Round Lab-Grown Diamond Rings: Brilliant & Affordable

Author: Alex K., CMO at Labrilliante Updated: 2025-11-14 Reading Time: 18 minutes

Lab-grown rounds deliver identical brilliance to natural diamonds at 70-97% lower cost through controlled manufacturing. Direct manufacturer pricing eliminates retail markup layers, allowing $3,000 budgets to secure 1.8-2.0ct stones in near-colorless, eye-clean grades—3-4x more diamond than traditional options. IGI and GIA apply identical certification standards to both types, with H-J color and VS2-SI1 clarity providing optimal value.

Engagement ring shopping forces impossible choices. Size versus quality. Sparkle versus budget. That compromise disappears with round lab-grown diamond rings—identical carbon structure and optical properties as natural stones, minus the 70-97% price premium. You'll discover how direct manufacturer models eliminate retail markup layers, which color and clarity grades deliver eye-clean brilliance without certification inflation, and why IGI and GIA reports guarantee quality regardless of origin. This guide reveals strategic budget optimization across the 4Cs, technical specifications driving maximum light return, and the production economics creating unprecedented access to 1.5-2.5ct rounds that once demanded five-figure investments.

When Natural Diamonds Justify the Premium: Resale Value and Heirloom Considerations

The strongest case against lab-grown diamonds centers on secondary market liquidity and generational wealth transfer. Natural diamonds maintain 40-70% of retail value in resale channels through the same scarcity mechanisms that elevate purchase prices. Lab-grown stones currently trade at 30-40% below retail when resold—reflecting abundant supply and rapid production scalability. For buyers viewing engagement rings as investment assets or family heirlooms appreciating over decades, this differential proves significant.

This argument holds validity in specific scenarios. Ultra-high-net-worth buyers allocating $50,000+ to exceptional natural stones (3ct+ D/IF) access genuine collector markets where provenance and rarity command premiums. Families with multi-generational jewelry traditions may prioritize continuity over economics. Geographic markets where cultural prestige attaches specifically to natural origin—certain Asian and Middle Eastern regions—create social value justifying premium pricing.

Here's the reality for most buyers: Engagement rings function as symbols, not securities. The average ownership period spans 40-60 years before potential inheritance, during which time the 70-97% initial savings compounds through investment or debt avoidance. A couple saving $12,000 on a 2ct lab-grown versus natural equivalent and investing that difference at 7% annual return accumulates $180,000 over 40 years—far exceeding any resale premium differential. Unless you're purchasing primarily for resale liquidity or operating in markets where natural origin carries specific cultural requirements, the lab-grown value proposition dominates for engagement ring applications. The "investment" framing rarely survives financial scrutiny when compared to actual investment vehicles.

Lab-Grown vs. Natural Diamond Pricing: Your Complete Cost Comparison Guide

Lab-grown diamonds cost 70-97% less than natural stones with identical physical properties. Same carbon structure. Same hardness. This price gap reflects production economics, not quality compromise—both types share Mohs 10 hardness and identical optical properties certified by IGI or GIA.

Why such dramatic savings? Natural diamonds pass through 5-7 intermediaries between mine and retail. Each adds 15-40% margin. Lab manufacturers control production from reactor to finished stone, eliminating four to six markup layers.

| Carat Weight | Quality Grade (Color/Clarity) | Natural Diamond Price | Lab-Grown Diamond Price | Your Savings | Savings Percentage |

|---|---|---|---|---|---|

| 0.5ct | D/VVS1 (Excellent Cut) | $2,400 | $350 | $2,050 | 85% |

| 0.5ct | G/VS2 (Excellent Cut) | $1,800 | $275 | $1,525 | 85% |

| 0.5ct | J/SI1 (Very Good Cut) | $1,200 | $200 | $1,000 | 83% |

| 1.0ct | D/VVS1 (Excellent Cut) | $7,200 | $750 | $6,450 | 90% |

| 1.0ct | G/VS2 (Excellent Cut) | $4,500 | $550 | $3,950 | 88% |

| 1.0ct | J/SI1 (Very Good Cut) | $2,800 | $375 | $2,425 | 87% |

| 1.5ct | D/VVS1 (Excellent Cut) | $13,500 | $1,200 | $12,300 | 91% |

| 1.5ct | G/VS2 (Excellent Cut) | $8,100 | $900 | $7,200 | 89% |

| 1.5ct | J/SI1 (Very Good Cut) | $5,400 | $625 | $4,775 | 88% |

| 2.0ct | D/VVS1 (Excellent Cut) | $24,000 | $1,800 | $22,200 | 93% |

| 2.0ct | G/VS2 (Excellent Cut) | $14,000 | $1,300 | $12,700 | 91% |

| 2.0ct | J/SI1 (Very Good Cut) | $8,400 | $900 | $7,500 | 89% |

| 2.5ct | D/VVS1 (Excellent Cut) | $37,500 | $2,250 | $35,250 | 94% |

| 2.5ct | G/VS2 (Excellent Cut) | $21,250 | $1,625 | $19,625 | 92% |

| 2.5ct | J/SI1 (Very Good Cut) | $12,500 | $1,125 | $11,375 | 91% |

| 3.0ct | D/VVS1 (Excellent Cut) | $57,000 | $2,700 | $54,300 | 95% |

| 3.0ct | G/VS2 (Excellent Cut) | $31,500 | $1,950 | $29,550 | 94% |

| 3.0ct | J/SI1 (Very Good Cut) | $18,000 | $1,350 | $16,650 | 93% |

Why Lab-Grown Diamonds Cost 70-97% Less Than Natural Stones

Three economic factors drive the price differential. First, production scalability. CVD reactors create 1-carat roughs in 2-4 weeks with predictable energy costs. Mining companies spend months exploring increasingly depleted deposits with no guarantee of finding comparable stones.

