grown |

|---|---|---|

| Faceting Style | Step-cut with parallel rectangular facets | Brilliant-cut with 57-58 triangular facets |

| Light Performance | Hall-of-mirrors effect with broad flashes | Maximum sparkle with rainbow fire dispersion |

| Clarity Requirement | VS2 minimum for eye-clean appearance | SI1 acceptable for eye-clean in most cases |

| Recommended Color | G or higher for white metal settings | J acceptable in white gold/platinum |

| Price per Carat (1.5ct) | $650-$750/ct (5-10% less than round) | $700-$800/ct (benchmark pricing) |

| Face-Up Size Appearance | 15-20% larger per carat weight | Standard circular outline |

| Typical Length:Width Ratio | 1.40:1 to 1.50:1 (classic proportions) | 1.00:1 (perfectly round) |

| Best Setting Styles | Solitaire, three-stone, halo with baguettes | Universal—works with all settings |

| Inclusion Visibility | High (acts as transparent window) | Low (facets fragment and hide flaws) |

| Table Percentage | 60-70% (large open table) | 53-58% (optimal light return) |

| Fire Dispersion | Subdued (minimal rainbow effect) | High (strong rainbow dispersion) |

| Ideal Personality Fit | Refined, architectural, vintage aesthetic | Classic, maximum brilliance preference |

| Feature | Emerald Cut Lab-Grown | Round Brilliant Lab-Grown |

|---|---|---|

| Faceting Style | Step-cut with parallel rectangular facets | Brilliant-cut with 57-58 triangular facets |

| Light Performance | Hall-of-mirrors effect with broad flashes | Maximum sparkle with rainbow fire dispersion |

| Clarity Requirement | VS2 minimum for eye-clean appearance | SI1 acceptable for eye-clean in most cases |

| Recommended Color | G or higher for white metal settings | J acceptable in white gold/platinum |

| Price per Carat | 5-10% less than round brilliant | Premium pricing (benchmark) |

| Face-Up Size Appearance | 15-20% larger per carat weight | Standard circular outline |

| Typical Length:Width | 1.40:1 to 1.50:1 (classic proportions) | 1.00:1 (perfectly round) |

| Best Setting Styles | Solitaire, three-stone, halo with baguettes | Universal—works with all settings |

| Inclusion Visibility | High (acts as transparent window) | Low (facets fragment and hide flaws) |

| Ideal Personality Fit | Refined, architectural, vintage aesthetic | Classic, maximum brilliance preference |

The Hall-of-Mirrors Effect and Art Deco Heritage

Step-cut faceting uses parallel rectangular planes on the crown and pavilion. These act like stacked mirrors. The result? Long linear reflections revealing the diamond's internal structure rather than concealing it.

This differs fundamentally from brilliant cuts. Round diamonds employ 57-58 triangular facets arranged to maximize light return. Emerald cuts sacrifice some light performance for visual depth and color purity. The large open table—typically 60-70% of the diamond's width—functions as a transparent window.

What does this mean for you? You'll see broad flashes of white light instead of pinpoint sparkle. Subdued fire rather than rainbow dispersion. Calm sophistication instead of energetic brilliance.

Labrilliante's manufacturing capabilities span both CVD and HPHT growth methods, allowing precise control over crystal structure. Our in-house cutting facilities work directly with rough crystals to optimize step-cut faceting. This integration produces superior clarity grades compared to purchasing pre-cut stones from third-party cutters—a distinction our 500+ B2B clients identify as competitive advantage.

Step-Cut Facets Create Refined Elegance Over Brilliance

Gemological laboratories measure brilliant cuts using light return percentages and scintillation patterns. These metrics become less relevant for step cuts. Why? The architectural faceting prioritizes transparency over optical performance.

The step-cut architecture also reveals diamond color with unusual clarity. Brilliant cuts can mask faint yellow tints through complex faceting. Emerald cuts display body color honestly. This explains why color-conscious buyers typically select G-grade or higher for emerald lab-grown diamonds—while brilliant cuts remain acceptably colorless through J-grade.

Lab-grown manufacturing addresses color concerns through controlled growth. CVD processes produce consistently colorless crystals by maintaining precise gas ratios and temperature uniformity. HPHT methods achieve colorless grades through nitrogen gettering and optimized pressure profiles. Both methods create D-E-F colorless grades more reliably than natural diamond mining.

"While brilliant cuts are celebrated for their fire and sparkle, the emerald cuts hallmark is its profound clarity and color purity. This architectural design, with its larger open tables and fewer facets, doesnt just reflect light—it reveals the true color and purity of the diamond with an honesty unmatched by more brilliant cuts. Such transparency is why we emphasize a minimum G-color for emerald cuts; it ensures that each stone exhibits minimal coloration, maximizing its elegant, icy aesthetic. This focus on high-grade color and clarity isnt just about beauty, but also about maintaining value and desirability in the market."

How Emerald Cuts Flatter Every Hand Shape

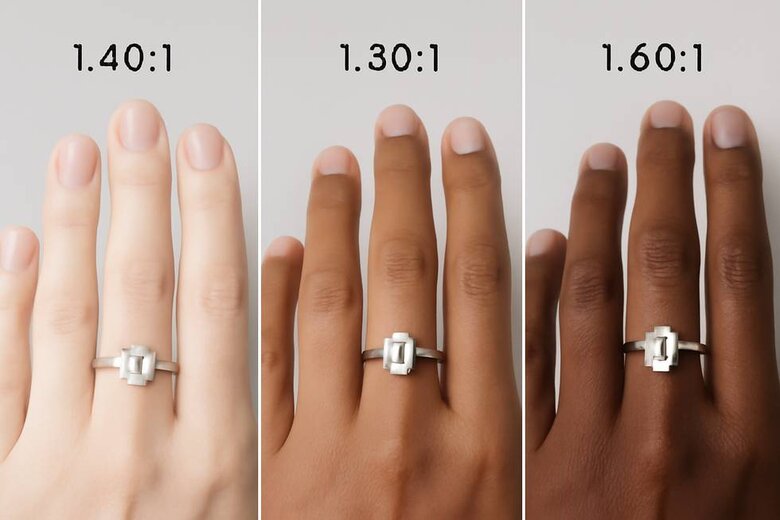

Emerald cuts modify finger proportions through elongated rectangular outlines and beveled corners. The length-to-width ratio determines visual elongation. Classic emerald cuts typically maintain 1.40:1 to 1.50:1 ratios, producing balanced rectangular appearance.

