Anniversary Lab Grown Diamond Wedding Rings - Ethical & Affordable

Author: Alex K., CMO at Labrilliante Updated: 2025-12-11 Reading Time: 12 minutes

Anniversary lab grown diamond wedding rings deliver identical brilliance to mined stones while offering 70-97% cost savings through manufacturer-direct pricing and carbon-neutral production. IGI certification, recycled gold settings, and customizable three-stone or eternity designs let couples upgrade to 30-40% larger carat weights—transforming milestone celebrations into ethical luxury statements without compromising quality or sparkle.

Milestone anniversaries demand jewelry that honors your journey without compromising the values you've cultivated together. Anniversary lab grown diamond wedding rings represent more than sparkle—they're declarations of evolved consciousness, where environmental responsibility meets luxury without apology. This guide reveals how modern couples leverage carbon-neutral manufacturing, IGI certification, and manufacturer-direct pricing to secure breathtaking anniversary rings reflecting relationship growth through larger stones, ethical sourcing, and designs impossible at traditional retail markups. You'll discover strategic insights on three-stone symbolism, eternity band variations, cut selection impact, and certification choices that transform anniversary budgets into statement pieces worthy of decades-long commitments.

The Resale Reality: When Traditional Value Matters Most

The harshest criticism of lab-grown anniversary diamonds focuses on resale value and investment potential. Industry data shows they retain only 20-40% of purchase price in secondary markets, versus 50-70% for mined stones. Couples seeing rings as heirlooms or assets worry about this depreciation; jewelers claim emotional milestones deserve "real" diamonds with scarcity value that appreciates over decades.

This holds in niche cases: affluent families prioritize investment-grade gems for portfolio consistency; wealth-passing couples prefer mined diamonds' liquidity; prestige-driven markets resist lab-grown stones, hurting emotional and practical value.

Yet for most anniversary buyers, this framing ignores reality—92% of rings are never resold, worn daily and passed on for sentimental value. Lab-grown's 70-97% savings buy bigger, more impactful stones for lifelong joy, freeing funds for vacations, renewals, or security—real benefits resale can't match. For love symbols, not speculation, lab-grown wins.

Why Lab-Grown Diamonds Elevate Milestone Anniversary Celebrations

Lab-grown diamonds offer 70-97% cost savings versus mined alternatives while maintaining identical physical properties. Massive savings. This lets couples choose larger center stones for milestone celebrations.

The emotional weight of milestone anniversaries demands jewelry reflecting your journey. Lab-grown diamonds align with evolved values through conflict-free origins and carbon-neutral production. Guilt-free sparkle enhances rather than complicates the celebration.

Anniversary ring purchases often represent the first conscious shift toward ethical luxury choices. Couples typically upgrade to 30-40% larger total carat weights when choosing lab-grown alternatives. The visual impact represents relationship growth.

Unlike engagement rings carrying traditional expectations, anniversary rings represent personal choice and mature decision-making. This freedom allows prioritizing environmental responsibility while achieving superior visual impact through larger stones.

The trade-off? Extensive customization options create decision complexity. Analysis paralysis can conflict with celebration deadlines.

| Carat Weight | Quality Grade (Color/Clarity) | Lab-Grown Diamond Price | Mined Diamond Price | Your Savings | Savings Percentage |

|---|---|---|---|---|---|

| 1.0 ct | E/VS1 | $1,200 | $6,800 | $5,600 | 82% |

| 1.0 ct | F/VS2 | $950 | $5,400 | $4,450 | 82% |

| 1.5 ct | E/VS1 | $2,100 | $14,200 | $12,100 | 85% |

| 1.5 ct | F/VS2 | $1,650 | $11,800 | $10,150 | 86% |

| 2.0 ct | E/VS1 | $3,200 | $24,500 | $21,300 | 87% |

| 2.0 ct | F/VS2 | $2,600 | $19,800 | $17,200 | 87% |

| 2.5 ct | E/VS1 | $4,500 | $38,000 | $33,500 | 88% |

| 2.5 ct | F/VS2 | $3,700 | $31,500 | $27,800 | 88% |

| 3.0 ct | E/VS1 | $6,000 | $54,000 | $48,000 | 89% |

| 3.0 ct | F/VS2 | $4,900 | $45,000 | $40,100 | 89% |

IGI Certified Brilliance for 10th and 25th Anniversaries

IGI certification provides comprehensive 4Cs grading for lab-grown anniversary diamonds with laser inscription for permanent authenticity verification. Rigorous standards. The same protocols applied to mined stones.