Second, capital requirements differ drastically. Natural diamond producers typically invest $150-400 million developing a single mine with 10-20 year payback horizons. Lab facilities generally operate with $2-8 million equipment investments and begin production within months.

Third, inventory control mechanisms. The natural diamond industry maintains price floors through controlled supply release—a practice dating to the 1930s when one entity controlled 90% of global rough. Lab manufacturers operate in competitive markets where production efficiency determines pricing, not cartel coordination.

The trade-off? Natural diamonds maintain secondary market pricing through the same scarcity mechanisms that elevate initial costs. Lab-grown stones currently trade at 30-40% below retail in resale channels. But the 2-3x initial price difference often offsets any resale premium over typical ownership periods.

Price Per Carat Breakdown: What Your Budget Actually Buys

A $2,000 budget purchases 0.4-0.5 carat natural diamond (VS2/H) at traditional retail. The same budget? 1.5-2.0 carat lab-grown in identical grades from direct manufacturers. That's 3-4x more diamond.

The per-carat compression creates strategic opportunities in the 1.5-2.5 carat range. A 2-carat natural G/VS2 runs $12,000-18,000 depending on cut quality. The identical lab-grown stone? $1,800-3,200 from manufacturers, $2,400-4,000 through retailers like James Allen who source from third-party suppliers.

What does this mean for you? Budget allocation across the 4Cs shifts dramatically. A $3,000 natural diamond budget forces choosing between 0.7ct in D/VVS1 or 1.0ct in J/SI1. The same $3,000 in lab-grown allows 2.0ct in D/VVS1 or 3.0ct in H/VS2—eliminating forced compromises between size and quality.

Current price ranges (late 2025): Lab-grown rounds in D-F colorless and VVS1-VVS2 clarity run $600-900 per carat for excellent cut with IGI certification. Near-colorless G-J in VS1-SI1 clarity: $400-650 per carat. J-K in SI1-SI2 eye-clean clarity: $300-450 per carat. Natural equivalents command $4,500-8,000, $3,200-5,500, and $2,400-3,800 respectively—maintaining 70-90% differentials across all quality tiers.

Labrilliante's direct manufacturer model removes an additional markup layer. Most lab-grown retailers like Brilliant Earth and Clean Origin purchase finished inventory from labs, typically adding 25-35% margin. Our in-house CVD and HPHT production with direct shipping from cutting facilities results in 15-30% lower pricing than multi-brand retailers—savings most apparent in the 1.5-2.5ct range where absolute dollar differences reach $400-800.

Direct Manufacturer Pricing Eliminates Retail Markup Layers

Traditional jewelry retail adds 2.2-2.8x multiplier on wholesale costs. Storefront leases. Sales staff. Inventory carrying costs. A natural diamond wholesaling at $5,000 reaches retail at $11,000-14,000. Lab-grown stones acquired at $1,200 retail for $2,600-3,400 under the same structure.

Direct manufacturers eliminate this final multiplication. Certified stones ship from cutting facilities to consumers within days of finishing. Multi-brand online retailers like Blue Nile pioneered lower-overhead models by eliminating showrooms but still typically add 1.4-1.8x multipliers to wholesale costs—better than traditional retail but still substantial.

| Distribution Channel | Cost Basis | Markup Added | Price to Consumer | Total Markup from Production |

|---|---|---|---|---|

| Direct Manufacturer (Labrilliante) | $980 | $147 (15%) | $1,127 | $147 |

| Online Retailer (Blue Nile, James Allen) | $1,200 | $780 (65%) | $1,980 | $1,000 |

| Traditional Jewelry Store | $1,200 | $1,440 (120%) | $2,640 | $1,660 |

| Specifications: 1.5ct Round Lab-Grown Diamond, G Color, VS2 Clarity, Excellent Cut, IGI Certified | ||||

| Consumer Savings vs. Traditional Retail: Direct Manufacturer saves $1,513 (57%) | Online Retailer saves $660 (25%) |

Here's the reality: The business model requires maintaining relationships with dozens of suppliers and carrying inventory risk. Those costs pass to customers even in digital storefronts.

Our 500+ B2B clients—jewelry stores, chain retailers, custom designers—provide perspective on markup economics. Retail jewelers purchasing certified lab rounds from us at wholesale typically apply 2.0-2.5x multipliers to reach competitive local rates. End consumers purchasing directly through our platform pay 1.15-1.25x over actual production costs including cutting, certification, and fulfillment.

The 60% shift to online diamond purchasing (2024 data) reflects buyers recognizing these structural differences. The trade-off? Traditional retail offers in-person inspection and immediate gratification. Direct manufacturers require trust in certification standards and acceptance of 3-7 day delivery windows. IGI and GIA grading reports serve as quality assurance replacing physical showroom comparison.

The manufacturer-direct advantage compounds in custom work. Traditional jewelers ordering specific parameters face 4-8 week lead times as requests move through supplier networks. Vertically integrated producers manufacture to order within 2-4 weeks, controlling cutting parameters—table percentage, depth ratio, facet angles—from rough selection through final polish.

IGI and GIA Certification Standards for Lab-Grown Round Brilliant Diamonds

IGI and GIA apply identical grading methodologies to lab-grown and natural diamonds. Same color scales. Same clarity standards. Same cut evaluation. Both evaluate through identical gemological instruments and trained graders, with lab-grown samples marked on certificates but graded without origin-based adjustment.