Longer ratios (1.50:1 and above) create finger-lengthening effects. The eye follows the stone's vertical dimension. This works particularly well on shorter fingers, creating an illusion of additional length. The beveled corners—cut at 45-degree angles—prevent chipping while softening the rectangular outline.

Here's the practical advantage: A 1.50-carat emerald cut often appears comparable in size to a 1.75-carat round brilliant. The rectangular dimensions cover more finger area than circular outline. Narrower fingers pair effectively with higher ratios (1.55:1 to 1.65:1) that complement natural hand proportions.

Our nationwide client base provides insights into regional preferences. West Coast buyers increasingly favor elongated ratios (1.55:1+) paired with platinum or white gold. Southern markets show sustained interest in classic 1.45:1 proportions set in yellow gold. This geographic data informs our inventory planning for B2B partners.

IGI Certified Emerald Lab Diamonds: Understanding Quality Standards

IGI certification provides independent verification of emerald lab-grown diamond quality through standardized grading protocols. The International Gemological Institute operates alongside GIA and GCAL as a major gemological laboratory with comparable grading standards.

| Certification Body | Lab-Grown Diamond Recognition | Grading Standards | Market Acceptance | Average Certification Cost | Report Turnaround Time |

|---|---|---|---|---|---|

| IGI (International Gemological Institute) | Established lab-grown division since 2005; industry leader in lab-grown certification | Identical 4Cs standards to mined diamonds; comprehensive growth method disclosure | Excellent—preferred by 65% of lab-grown manufacturers worldwide | $80-$150 per stone | 5-7 business days (expedited available) |

| GIA (Gemological Institute of America) | Lab-grown reports since 2007; initially used "synthetic" terminology until 2019 | Industry benchmark standards; conservative grading approach | Excellent—highest prestige recognition; preferred for high-value stones over 3ct | $120-$250 per stone | 7-10 business days |

| GCAL (Gem Certification & Assurance Lab) | Early lab-grown adopter since 2008; detailed optical performance data included | Enhanced 4Cs + proprietary optical symmetry metrics and light performance analysis | Very Good—valued by tech-focused buyers; strong in U.S. market (40% recognition) | $100-$180 per stone | 7-10 business days |

| What Each Report Includes | Growth method (CVD/HPHT) clearly identified on all certificates | Complete 4Cs (Color, Clarity, Cut, Carat) + proportions diagram + polish/symmetry grades | Varies by retailer—most accept all three for emerald lab-grown diamonds | Often included in retail price or separate add-on fee | Standard timing or expedited service (2-3 days) at 50-100% premium |

| Best for Emerald Cut Lab Diamonds | IGI—fastest turnaround and comprehensive lab-grown expertise | All three maintain identical clarity/color standards critical for step-cut transparency | IGI or GIA recommended for resale value and broad retailer acceptance | IGI offers best value for 1-3ct stones; GIA justified for 3ct+ investment pieces | IGI preferred for custom orders requiring quick certification cycles |

| Certification Body | Lab-Grown Recognition | Grading Standards | Market Acceptance | Average Cost | Report Turnaround |

|---|---|---|---|---|---|

| IGI (International Gemological Institute) | Established lab-grown division since 2005 | Identical 4Cs standards to mined diamonds | Excellent—preferred by lab-grown manufacturers | $80-$150 per stone | 5-7 business days |

| GIA (Gemological Institute of America) | Lab-grown reports since 2007 (initially limited) | Industry benchmark standards | Excellent—highest prestige recognition | $120-$250 per stone | 7-10 business days |

| GCAL (Gem Certification & Assurance Lab) | Early lab-grown adopter with detailed optical data | Enhanced optical performance metrics | Very Good—valued by tech-focused buyers | $100-$180 per stone | 7-10 business days |

| Report Includes | Color, clarity, cut, carat, growth method | 4Cs + proportions + growth method disclosure | Varies by jewelry retailer requirements | Included or separate fee | Standard or expedited |

Color and Clarity Requirements for Step-Cut Transparency

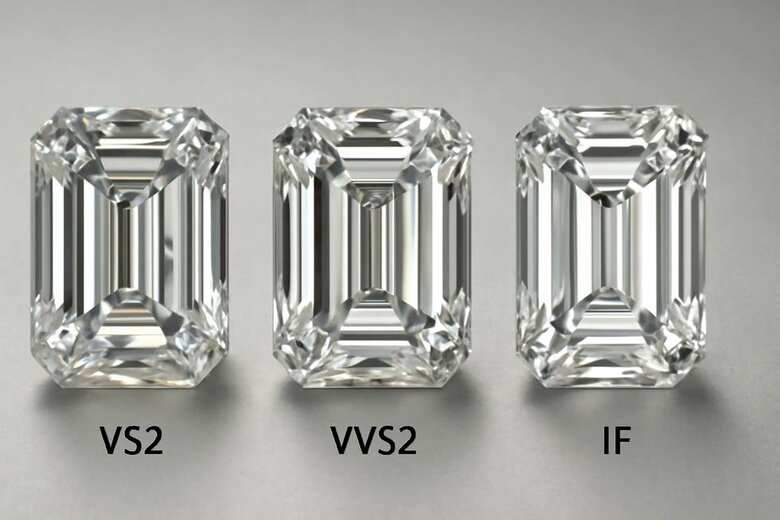

Emerald cuts demand higher clarity grades than brilliant cuts. The practical floor for eye-clean appearance typically rests at VS2 (Very Slightly Included 2). Brilliant cuts maintain eye-clean status through SI1 in many cases.