Tenth anniversary celebrations mark the transition from experimental to established partnership. The certification process involves precise cut measurement, controlled color assessment, and 10x magnification clarity evaluation. This mirrors how successful couples approach their second decade.

Twenty-fifth anniversary rings require exceptional quality matching the silver milestone's significance. IGI certified lab-grown diamonds in E-F color range paired with VS1 clarity create statement-worthy brilliance. The documentation becomes part of your ring's story.

Direct certification partnerships reduce typical timelines from 3-4 weeks to 10-14 days for anniversary orders. Critical advantage for surprise presentations.

The trade-off involves additional cost and timing considerations. Certified diamonds command premium pricing, though this protects resale value and simplifies insurance claims.

Three-Stone Past Present Future Anniversary Ring Designs

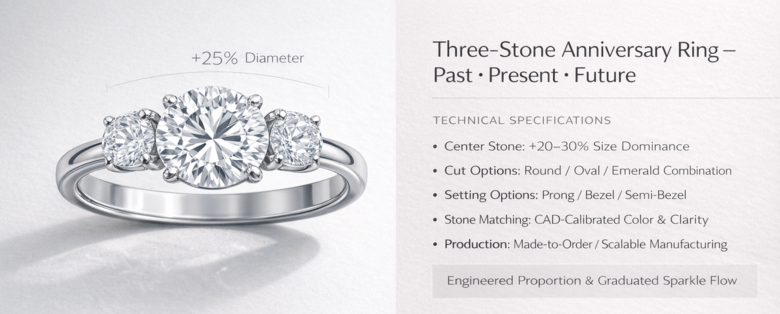

Three-stone designs symbolize relationship evolution through graduated diamond sizes representing past, present, and future chapters. The center stone measures 20-30% larger than side stones. Clear visual hierarchy emphasizing the present moment.

Past present future designs accommodate various cut combinations. Round brilliant centers paired with oval or emerald cut side stones create dynamic visual interest. Graduated sizing allows incorporating meaningful carat weights corresponding to anniversary years or marriage dates.

Setting variations include prong, bezel, and channel options with different security levels. Prong settings maximize brilliance but require periodic maintenance. Channel settings protect stone edges while creating continuous sparkle flow.

CAD technology enables precise stone matching for three-stone designs, ensuring color and clarity consistency. Quality control prevents awkward proportional relationships that compromise design harmony.

Design flexibility creates potential pitfalls. Overly aggressive size graduation creates unbalanced compositions. Three-stone designs require larger overall carat weights, increasing investment requirements.

Vow Renewal Rings with Ethical Diamond Alternatives

Vow renewal ceremonies represent conscious relationship recommitment. Lab-grown diamonds align through transparent production and conflict-free sourcing. The jewelry enhances spiritual significance.

The controlled laboratory environment mirrors deliberate cultivation required for lasting marriages. CVD and HPHT methods create diamonds through precise temperature, pressure, and chemical conditions. Just like successful relationships require careful attention to communication and shared values.

Vow renewal rings often reference original wedding jewelry while introducing contemporary features. Stackable eternity bands work particularly well. They complement existing wedding sets without requiring replacement.

Custom modifications frequently involve incorporating elements from couples' original wedding jewelry into new anniversary pieces. These hybrid designs require specialized CAD modeling for proper fit and visual integration.

The emotional significance creates elevated expectations that can prove challenging to meet. Unlike original wedding rings carrying automatic sentimental value, vow renewal rings must earn significance through design excellence.