The Gemological Institute of America established the 4Cs framework in the 1940s-1950s. This created standardized terminology that transformed diamonds from subjective luxury goods to quantifiable commodities. The International Gemological Institute, founded in 1975 in Antwerp, adopted and refined these standards while developing particular expertise in lab-grown evaluation as that market expanded through the 2010s.

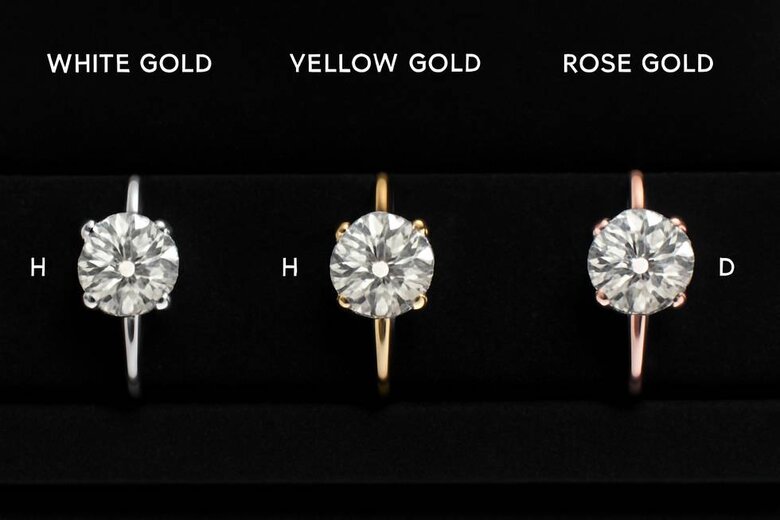

| Color Grade | Price Differential vs. D Grade | Visibility in White Gold/Platinum | Visibility in Yellow/Rose Gold | Recommended Use Case |

|---|---|---|---|---|

| D (Colorless) | Baseline (0%) | Completely colorless | Completely colorless | Maximum certification prestige; collector-grade stones; investment purposes |

| E (Colorless) | -8% to -12% | Indistinguishable from D to untrained eye | Indistinguishable from D | Excellent balance of premium quality and value; ideal for engagement rings in white settings |

| F (Colorless) | -15% to -20% | Appears colorless in mounted settings | Appears colorless | High-quality choice offering significant savings; undetectable color in typical viewing |

| G (Near-Colorless) | -22% to -28% | Virtually colorless when mounted | Completely colorless appearance | Optimal value grade; excellent appearance in all setting metals; most popular choice |

| H (Near-Colorless) | -30% to -38% | Slight warmth detectable only by side-by-side comparison | Appears colorless; warm metal complements tone | Best value proposition; eye-clean color in mounted jewelry; recommended for budget-conscious buyers |

| I (Near-Colorless) | -40% to -48% | Faint warmth visible under close inspection | Warm tone blends naturally with setting | Strong value choice for yellow/rose gold settings; larger carat weights at accessible pricing |

| J (Near-Colorless) | -50% to -58% | Noticeable warmth in white settings over 1.5ct | Harmonious warm appearance; color undetectable | Maximum carat size for budget; ideal for vintage-style yellow gold designs; avoid white metal above 1ct |

| K (Faint Color) | -60% to -68% | Visible yellow tint; not recommended for white metals | Warm golden hue complements setting beautifully | Budget-maximizing option for yellow/rose gold exclusively; prioritize excellent cut to enhance brilliance |

Both operate as independent third parties. They charge per-stone grading fees without stake in valuation outcomes. GCAL (Gem Certification and Assurance Lab) entered the market with additional documentation including light performance imaging and guaranteed grading backed by financial reimbursement. GCAL certification typically adds $75-150 to stone costs compared to IGI—a premium some buyers accept for enhanced verification.

Reading Your Diamond Grading Report: Color, Clarity, and Cut Grades

Color grading follows the D-Z scale developed by GIA in the early 1950s. D represents complete absence of color. Z marks the threshold where stones transition to fancy yellow category. Graders compare stones face-down against master diamonds under controlled 5500K lighting, eliminating brilliance factors that influence color perception.

The scale breaks into ranges: D-F designates colorless, G-J near-colorless, K-M faint color. These distinctions prove perceivable to trained graders under laboratory conditions. But once mounted? Often indistinguishable to buyers in typical viewing.

| Color Grade | Price Differential vs. D Grade | Visual Impact in White Gold/Platinum | Visual Impact in Yellow/Rose Gold | Recommended Use Case |

|---|---|---|---|---|

| D (Colorless) | Baseline (0%) | Completely colorless under all lighting conditions | Appears colorless; maximum contrast against warm metal | Certification prestige; investment-grade pieces; 3ct+ statement rings where color differences become more visible |

| E (Colorless) | -8% to -12% | Indistinguishable from D to untrained observers in typical viewing | Appears colorless; imperceptible difference from D grade | Optimal for buyers prioritizing colorless certification without D-grade premium; excellent balance for 2-4ct rings |

| F (Colorless) | -15% to -20% | Face-up colorless; minute warmth detectable only by trained graders face-down comparison | Completely colorless appearance; warm metal reflections mask any trace tint | Best value in colorless range; recommended for 1-3ct rounds in any setting; indistinguishable from D-E when mounted |

| G (Near-Colorless) | -22% to -28% | Appears colorless face-up in rounds under 2ct; slight warmth may show in 3ct+ stones under direct comparison to colorless grades | Fully colorless appearance; yellow gold reflections complement any trace warmth | Superior value grade; recommended for 0.5-2ct rounds; allocate savings to cut quality upgrade from Very Good to Excellent |