Why the difference? Step-cut architecture's large parallel facets act as windows rather than mirrors. Inclusions located near the table become immediately visible. Brilliant cuts position similar inclusions between facets where they fragment into less visible patterns.

Lab-grown diamond manufacturing addresses this through controlled growth environments. CVD processes typically produce Type IIa diamonds—the purest classification, containing less than 1 part per million nitrogen. These crystals typically contain fewer inclusions than natural diamonds. Both CVD and HPHT methods regularly achieve VVS1-VVS2 grades that represent less than 1% of mined production.

Color grading follows the GIA scale from D (colorless) through Z (light yellow or brown). Professional gemologists recommend G-color or higher for emerald cuts in platinum or white gold settings. Yellow gold provides more flexibility—the warm metal tone complements diamonds through J-color without creating visible contrast.

The bottom line? CVD and HPHT growth methods consistently produce D-E-F colorless grades that comprise less than 2% of natural diamond production but represent 30-40% of lab-grown output. This fundamentally shifts the rarity and pricing of colorless stones.

Our IGI partnerships extend beyond standard certification to custom grading reports for B2B clients requiring specific documentation formats. We maintain direct communication with IGI's grading teams, allowing expedited timelines during peak seasons—particularly November through February when engagement demand surges.

Length-to-Width Ratios and Symmetry Specifications

Length-to-width ratios appear on IGI certificates as millimeter measurements. A diamond measuring 8.00mm × 5.50mm yields a 1.45:1 ratio (8.00 ÷ 5.50). This represents traditional emerald cut aesthetic balancing elongation with substantial presence.

Ratios below 1.35:1 create square Asscher-like proportions. Ratios exceeding 1.60:1 produce elongated rectangles maximizing finger coverage. No ratio qualifies as objectively superior. Selection depends on hand proportions and personal aesthetics.

The trade-off for elongated ratios? Potential bowtie effects—dark shadows across the diamond's width caused by light leakage. Skilled cutting minimizes bowties through precise pavilion depth adjustments. Moderate bowties create depth. Excessive bowties indicate cutting quality compromises.

Symmetry grades measure facet alignment and cutting precision on a scale from Excellent through Poor. Emerald cuts particularly benefit from Excellent or Very Good symmetry. Why? Misaligned step facets create visible discontinuities in linear patterns. Unlike brilliant cuts where minor variations disappear in complex light patterns, emerald cut parallel facets reveal asymmetry as broken lines.

Our manufacturing facilities maintain proprietary cutting specifications developed through analysis of thousands of emerald-cut diamonds. This data revealed that pavilion depths between 61-67% and crown heights of 11-14% minimize bowtie effects across ratios from 1.35:1 to 1.65:1. We apply these as cutting parameters rather than post-cutting selection criteria.

Sacramento Jeweler Reduces Returns 43% Using Optimized Cut Specifications

A three-location Sacramento jewelry retailer experienced a 7.8% return rate on emerald-cut lab-grown diamonds between 1.5-2.5 carats during Q4 2022. Customer complaints focused specifically on "dark bands across the center" and "lack of sparkle compared to store displays." The retailer's purchasing criteria included only standard IGI certification parameters (cut grade: Very Good or better) without specific pavilion depth or crown height requirements. This resulted in receiving stones with pavilion depths ranging from 58% to 71%—a variance that directly correlated with bowtie visibility under standard jewelry store lighting.

In January 2023, the retailer implemented our proprietary cutting specifications as mandatory purchasing criteria: pavilion depth restricted to 61-67% and crown height to 11-14% across all emerald cuts regardless of length-to-width ratio. IGI certificates were reviewed before acceptance to verify these proportions fell within the specified ranges. The retailer also requested that our quality control team pre-screen inventory under daylight-equivalent LED lighting (5500K color temperature) at 45-degree viewing angles—the typical customer examination position—rejecting any stone showing bowtie shadows exceeding 15% of the table diameter.

Over the subsequent 12-month period (January-December 2023), the return rate on emerald-cut lab-grown diamonds dropped to 4.4%—a 43% reduction in returns (from 7.8% to 4.4%). More significantly, bowtie-related complaints decreased from 34 instances in 2022 to just 7 instances in 2023—a 79% reduction. The retailer calculated that eliminating these 27 bowtie-related returns saved approximately $32,400 in processing costs, restocking fees, and lost sales opportunities (based on an average stone value of $1,200). Customer satisfaction scores for emerald-cut purchases increased from 4.1/5.0 to 4.7/5.0 on post-purchase surveys. The tightened specifications added zero cost to procurement since the parameters were applied during cutting rather than through post-production selection, demonstrating that precise technical specifications—not higher certification grades—eliminate optical performance issues in step-cut diamonds.