| H (Near-Colorless) | -30% to -38% | Near-colorless face-up; virtually undetectable warmth in rounds under 1.5ct when viewed individually | Completely colorless appearance; warm tones enhance diamond brilliance without visible tint | Exceptional value for 0.75-1.5ct rounds; most popular choice balancing certification quality with budget optimization |

| I (Near-Colorless) | -40% to -48% | Slight warmth detectable in 1ct+ rounds when compared side-by-side with colorless grades; individual viewing shows minimal tint | Appears colorless; yellow/rose gold completely masks warmth; ideal pairing for vintage-style settings | Maximum value for yellow/rose gold settings; suitable for 0.5-1.5ct rounds where setting color dominates perception |

| J (Near-Colorless) | -50% to -58% | Noticeable warmth in 1ct+ rounds under direct lighting; acceptable for smaller stones or mixed metal designs | Near-colorless appearance; warm metal reflections harmonize with stone tint creating cohesive aesthetic | Budget-conscious buyers prioritizing size over color; strongly recommended only in yellow/rose gold; ideal for vintage or antique-style designs where warmth enhances period authenticity |

| K (Faint Color) | -60% to -68% | Visible faint yellow tint in all sizes; warmth apparent to untrained observers in white metal settings | Slight warmth visible but aesthetically complementary; creates warm vintage glow rather than undesirable tint | Yellow/rose gold settings exclusively; vintage and antique designs where warmth contributes to aesthetic; budget maximization allowing 40-50% larger carat weight versus colorless grades |

What does this mean for you? H-J range stones in platinum or white gold appear colorless to most observers when compared side-by-side with D-F stones. Yellow or rose gold settings complement even K-L diamonds by reflecting warm tones into the stone. The price progression from H to F represents 15-25% increases for identical clarity and cut—a premium delivering measurable laboratory differences but subjective visual distinctions.

Clarity grading evaluates inclusions and blemishes visible under 10x magnification: Flawless, Internally Flawless, VVS1-VVS2 (Very Very Slightly Included), VS1-VS2 (Very Slightly Included), SI1-SI2 (Slightly Included), and I1-I3 (Included). The critical threshold falls between VS2 and SI1, where inclusions remain invisible to unaided vision in properly cut stones—the "eye-clean" designation balancing certified quality with practical appearance.

Our quality control across in-house CVD and HPHT production targets VS1-VS2 clarity as optimal for consumer value. VVS grades require rejecting rough with minor inclusions invisible once cut, reducing yield efficiency by 15-20%. SI1-SI2 grades increase yield but introduce variables in eye-clean status depending on inclusion location—dark carbon spots near table facets prove more visible than feather fractures near crown edges.

Cut grading represents the most complex evaluation. GIA assigns Excellent, Very Good, Good, Fair, or Poor grades based on proportions, symmetry, and polish. The synthesis incorporates table percentage (54-58% optimal), total depth (59-62% ideal), crown angle (34-35°), pavilion angle (40-41°), and girdle thickness. Excellent cut rounds exhibit maximum light return through the table, minimizing leakage through the pavilion.

Here's what matters: Cut grade carries greater weight than clarity or color for visible brilliance. An Excellent cut H/SI1 outshines a Very Good cut D/VVS1 in sparkle intensity, though the latter commands 30-40% higher pricing. This creates strategic opportunities—buyers prioritizing appearance over certification prestige benefit from allocating budget to cut quality rather than incremental clarity or color improvements.

Certification Reliability: Lab-Grown vs Natural Diamond Quality Assurance

GIA introduced lab-grown diamond grading in 2007 with synthetic diamond reports, initially using descriptive categories rather than traditional letter-number scales. The institute shifted to full 4Cs grading reports in 2020, maintaining origin disclosure through conspicuous "laboratory-grown" designation. This evolution reflected recognition that quality exists independently of origin—a 2ct D/VVS1 Excellent cut possesses identical gemological properties whether formed in Earth's mantle or a CVD reactor.

IGI maintained consistent grading standards across both types throughout its history. Same master stone comparisons. Same measurement protocols. The institution's early adoption of comprehensive lab-grown documentation positioned it as the dominant certifier in that segment, grading an estimated 65-70% of lab-grown diamonds entering certified channels globally (2025 data).

"While color and clarity are often highlighted in diamond marketing, cut quality significantly outweighs these factors in terms of impact on a diamonds visual appeal. An Excellent cut can make a lower color or clarity diamond appear more brilliant than a higher graded but poorly cut counterpart. This insight is crucial for consumers prioritizing the sparkle over the paper credentials."

The reliability debate centers on inter-laboratory grading differences, not consistency between diamond types. GIA maintains reputation for conservative standards—stones sometimes receive grades one level lower than IGI assigns to identical characteristics. A D color GIA stone might grade E at IGI. VVS2 clarity might become VS1. This systematic difference reflects institutional philosophy rather than accuracy failures.

Sound technical? Here's what matters: Both maintain internal consistency. A buyer comparing two GIA-graded stones or two IGI-graded stones sees reliable relative rankings.

Our partnerships with IGI, GIA, and GCAL for manufactured inventory allow direct observation of grading patterns across thousands of annual submissions. The certifier choice represents a trade-off between cost, turnaround, and market perception. GIA certification adds $150-200 per stone and 4-6 week processing but commands slight premiums in certain markets. IGI processes in 10-14 days at $75-100 with comparable accuracy for lab-grown evaluation. GCAL's enhanced documentation serves buyers seeking maximum verification at $200-275 including optical performance imaging.

The certification serves dual purposes: third-party verification of claimed characteristics and standardized documentation enabling comparison across suppliers. A buyer evaluating stones from multiple sources can directly compare IGI reports or GIA reports, trusting that D color means identical absence of color regardless of which manufacturer submitted the stone.

How Direct Manufacturers Control Quality From Lab to Customer

Vertical integration allows manufacturers to control quality at each production stage rather than inspecting finished inventory from external suppliers. The process begins with rough selection immediately after growth cycle completion. Gemologists evaluate which CVD plates or HPHT crystals merit cutting into certified rounds versus industrial applications. This first sort determines yield economics—maximizing carat recovery versus optimizing cut quality and certification grades.

The planning stage maps facet placement onto rough using 3D scanning and computer modeling. This positions the table facet to avoid inclusions and orients crystal structure for optimal light performance. Modern software calculates multiple cutting scenarios, projecting final carat weight, predicted clarity grade, and proportions for each option.

Here's the trade-off: A 2.8ct rough might yield 1.3ct VS1 or 1.1ct VVS2 depending on inclusion placement. Price-per-carat calculations determine optimal approach.

Cutting execution on precision equipment transforms rough into finished rounds with 57 or 58 facets. The process requires 6-12 hours across multiple stages: shaping rough into circular outline, creating crown facets, forming pavilion, and polishing all surfaces. Automated equipment eliminates human inconsistency in angle precision, maintaining 34-35° crown and 40-41° pavilion angles within 0.3-0.5° tolerances.

Our in-house cutting facilities in partnership with specialized labs process rough from CVD and HPHT reactors within days of growth completion, maintaining chain-of-custody throughout transformation. If a stone grades VS2 instead of anticipated VS1, we understand whether the inclusion originated during growth or represents rough variation—feedback informing reactor parameter adjustments. Retailers purchasing pre-finished inventory lack this production intelligence.

Post-cutting inspection includes optical performance verification beyond certification requirements. Light return meters quantify the percentage of light entering the crown that returns through the table rather than leaking through pavilion facets—the measurable basis of brilliance. Advanced facilities conduct ASET imaging showing light interaction patterns, allowing identification of cut proportion issues that certification reports describe only through measurements.

The quality control loop closes when manufacturers track certification results against growth and cutting parameters. A pattern of lower-than-expected clarity grades in CVD diamonds from specific reactor chambers might indicate contamination in gas feedstock or temperature inconsistencies—variables manufacturers correct but retailers never observe.

Round Brilliant Cut Technical Specifications: 58 Facets and Optimal Proportions

The round brilliant cut comprises 58 facets in precise geometric relationship to maximize light return through the crown. The pattern includes 1 table facet, 8 bezel facets surrounding the table, 8 star facets between bezels, 16 upper girdle facets, 16 lower girdle facets, and 8 pavilion main facets. Early cuts included a 58th culet facet at the pavilion point, though modern practice typically brings pavilion mains to a point—technically creating 57 facets but still described as 58-facet brilliant in industry convention.

| Cut Grade | Table % | Total Depth % | Crown Angle | Pavilion Angle | Symmetry | Polish | Light Return % | Price Premium vs. Very Good |

|---|---|---|---|---|---|---|---|---|

| Excellent | 54-58% | 59-62% | 33.0-35.5° | 40.0-41.5° | Excellent to Very Good | Excellent to Very Good | 92-94% | +10-15% |

| Very Good | 53-59% | 58.5-63% | 32.5-36.0° | 39.5-42.0° | Very Good to Good | Very Good to Good | 88-91% | Baseline |

Marcel Tolkowsky's 1919 doctoral thesis "Diamond Design: A Study of the Reflection and Refraction of Light in a Diamond" established the mathematical foundation for ideal proportions. His calculations demonstrated that crown angles near 34.5° combined with pavilion angles near 40.75° create optimal light performance. Table sizes between 53-58% of girdle diameter. Total depths of 59-62% from table to culet. These parameters, derived from ray-tracing calculations with 1910s-era mathematics, remain central to modern cut grading.

The physics? Critical angle reflection at diamond-air interfaces. Light entering through the crown refracts into the diamond, reflects off internal pavilion facets, and exits through the crown if angles keep the light path above the critical angle of approximately 24.4° for diamond.

What happens with wrong angles? Pavilion angles too shallow (under 39°) allow light to leak through the bottom. Too steep (above 42°) causes light to reflect horizontally, exiting through crown sides rather than returning through the table where viewers see maximum brightness.

Modern cut grading by GIA and other certifiers evaluates proportions against ranges rather than single ideal numbers. Table percentages from 54-58%, depths from 59-62%, crown angles from 33-35.5°, and pavilion angles from 40-41.5° all receive Excellent cut grades if other factors complement those measurements. This reflects reality that small variations in one parameter can be compensated by adjustments in others.

| Parameter | GIA Excellent Cut | GIA Very Good Cut | Performance Impact |

|---|---|---|---|

| Table Percentage | 54-58% | 53-61% | Minimal visual difference |

| Total Depth | 59-62% | 58-63.5% | 1-2% light return variation |

| Crown Angle | 33-35.5° | 31.5-37° | Affects fire and brilliance balance |

| Pavilion Angle | 40-41.5° | 39-42.5° | Critical for light leakage prevention |

| Symmetry Grade | Excellent to Very Good | Very Good to Good | Minor facet alignment differences |

| Polish Grade | Excellent to Very Good | Very Good to Good | Surface smoothness variation |

| Light Return Percentage | 92-94% | 88-91% | 2-4% measured light performance difference |

| Price Example (2ct Lab-Grown D-VVS1) | $2,400 | $2,040-$2,160 | 10-15% price differential |

| Visual Appearance to Untrained Eye | Maximum brilliance and fire | Nearly indistinguishable sparkle | Subtle difference in side-by-side comparison |

| Carat Weight Retention from Rough | Lower (sacrifices 5-10% weight) | Higher (optimizes carat retention) | Same rough yields 1.88ct vs 2.02ct |