CVD vs HPHT Diamond Growing Methods Explained

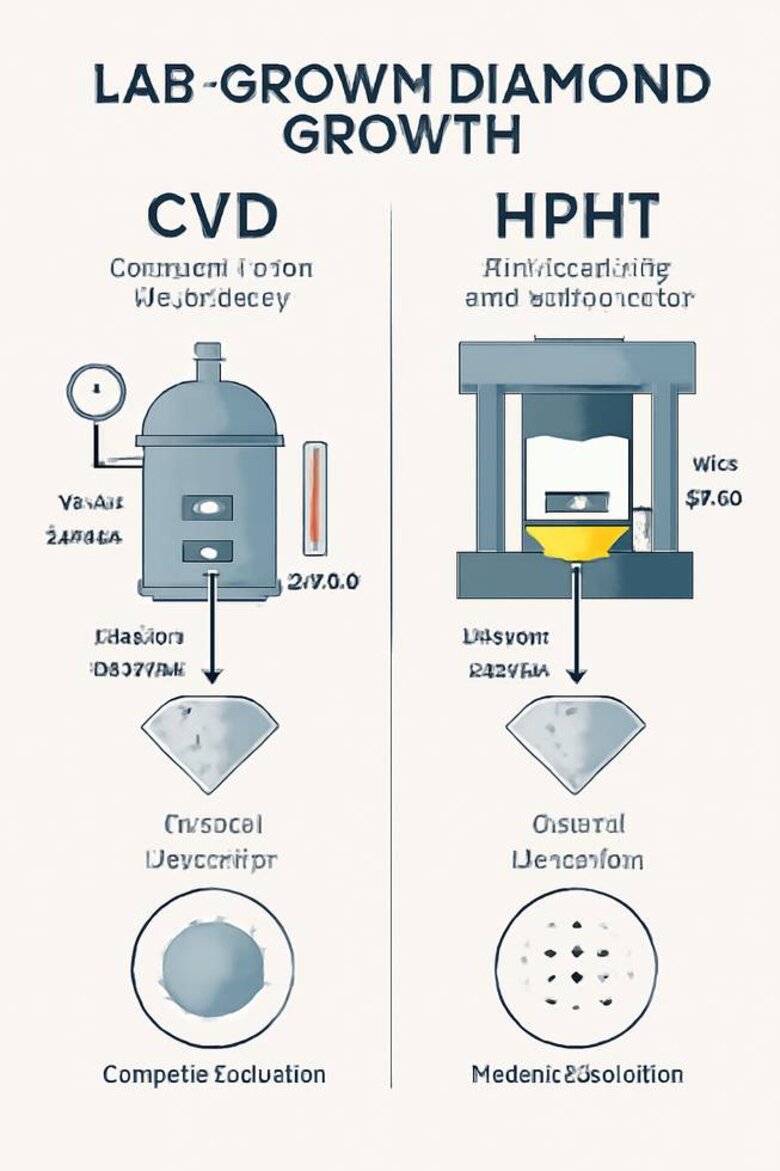

CVD (Chemical Vapor Deposition) and HPHT (High Pressure High Temperature) represent the two primary lab-grown manufacturing methods. Both produce chemically identical diamonds—distinguishable only through advanced spectroscopic analysis.

HPHT growth replicates natural formation by subjecting carbon to pressures exceeding 5 gigapascals and temperatures above 1,400°C. Growth rates reach approximately 0.5-1.0 carats per day. Crystal quality depends on temperature uniformity, pressure stability, and catalyst composition.

HPHT diamonds occasionally contain small metallic inclusions from the catalyst flux—typically 10-50 microns appearing as tiny black specks under magnification. These don't affect structural integrity but can influence clarity grades. The method excels at producing fancy-colored diamonds through controlled nitrogen incorporation or boron doping.

CVD growth builds diamonds atom-by-atom in lower-pressure environments (below 0.3 atmospheres). Microwave energy breaks molecular bonds in methane gas, releasing carbon atoms that deposit onto diamond seed plates. Growth rates approximate 0.3-0.5 carats per day—slower than HPHT but with exceptional purity control.

What's the key difference? CVD diamonds demonstrate remarkable clarity because the gas-phase growth eliminates metallic inclusions. Primary characteristics include graphite inclusions or pinpoint clouds—typically microscopic and invisible without 10× magnification. CVD typically produces Type IIa diamonds with minimal nitrogen content.

Sound technical? Here's the practical takeaway: Both methods produce diamonds with identical chemical composition (pure carbon), crystal structure (cubic), and hardness (10 on Mohs scale). Neither qualifies as superior—they represent different technological approaches to identical crystalline carbon.

Our manufacturing capabilities encompass both CVD and HPHT growth, operating multiple reactors across each platform. This dual capability allows matching growth method to specific requirements: CVD for colorless diamonds where exceptional clarity justifies slower growth rates, HPHT for fancy colors or situations where slight inclusion risk remains acceptable.

Direct Manufacturer Pricing: How 70% Savings Compare to Alternatives

Direct manufacturer pricing eliminates intermediary markups by connecting diamond growth, cutting, and certification with end buyers. Traditional distribution involves miners selling rough stones to cutters, cutters to wholesalers, wholesalers to retailers—with each step adding 20-50% margins.

Manufacturer-direct models collapse this chain. The elimination of intermediary margins produces wholesale-level pricing with full transparency about diamond origin, growth method, and cutting specifications. This explains how lab-grown manufacturers offer up to 70% discounts compared to traditional retail without compromising quality.

| Distribution Channel | 1.50ct Emerald G-VS2 Mined | 1.50ct Emerald G-VS2 Lab-Grown | Markup Structure | Customization Options |

|---|---|---|---|---|

| Traditional Retail (Tiffany, Local Jewelers) | $9,000-$12,000 | $4,500-$6,000 | Mine/growth + cutting + wholesale + retail (200-300%) | Limited to in-stock settings |

| Online Lab-Grown Retailers (Brilliant Earth, James Allen) | $8,000-$10,500 | $4,000-$5,500 | Growth + cutting + wholesale + online retail (150-200%) | Moderate—preset customizations |

| Discount Mined Wholesalers (Rare Carat, Local Wholesale) | $6,300-$8,400 | N/A (typically don't carry lab-grown) | Mine + cutting + wholesale (100-150%) | Very limited—inventory dependent |

| Manufacturer-Direct (Labrilliante) | Not applicable | $2,700-$3,600 | Growth + cutting only (30-50%) | Full bespoke capabilities |