The distinction between Very Good and Excellent cut grades often proves invisible to untrained observers. Stones at Excellent cut boundaries might show 92-94% light return in laboratory measurement. Very Good cuts return 88-91%—meaningful in precise measurement but subtle in subjective sparkle assessment. The 10-15% price differential creates opportunity for budget-conscious buyers.

The trade-off in pursuing optimal proportions appears in carat weight retention. Cutting rough to perfect Excellent specifications often sacrifices 5-10% finished carat weight compared to slightly compromised proportions. A rough yielding 1.88ct Excellent cut might produce 2.02ct Very Good from identical starting material—the difference between "1.9-carat" and "2-carat" with corresponding price tier implications.

Our cutting protocol prioritizes Excellent cut grades across production, accepting 6-8% average yield reduction compared to maximizing carat retention. The philosophy? Light performance drives customer satisfaction and repeat B2B relationships more than marginal carat advantages. Technical staff analyze each rough individually but default to 54-57% table, 60-61.5% depth, 34-35° crown, and 40.5-41° pavilion range that consistently produces Excellent grades.

The round brilliant's dominance in engagement rings—representing approximately 60% of center stones—stems directly from superior light return compared to fancy shapes. Princess, oval, cushion, emerald cuts sacrifice some optical performance for distinctive appearance. Most buyers prioritize sparkle intensity.

Carat Size and Budget Optimization: Maximizing Diamond Size Without Compromise

The price-per-carat exponential curve creates strategic opportunities at specific weight thresholds where psychological pricing meets physical realities. Natural diamonds show dramatic price jumps at 0.50, 0.75, 1.00, 1.50, and 2.00 carats. Why? Mining yields concentrate at certain sizes and buyers anchor on round numbers. A 0.99ct stone costs 15-20% less per carat than 1.00ct in identical quality despite 1% weight difference.

Lab-grown diamonds exhibit similar but less pronounced threshold effects. Growth cycles can be controlled to target specific sizes without geological constraints.

| Carat Weight Comparison | Per-Carat Price Jump (%) | Face-Up Diameter Difference (mm) | Total Cost Difference (G/VS2 Excellent) | Visual Detectability Rating | Strategic Savings Opportunity |

|---|---|---|---|---|---|

| 0.90ct vs. 1.00ct | 12-15% | 6.3mm vs. 6.5mm (0.2mm) | $540 vs. $680 ($140 savings) | Undetectable in normal viewing | High - Save $140 for invisible difference |

| 1.40ct vs. 1.50ct | 8-11% | 7.2mm vs. 7.4mm (0.2mm) | $980 vs. $1,125 ($145 savings) | Undetectable in normal viewing | High - Avoid psychological threshold premium |

| 1.90ct vs. 2.00ct | 10-13% | 8.0mm vs. 8.2mm (0.2mm) | $1,520 vs. $1,760 ($240 savings) | Undetectable in normal viewing | Very High - Significant savings, upgrade color/clarity instead |

| 1.85ct vs. 2.00ct | 8-10% | 7.95mm vs. 8.2mm (0.25mm) | $1,480 vs. $1,760 ($280 savings) | Undetectable in normal viewing | Very High - Use savings for G→E color upgrade |

| 2.40ct vs. 2.50ct | 6-9% | 8.7mm vs. 8.8mm (0.1mm) | $1,920 vs. $2,125 ($205 savings) | Completely invisible | Moderate - Less pronounced threshold effect |

| 2.90ct vs. 3.00ct | 7-10% | 9.3mm vs. 9.4mm (0.1mm) | $2,320 vs. $2,580 ($260 savings) | Completely invisible | High - Major psychological threshold savings |

The strategic approach? Purchase slightly below psychological thresholds when budget constrains size. A buyer with $3,500 for lab-grown might afford 2.00ct H/VS2 Excellent cut or 1.85ct G/VS1 Excellent at the same total price. The latter carries 8% less weight but superior color and clarity. The former achieves the round number that resonates in conversation—"2-carat diamond" versus "almost 2 carats."

Here's the reality: 0.15ct differences in face-up size (6.5mm versus 6.4mm for rounds) prove invisible in normal viewing. Pure preference decision, not visual trade-off.

Face-up diameter increases more slowly than carat weight due to cubic relationship between linear dimensions and volume. A 1.00ct round brilliant measures approximately 6.4-6.5mm diameter when properly proportioned. A 2.00ct stone measures 8.1-8.2mm—only 25% larger in diameter despite double the weight. This mathematical reality means 1.5ct stones at 7.3-7.4mm appear nearly as large as 2ct stones to casual observers while costing 25-30% less in lab-grown markets.

The budget maximization strategy depends on priority ranking among the 4Cs. Buyers prioritizing visible size benefit from allocating budget to carat weight while accepting H-J color and VS2-SI1 clarity that remain eye-clean and near-colorless in settings. Those prioritizing certification prestige might choose smaller stones in D-F color and VVS-VS1 clarity. Neither proves universally optimal.