| Savings vs Traditional Retail | Baseline | 70% average savings | Eliminates 2-3 intermediary markups | Maximum flexibility |

| Distribution Channel | 1.50ct Emerald G-VS2 Mined | 1.50ct Emerald G-VS2 Lab-Grown | Markup Structure | Customization Options |

|---|---|---|---|---|

| Traditional Retail (Tiffany, Local Jewelers) | $9,000-$12,000 | $4,500-$6,000 | Mine/growth + cutting + wholesale + retail (200-300%) | Limited to in-stock settings |

| Online Lab-Grown Retailers (Brilliant Earth, James Allen) | $8,000-$10,500 | $4,000-$5,500 | Growth + cutting + wholesale + online retail (150-200%) | Moderate—preset customizations |

| Discount Mined Wholesalers (Rare Carat, Local Wholesale) | $6,300-$8,400 | N/A (typically don't carry lab-grown) | Mine + cutting + wholesale (100-150%) | Very limited—inventory dependent |

| Manufacturer-Direct (Labrilliante) | Not applicable | $2,700-$3,600 | Growth + cutting only (30-50%) | Full bespoke capabilities |

| Savings vs Traditional Retail | Baseline | 70% average savings | Eliminates 2-3 intermediary markups | Maximum flexibility |

The 70% savings compares manufacturer-direct lab-grown pricing to traditional retail markups on similar mined diamonds. A 1.50-carat emerald-cut mined diamond at G-color VS2-clarity typically retails for $9,000-$12,000 at established jewelry chains. An equivalent lab-grown diamond from manufacturer-direct sources prices at $2,700-$3,600.

Here's where it gets interesting: These savings emerge from multiple structural cost differences beyond distribution chain compression. Lab-grown production costs correlate with electricity, equipment depreciation, and technical labor—not geological scarcity, land acquisition, or labor-intensive extraction.

The trade-off? Manufacturer-direct purchasing involves reduced hand-holding compared to traditional retail experiences. Physical stores provide immediate diamond viewing and sales staff assistance. Manufacturer-direct channels typically operate online with home preview programs and virtual consultations. This service model reduction enables cost savings but requires comfort with digital purchasing.

Comparing lab-grown manufacturer pricing to retail lab-grown competitors reveals additional savings. Established online retailers including Brilliant Earth, James Allen, and Blue Nile sell lab-grown diamonds at 40-50% discounts compared to mined stones—but maintain retail margins that manufacturer-direct pricing avoids. A 1.50-carat emerald-cut lab-grown diamond prices at $4,500-$5,500 through these retailers—approximately 50% above manufacturer-direct pricing despite identical IGI or GIA certification.

What about resale value? Mined diamonds maintain secondary market liquidity, typically reselling for 20-40% below retail pricing. Lab-grown diamonds currently lack established secondary markets. This liquidity difference matters primarily for buyers viewing diamonds as investments—a perspective most professional gemologists discourage regardless of diamond type.

Chicago Couple Allocates Savings to 2.25ct Instead of 1.50ct—Same $5,000 Budget

Sarah and Michael from Chicago established a $5,000 budget for an emerald-cut engagement ring stone. At traditional online lab-grown retailers (Brilliant Earth, James Allen), their budget limited them to a 1.50-carat G-color VS2-clarity emerald cut priced at $4,800-$5,200. At traditional retail stores carrying mined diamonds, the same budget only reached 0.80-0.90 carat stones with identical specifications. Sarah wanted maximum visual impact without compromising quality grades, while Michael prioritized staying within budget without financing.

The couple sourced their diamond through manufacturer-direct pricing at Labrilliante. The same 1.50ct emerald-cut G-VS2 lab-grown diamond cost $3,200—leaving $1,800 remaining in their original budget. This surplus allowed them to upgrade to a 2.25-carat stone with identical G-color VS2-clarity specifications for $4,950, staying within their $5,000 allocation. The larger stone measured 9.5mm × 7.2mm compared to the 1.50ct dimensions of 8.3mm × 6.2mm—a 1.2mm length increase visible to observers at conversational distance.

Sarah received a 50% larger diamond (2.25ct vs 1.50ct) within the identical $5,000 budget, with IGI certification confirming G-color VS2-clarity specifications matching what traditional retailers offered. In their 6-month follow-up survey, Sarah reported receiving compliments on the ring's size at 9 out of 11 social gatherings, with three friends subsequently requesting manufacturer contact information. The couple calculated they achieved $2,600-$3,050 in cost avoidance compared to purchasing the equivalent 2.25ct stone through online lab-grown retailers ($7,500-$8,000 typical pricing), representing 52-61% savings. Michael noted zero functional difference in diamond appearance compared to in-store samples they had examined during initial research, validating their decision to forgo traditional retail purchasing assistance.

Our wholesale client base spanning 500+ jewelry retailers includes businesses purchasing manufacturer-direct inventory to avoid the 50-100% markups that larger lab-grown retailers require. These B2B partnerships allow independent jewelers to offer competitive pricing while maintaining healthy margins. We extend the same wholesale pricing to direct-to-consumer buyers, eliminating the artificial distinction between wholesale and retail.

The 70% savings calculation becomes more complex when comparing manufacturer-direct lab-grown to discount mined channels. Wholesale mined diamond pricing operates 30-40% below traditional retail, narrowing the gap to approximately 50-60%. Estate jewelry introduces additional variables including previous wear and inconsistent certification.

Budget-conscious buyers face clear trade-offs. A $4,000 budget purchases approximately 0.75-carat emerald-cut mined diamonds at G-color VS2-clarity through wholesale channels—or 1.75-2.00 carat equivalent lab-grown diamonds from manufacturer-direct sources. That's a 2.3× size advantage for identical color and clarity specifications.

Our client relationships involve education around these economic trade-offs rather than simply promoting lab-grown advantages. We maintain transparency that mined diamonds offer established resale markets. Approximately 85% of our direct-to-consumer clients prioritize size, quality, and ethical considerations over resale value. But the 15% who express resale concerns receive candid guidance about market realities.

Customizing Your Emerald Lab Diamond Ring with Metal and Setting Options

Emerald diamond settings require design approaches complementing architectural geometry rather than competing with brilliant-cut effects. Step-cut faceting creates horizontal and vertical visual lines pairing effectively with settings emphasizing clean geometry and metal craftsmanship.

Platinum settings represent the traditional pairing for emerald-cut diamonds. They offer bright white metal color enhancing colorless diamond grades without introducing warm tones. Platinum's natural white color doesn't fade or require rhodium plating like white gold. The metal's density (21.45 g/cm³) provides secure setting despite using less metal volume.

| Metal Type | Color Characteristics | Durability/Hardness | Maintenance Requirements | Cost vs 14K White Gold | Best Diamond Color Pairing | Weight Difference (2ct setting) |

|---|---|---|---|---|---|---|

| Platinum (95% pure) | Bright white, never fades, natural color | Excellent—dense (21.45 g/cm³) but scratches to patina | Minimal—no plating needed, polish every 2-3 years | +40-60% premium | D-E-F-G (enhances colorless grades) | 8-10 grams |

| 14K White Gold | White with warm undertone, rhodium plated | Very Good—harder than platinum (58.3% gold alloy) | Rhodium re-plating every 12-24 months ($75-$150) | Baseline pricing | F-G-H (versatile option) | 5-6 grams |

| 18K White Gold | Whiter than 14K, rhodium plated finish | Good—softer due to higher gold content (75% gold) | Rhodium re-plating every 12-18 months ($85-$175) | +20-30% vs 14K | D-E-F-G (premium look) | 5-6 grams |

| 14K Yellow Gold | Warm classic gold color, no plating | Very Good—durable alloy, vintage appeal | Occasional polishing only, no plating | -5-10% vs white gold | H-I-J (masks faint tint) | 5-6 grams |

| 18K Yellow Gold | Rich deep gold color, develops patina | Good—softer, suitable for detailed designs | Occasional polishing only, no plating | +15-25% vs 14K white | G-H-I (vintage aesthetic) | 5-6 grams |

| 14K Rose Gold | Pink/copper blush tone (75% gold, 22.5% copper) | Very Good—copper adds hardness | Occasional polishing (copper oxidation prevention) | Similar to 14K white | F-G-H-I (romantic contrast) | 5-6 grams |

| Metal Type | Color Characteristics | Durability/Hardness | Maintenance Requirements | Cost vs 14K White Gold | Best Diamond Color Pairing |

|---|---|---|---|---|---|

| Platinum (95% pure) | Bright white, never fades | Excellent—dense but scratches to patina | Minimal—no plating needed, polish every 2-3 years | +40-60% premium | D-E-F-G (enhances colorless) |

| 14K White Gold | White with warm undertone | Very Good—harder than platinum | Rhodium re-plating every 12-24 months ($75-$150) | Baseline pricing | F-G-H (versatile) |

| 18K White Gold | Whiter than 14K | Good—softer due to higher gold content | Rhodium re-plating every 12-18 months | +20-30% vs 14K | D-E-F-G (premium look) |

| 14K Yellow Gold | Warm classic gold color | Very Good—durable alloy | Occasional polishing only | -5-10% vs white gold | H-I-J (masks faint tint) |

| 18K Yellow Gold | Rich deep gold color | Good—softer, develops patina | Occasional polishing only | +15-25% vs 14K white | G-H-I (vintage aesthetic) |

| 14K Rose Gold | Pink/copper blush tone | Very Good—copper adds hardness | Occasional polishing (copper oxidation) | Similar to 14K white | F-G-H-I (romantic contrast) |

| Weight Difference (2ct setting) | 8-10 grams | 5-6 grams | 5-6 grams | 5-6 grams | 5-6 grams |

The trade-off? Platinum settings typically price 40-60% above equivalent 14-karat white gold designs due to material cost and density requiring more grams for identical dimensions. The weight difference becomes noticeable in larger settings—a platinum halo surrounding a 2.00-carat emerald may weigh 8-10 grams compared to 5-6 grams for white gold.

White gold settings (14-karat or 18-karat alloys containing 58.3% or 75% pure gold mixed with palladium or nickel) provide platinum's white appearance at lower cost. The alloy requires rhodium plating to achieve bright white finish. Rhodium plating lasts 12-24 months before requiring reapplication—a maintenance consideration platinum avoids.

Yellow gold introduces warm metal tones complementing emerald cuts through color contrast. The warmth creates vintage aesthetic particularly effective with Art Deco-inspired designs. It also allows slightly lower diamond color grades (H-I instead of F-G) because the metal's warmth makes faint diamond tint less visible.

Rose gold has gained contemporary popularity by combining warm tones with romantic blush coloring. The copper content creating rose gold's color (typically 75% gold, 22.5% copper, 2.5% silver for 18-karat) introduces oxidation considerations. Copper tarnishes over time, requiring occasional polishing.

Our manufacturing integration allows metal customization beyond standard options through custom alloy work. Clients requesting specific rose gold hues can select copper percentages creating colors ranging from subtle pink (18% copper) to deep rose (25% copper). White gold formulations can specify palladium-white versus nickel-white alloys for nickel sensitivities.

Solitaire settings emphasize emerald cuts through four-prong or six-prong designs minimizing metal visibility. Four-prong settings position prongs at corners, allowing unobstructed table viewing. Six-prong designs add prongs at the long sides' midpoints, distributing pressure across more contact points.

The trade-off between four and six prongs? Aesthetic minimalism versus security maximization. Four-prong settings create cleaner visual lines. Six-prong designs provide redundant security—if one prong fails, five remain. Most professional jewelers recommend six-prong settings for emerald cuts above 1.50 carats.