Our B2B client consultations reveal approximately 60% of end retail customers purchasing lab-grown engagement rings prioritize carat weight as primary specification, accepting one to two color grades or clarity steps to reach desired size thresholds. The remaining 40% distribute across color priority (15%), clarity priority (10%), and cut quality priority (15%). This pattern holds remarkably consistent across $1,500 to $8,000 budgets.

Budget Allocation Strategy Comparison—Size vs. Certification Grade Priorities

Two clients approached our B2B consultation service with identical $4,000 budgets for lab-grown round brilliant engagement diamonds but fundamentally different priorities. Customer A (age 28, marketing professional) prioritized maximum visual size, stating "I want people to notice the ring immediately—size matters most to me." Customer B (age 32, finance analyst) prioritized certification specifications, explaining "I want the peace of mind knowing I have top-tier color and clarity grades on paper, even if the difference isn't visible."

We optimized each budget according to stated priorities while maintaining Excellent cut quality as non-negotiable baseline.

Six-month follow-up surveys revealed both customers rated satisfaction at 9.5/10 and 9/10 respectively.

The lab-grown pricing structure allows buyers to avoid compromises entirely in certain ranges. A $4,000 budget insufficient for 1.00ct D/VVS1 natural diamond ($12,000-16,000 range) easily accommodates 2.00ct D/VVS1 lab-grown round at $1,800-2,400 from direct manufacturers. This elimination of forced trade-offs represents the primary psychological appeal—achieving both size and quality specifications without choosing between competing priorities.

The carat weight sweet spot for lab-grown value appears in the 1.5-2.5ct range. Lab pricing remains relatively linear per carat while natural diamond prices accelerate exponentially. A 1.5ct lab-grown Excellent cut G/VS1 costs $900-1,200 ($600-800 per carat). Same stone at 2.5ct runs $1,600-2,100 ($640-840 per carat)—nearly proportional scaling. Natural equivalents at $14,000 ($9,300 per carat) and $32,000 ($12,800 per carat) show 38% per-carat price acceleration.

Smart Value Choices: Color and Clarity Sweet Spots for Round Lab Diamonds

The H-J color range represents optimal value for most buyers in white metal settings. Near-colorless appearance indistinguishable from D-F grades to untrained observers. Costs 20-35% less per carat in comparable clarity and cut. The savings stem from precision manufacturing in lab growth—CVD and HPHT processes can target specific nitrogen concentrations determining color grades.

Color perception in mounted rounds depends critically on metal choice. A round brilliant's crown facets reflect surrounding environment including setting metal. White gold or platinum maintain color neutrality. Yellow gold reflects warm tones into the stone. This optical reality means H-J diamonds in yellow gold often appear identical to D-F stones in the same setting. The color distinction becomes more apparent in white metals.

What's the takeaway? Buyers selecting rose gold, yellow gold, or two-tone designs gain minimal practical benefit from colorless premium grades. H-J proves the rational choice regardless of budget.

The VS2-SI1 clarity range provides the second value optimization point. This represents the threshold where inclusions remain invisible to unaided vision in most well-cut rounds. The "eye-clean" designation describes stones where inclusions require magnification to detect despite their presence in certification reports—functionally perfect appearance at reduced pricing compared to VVS and higher grades. The 15-25% savings between VS1 and SI1 grades purchases tangible upgrades in carat weight or color that affect appearance more than invisible clarity differences.

Clarity value optimization requires individual stone evaluation, not grade-based assumptions. Why? Inclusion type and location matter more than quantity. An SI1 with small white crystals dispersed near the girdle appears cleaner than VS2 with a single dark carbon inclusion near the table facet, despite superior grade. Modern certification photography on reports allows buyers purchasing online to verify eye-clean status by examining inclusion plots.

| Clarity Grade | Typical Price Per Carat (Round Lab-Grown) | Eye-Clean Probability 1ct | Eye-Clean Probability 2ct | Eye-Clean Probability 3ct+ | Common Inclusion Types | Optimal Use Cases |

|---|---|---|---|---|---|---|

| VVS2 | $950-$1,200 | 100% | 100% | 100% | Minute pinpoints, minor feathers near girdle | Investment pieces, maximum clarity assurance across all sizes, buyers prioritizing certification prestige |

| VVS1 | $800-$1,050 | 100% | 100% | 100% | Surface graining, tiny pinpoints visible only under 10x magnification | High-end engagement rings, stones above 2.5ct where clarity becomes more critical |

| VS1 | $700-$900 | 99% | 98% | 95% | Small crystals, minor clouds, feathers in non-critical locations | Premium engagement rings, stones 2-3ct range requiring clarity confidence |

| VS2 | $600-$800 | 95% | 90% | 85% | Small white crystals dispersed, minor feathers, occasional clouds | OPTIMAL VALUE ZONE: Engagement ring center stones 1-2ct, professional settings requiring close observation confidence |

| SI1 | $500-$650 | 85% | 75% | 60% | White crystals near girdle, small feathers, clouds in pavilion area | MAXIMUM VALUE ZONE: Best price-to-appearance ratio for 1-1.5ct stones, requires individual verification of inclusion location |

| SI2 | $400-$550 | 65% | 50% | 35% | Larger crystals, dark carbon inclusions, visible feathers, clouds near table | Budget-focused buyers under 1.5ct, stones where inclusion plot shows favorable positioning away from table facet |

Our manufacturing experience across the full clarity spectrum reveals VS2-SI1 range requires minimal growth parameter adjustment from VVS production. The difference often involves accepting slightly higher methane concentrations in CVD feedstock or modest temperature variation in HPHT cycles. This technical similarity explains why price differentials seem disproportionate to visual differences—the market prices based on certification grades and traditional scarcity patterns from natural diamonds rather than production cost variation.