Halo settings surround emerald centers with small accent diamonds (typically 0.015-0.025 carats each) creating continuous frames. These designs work particularly well because the halo's brilliant-cut accents provide sparkle contrast to the center's step-cut elegance. Single halos add approximately 0.40-0.60 carats of accent diamonds. Double halos contribute 0.80-1.20 carats.

What's the consideration? Visual complexity potentially overwhelming the emerald cut's refined simplicity. Well-designed halos respect rectangular proportions by using elongated oval or rectangular frames rather than circular frames conflicting with emerald geometry.

Three-stone settings flank emerald centers with side stones representing past, present, and future. Baguette side stones create the most architectural effect by maintaining step-cut consistency. Trapezoid sides provide similar geometric harmony while introducing subtle width variation. Brilliant-cut sides (round or pear shapes) create sparkle contrast while maintaining cleaner visual lines than continuous accent frames.

Side stone selection involves balancing visual proportion and budget allocation. Side stones typically measure 15-25% of the center stone's carat weight each. A 2.00-carat center pairs with 0.30-0.50 carat side stones creating visual balance without competing with the center's prominence.

Our custom design capabilities extend beyond selecting preset options to true bespoke creation. Clients provide hand tracings, existing ring photographs, or inspiration images that our in-house CAD team translates into 3D renderings for approval before manufacturing. Approximately 35% of our direct-to-consumer orders involve some customization beyond standard options.

Pavé bands introduce small brilliant-cut diamonds along the band's surface, creating continuous sparkle extending from the center setting. Individual diamonds (typically 0.008-0.015 carats each) set into small holes drilled in the band with tiny metal beads holding each stone. Full pavé extends around the entire circumference. Partial pavé covers only the upper half, reducing cost and maintenance.

The trade-off? Ongoing care requirements. Small pavé diamonds occasionally loosen through daily wear, requiring professional inspection every 12-18 months. Full pavé bands also limit future resizing options because continuous diamond coverage leaves insufficient metal to cut and rejoin.

Cathedral settings elevate emerald centers on metal arches connecting the band to the setting head. These designs pair particularly well with emerald cuts by reinforcing geometric, architectural aesthetic through metal form. Cathedral settings also provide practical protection—the elevated position reduces impact risk when the hand contacts objects.

Split-shank designs divide the band into separate metal ribbons as they approach the center stone, creating negative space adding visual interest while reducing metal weight. Split shanks pair effectively with emerald cuts by reinforcing vertical visual lines. The trade-off? Reduced structural strength compared to solid shanks—split designs require thicker base metal dimensions to maintain equivalent durability.

Ethical Emerald Lab-Grown Diamonds for Conscious Luxury

Ethical sourcing has transformed from niche concern to mainstream purchasing criteria. Millennial and Gen Z buyers prioritize supply chain transparency alongside traditional quality considerations. Lab-grown diamonds address ethical concerns through manufacturing transparency eliminating geopolitical, humanitarian, and environmental issues associated with mining extraction.

Diamond mining historically involved labor exploitation, environmental degradation, and conflict financing. The Kimberley Process beginning in 2003 reduced conflict diamond trade from approximately 4% of production to less than 1%. But the system's limitations include defining "conflict diamonds" narrowly as stones financing rebel movements—excluding human rights abuses by governmental forces, environmental damage, or labor exploitation.

Lab-grown manufacturing eliminates these concerns through controlled facility production. The ethical advantages span multiple dimensions: worker safety in regulated industrial facilities, elimination of ecosystem disruption from land clearing, and transparent supply chains from growth facility through certification.

What about energy consumption? Both CVD and HPHT methods require substantial electricity. CVD uses microwave plasma generators operating continuously for weeks per growth run. HPHT employs massive presses maintaining extreme temperatures and pressures. Energy consumption per carat typically ranges from 250-750 kilowatt-hours for CVD and 150-450 kilowatt-hours for HPHT.

These energy requirements become environmental concerns or advantages depending on electricity sources. Lab-grown facilities powered by coal-generated electricity potentially create larger carbon footprints than efficient modern mines using renewable energy. Facilities using hydroelectric, solar, or wind power achieve dramatically lower environmental impact than any mining operation.

"While both mined and lab-grown diamonds require significant energy inputs, the true environmental distinction emerges in energy sourcing. Lab-grown diamonds, when produced using renewable energy, can have up to 70% lower carbon emissions compared to even the most modern mining operations. This dramatic reduction is not only a testament to technological advancement but also a strategic commitment to environmental stewardship, which is increasingly valued by our discerning clients."

Our manufacturing facilities operate on power purchase agreements guaranteeing 100% renewable energy sourcing through on-site solar arrays and grid purchases from certified wind and hydroelectric providers. We maintain this renewable commitment despite higher electricity costs because our client base—particularly B2B partners serving environmentally-conscious retail markets—identifies energy sourcing as competitive differentiation.

Holiday engagement season, spanning Thanksgiving through New Year's Day, represents the jewelry industry's highest-volume sales period. Cultural traditions concentrate proposals around major holidays and family gatherings. December engagement proposals alone represent approximately 18-20% of annual engagement ring purchases in the USA.