The clarity trade-off materializes in specific viewing conditions. SI1-SI2 stones appearing perfectly eye-clean in normal lighting may reveal inclusions under direct sunlight or bright retail spotlighting, particularly if inclusions sit near the table facet where light concentration occurs. Buyers in professions requiring frequent close observation by others—healthcare workers, teachers, service providers—sometimes prefer VS2 and higher to eliminate any visibility risk.

The combined optimization strategy targets H-J color with VS2-SI1 clarity in Excellent cut rounds. This specification combination delivers maximum size for budget while maintaining near-colorless, eye-clean appearance and optimal light performance. This typically allows purchasing 30-40% more carat weight than prioritizing D-F/VVS specifications at equal total cost.

Let's break this down: A buyer with $3,000 might choose between 1.2ct D/VVS2 or 1.8ct H/VS2, both in Excellent cut. The latter provides 50% more face-up diameter (7.7mm versus 6.8mm) at identical sparkle and functionally equivalent appearance when mounted.

D-F colorless grades justify their premium in specific contexts: yellow gold settings where color contrast becomes noticeable, larger stones above 2.5ct where color perception intensifies, or buyers with trained color sensitivity detecting warmth in G-J stones others miss. The psychological value of certification prestige also drives some buyers toward colorless grades regardless of visual differences—the satisfaction of owning a "D color" diamond represents intangible value some prioritize over practical appearance.

The clarity sweet spot shifts slightly in stones above 2ct where inclusion visibility increases with size. A 1.5ct SI1 appearing eye-clean may have a 3.0ct equivalent in the same grade showing visible inclusions. Why? Physical inclusion size doesn't scale proportionally with diamond size—a 0.3mm crystal remains 0.3mm whether in 1ct or 3ct stone but occupies visually different proportions. Buyers in larger carat ranges often optimize at VS2-VS1 rather than dipping into SI grades.

Why This Matters Now

Round lab-grown diamonds eliminate forced compromises between size, quality, and budget through 70-97% savings and direct manufacturer access. You achieve 1.5-2.5ct eye-clean, near-colorless stones with Excellent cut and IGI/GIA certification at prices once requiring quality sacrifices. The H-J/VS2-SI1 sweet spot delivers maximum brilliance per dollar while vertical integration controls every quality checkpoint from reactor to shipping.

Your Next Step

Book a consultation with Labrilliante's diamond specialists to identify your optimal carat, color, and clarity combination. Our in-house CVD and HPHT production with direct fulfillment removes retail markup layers—typically saving 15-30% versus multi-brand retailers on identical specifications. Design your custom round brilliant engagement ring today and secure manufacturer-direct pricing before production slots fill.

Frequently Asked Questions

Lab-grown diamonds cost 70-97% less than natural diamonds with identical physical properties, clarity, and brilliance. This dramatic price difference reflects production economics and eliminated intermediary markup layers rather than any quality compromise, as both types share the same carbon structure, Mohs 10 hardness, and optical properties certified by IGI or GIA.

H-J color with VS2-SI1 clarity represents the optimal value sweet spot for most buyers. These near-colorless, eye-clean grades appear virtually identical to higher grades when mounted but cost 20-35% less, allowing you to purchase 30-40% more carat weight at the same budget while maintaining excellent visual appearance.

Lab-grown diamonds currently trade at 30-40% below retail in resale channels, compared to natural diamonds maintaining 40-70% of retail value. However, the initial 70-97% savings typically outweighs resale differentials over typical 40-60 year ownership periods—investing the $12,000 saved on a 2ct lab-grown versus natural equivalent at 7% annual return accumulates $180,000 over 40 years.

Both IGI and GIA apply identical grading methodologies to lab-grown and natural diamonds using the same color scales, clarity standards, and cut evaluation systems. GIA tends to grade slightly more conservatively (sometimes one grade lower than IGI for identical characteristics), but both maintain consistent internal standards—making either certification reliable for comparing stones from multiple suppliers.

Eye-clean status in SI1 diamonds depends on inclusion type, size, and location rather than grade alone—white crystals near the girdle remain invisible while dark carbon spots near the table facet show more readily. Modern certification reports include inclusion plots and photographs allowing you to verify visibility before purchase, with VS2-SI1 stones under 2ct having high probability of eye-clean appearance.

The 1.5-2.5ct range offers optimal value as lab-grown pricing scales nearly proportionally per carat ($600-840/ct) while natural diamonds show 38% per-carat acceleration in this range. Strategic buyers can also save 15-20% by purchasing just below psychological thresholds—a 1.90ct stone costs significantly less than 2.00ct despite only 0.4mm diameter difference that's invisible when worn.

Prioritize cut quality first (Excellent grade), then carat size for visual impact, followed by H-J color and VS2-SI1 clarity which remain near-colorless and eye-clean at lower cost. This allocation delivers maximum sparkle and size—a $3,000 budget gets you 1.8-2.0ct H/VS2/Excellent lab-grown versus forcing compromises between 0.7ct D/VVS1 or 1.0ct J/SI1 in natural diamonds at the same price.

Yellow and rose gold settings make H-J color diamonds appear identical to D-F grades because the metal reflects warm tones into the stone, masking slight color differences. If you're selecting colored metal, you gain no practical benefit from colorless premium grades—making H-J the rational choice that allows redirecting 20-35% savings toward larger carat size or superior cut quality.