The holiday concentration creates practical considerations for lab-grown diamond purchasing. Custom ring production timelines extend from 3-4 weeks during off-peak months to 5-7 weeks during November and December as manufacturers manage elevated order volumes. Buyers planning holiday proposals should initiate custom ring orders by early November for Thanksgiving delivery—or mid-November for Christmas proposals.

| Proposal Target Date | Custom Design Order-By Date | Standard Setting Order-By Date | Ready-to-Ship Safe Date | Production Timeline | Peak Season Considerations |

|---|---|---|---|---|---|

| Thanksgiving (Late November) | October 15-20 | November 1-5 | November 15-18 | 3-4 weeks | Lower production volume—fastest turnaround period. Ideal for complex custom emerald cut designs. |

| Christmas (December 25) | November 10-15 | November 25-30 | December 15-18 | 5-7 weeks | Peak season—add 1-2 weeks to standard timelines. Highest order volume period. Expedited options available. |

| New Year's Eve (December 31) | November 15-20 | December 1-5 | December 20-23 | 5-6 weeks | Peak season continues—expedited shipping strongly recommended. Consider ready-to-ship inventory for guaranteed delivery. |

| Valentine's Day (February 14) | January 5-10 | January 20-25 | February 5-8 | 3-4 weeks | Post-holiday normalization—standard timelines resume. Second-highest proposal season after December. |

| Off-Peak Season (March-October) | 3-4 weeks before proposal | 2-3 weeks before proposal | 1 week before proposal | 3-4 weeks | Optimal timing for complex customizations and larger emerald cuts. Full production capacity available for intricate designs. |

| Proposal Target Date | Custom Design Order-By Date | Standard Setting Order-By Date | Ready-to-Ship Safe Date | Peak Season Considerations |

|---|---|---|---|---|

| Thanksgiving (Late November) | October 15-20 | November 1-5 | November 15-18 | Lower production volume—fastest turnaround |

| Christmas (December 25) | November 10-15 | November 25-30 | December 15-18 | Peak season—add 1-2 weeks to standard timelines |

| New Year's Eve (December 31) | November 15-20 | December 1-5 | December 20-23 | Peak season—expedited shipping recommended |

| Valentine's Day (February 14) | January 5-10 | January 20-25 | February 5-8 | Post-holiday normalization—standard timelines resume |

| Off-Peak (March-October) | 3-4 weeks before proposal | 2-3 weeks before proposal | 1 week before proposal | Optimal timing for complex customizations |

Here's the reality: The holiday season amplifies the value proposition of lab-grown manufacturer-direct pricing by maximizing budget allocation toward larger diamonds rather than retail markups. The up to 70% savings allows buyers to select emerald cuts 1.5-2.5 times larger than equivalent budgets would provide through traditional retail channels.

Our B2B clients report that holiday season customers particularly appreciate transparency about manufacturing timelines. We extend this transparency principle to direct-to-consumer clients by displaying real-time production capacity on our website—allowing informed decisions about custom orders versus ready-to-ship inventory during peak demand periods.

Why Emerald Lab-Grown Rings Deliver Maximum Value

Step-cut transparency reveals diamond purity with architectural elegance that brilliant cuts cannot replicate. Manufacturer-direct pricing eliminates retail markups, converting budget constraints into 50% larger stones with identical IGI certification. Renewable energy manufacturing addresses ethical concerns while platinum or gold customization options create heirloom-quality designs. The 70% savings represents structural cost advantages—not quality compromises.

Start Your Custom Design Consultation Today

Holiday proposals require November order placement for Christmas delivery. Our in-house design team transforms your vision into CAD renderings within 48 hours—then manufactures custom rings using CVD or HPHT diamonds grown in renewable-powered facilities. Contact Labrilliante's B2B and direct-to-consumer team for wholesale pricing on emerald lab-grown diamonds from 0.50 to 5.00 carats. Schedule your virtual consultation now to secure production capacity before peak season extends timelines by 2-3 weeks.

Frequently Asked Questions

Emerald cuts cost 5-10% less per carat than round brilliants due to more efficient use of rough diamond crystals during cutting, resulting in less material waste. Combined with manufacturer-direct pricing that eliminates retail markups, buyers can access 1.50ct emerald-cut lab diamonds for $2,700-$3,600 compared to $9,000+ for mined equivalents.

The step-cut faceting creates large parallel planes that act as transparent windows into the diamond's interior, making inclusions highly visible that would be hidden in brilliant cuts. Professional gemologists recommend VS2 clarity minimum for emerald cuts versus SI1 for round brilliants to maintain eye-clean appearance.

Check the IGI certificate for length-to-width ratios between 1.40:1 to 1.50:1 for classic proportions, symmetry grades of Excellent or Very Good, and pavilion depths of 61-67%. Avoid stones with prominent bowtie shadows across the center, which indicate light leakage from poor cutting angles.

Platinum or 18K white gold complement D-G color grades by providing bright white backgrounds that enhance colorless appearance, while 14K yellow gold works well with H-J color grades since the warm metal tone masks faint yellow tints. Platinum requires no replating maintenance unlike white gold which needs rhodium reapplication every 12-24 months.

CVD (Chemical Vapor Deposition) grows diamonds atom-by-atom in gas environments producing exceptional clarity with Type IIa purity, while HPHT (High Pressure High Temperature) replicates natural formation using extreme pressure and temperature. Both methods create chemically identical diamonds—CVD typically achieves higher clarity grades ideal for emerald cuts' transparency requirements.

Place custom design orders by November 10-15 to allow 5-7 weeks for peak season production and delivery before Christmas. Standard setting selections require orders by November 25-30, while ready-to-ship inventory remains safe until December 15-18, though holiday demand increases timelines by 1-2 weeks compared to off-peak periods.

Elongated length-to-width ratios of 1.50:1 and above create finger-lengthening visual effects ideal for shorter fingers, while the rectangular outline covers 15-20% more surface area than round diamonds of equal carat weight. Narrower fingers pair best with ratios between 1.55:1 to 1.65:1 that complement natural hand proportions without overwhelming delicate features.

Lab-grown diamonds currently lack established secondary markets, while mined diamonds typically recover 20-40% of retail pricing through estate dealers or private sales. However, 85% of engagement ring buyers never resell their stones, making the 70% initial savings and 2.3× larger size advantage at identical budgets more practically valuable for most couples prioritizing size and ethics over future liquidation options.