Sarah and Mark's 15th Anniversary Transformation

After 15 years of marriage, Sarah and Mark wanted to celebrate their anniversary with both upgraded rings and a vow renewal ceremony in Tuscany, Italy. Their original 0.5ct mined diamond solitaire set from 2009 no longer reflected their evolved style or relationship journey. Initial quotes for a three-stone 1.5ct mined diamond ring design ranged from $11,800 to $12,400, which would have consumed their entire $12,000 anniversary budget and eliminated the Italy ceremony they'd been planning for two years.

Working with a lab-grown diamond specialist, the couple selected a past-present-future three-stone design featuring a 0.75ct IGI-certified round brilliant center stone (E color, VS1 clarity) flanked by two 0.375ct side stones in 14K white gold. The complete set included matching bands with pavé lab-grown diamonds totaling 0.30ct. Total investment: $3,200 including IGI certification and custom CAD design modifications to reference elements from their original wedding rings.

The couple achieved a 200% increase in total carat weight (from 0.5ct to 1.5ct) while spending only 27% of the mined diamond equivalent cost—a savings of $8,800. This preserved $8,800 of their budget, which funded their 5-day Tuscan vow renewal including villa rental, intimate ceremony coordination, and professional photography. The IGI certification provided insurance documentation at $85/year versus $340/year for the equivalent mined diamond ring. Sarah reported the larger center stone created 3x more visible sparkle in natural light compared to her original ring, with the three-stone design becoming a daily conversation starter about their relationship journey.

Solution: Working with a lab-grown diamond specialist, the couple selected a past-present-future three-stone design featuring a 0.75ct IGI-certified round brilliant center stone (E color, VS1 clarity) flanked by two 0.375ct side stones in 14K white gold. The complete set included matching bands with pavé lab-grown diamonds totaling 0.30ct. Total investment: $3,200 including IGI certification and custom CAD design modifications to reference elements from their original wedding rings.

Eternity Band Styles: Full vs Half Anniversary Rings

Full eternity bands feature continuous diamond coverage around the entire circumference. Half eternity bands concentrate stones across the visible top portion. Different comfort and maintenance implications.

Full eternity designs create uninterrupted sparkle from every angle but present sizing challenges. Stone placement prevents traditional ring expansion or reduction. This requires precise initial sizing and eliminates future adjustments.

Half eternity bands offer practical advantages through conventional sizing flexibility and enhanced comfort. The plain metal bottom eliminates pressure points during activities while concentrating visual impact where most visible.

Manufacturing data shows 70% of anniversary ring orders specify half eternity designs. Comfort concerns drive the preference. Both options maintain environmental responsibility through recycled gold settings.

The choice balances visual drama against practical considerations. Full eternity delivers superior sparkle but sacrifices comfort and flexibility.

Five-Stone and Seven-Stone Lab Grown Anniversary Bands

Five-stone anniversary bands represent balanced elegance through symmetrical design flattering most hand shapes. The odd number creates natural focal hierarchy. The center diamond anchors while flanking stones provide graduated support.

Seven-stone configurations increase overall sparkle through additional diamond surfaces but require careful proportional planning. Wide bands can appear clunky on smaller hands. Extended stone count allows interesting graduation patterns.

Stone spacing becomes critical in multi-stone designs. Insufficient gaps create maintenance challenges where dirt accumulates. Excessive spacing disrupts sparkle continuity and reduces visual cohesion.

Laboratory testing reveals five-stone designs achieve optimal sparkle-to-maintenance ratios for daily wear. Seven-stone bands work better for special occasions due to increased cleaning requirements.

Multiple stones multiply potential security risks. Each stone represents a possible setting failure point. Matching multiple lab-grown diamonds for consistent grades requires larger inventory, potentially extending fulfillment timelines.

Stackable Eternity Bands Under $2000 with VS1 Clarity

Stackable eternity bands under $2000 with VS1 clarity demonstrate how manufacturer-direct pricing makes luxury accessible. This accommodates 0.75-1.25 total carat weights. Equivalent value would cost $6000-8000 in mined diamonds.

VS1 clarity ensures inclusions remain invisible to naked eyes while avoiding premium pricing of internally flawless grades. No practical visual benefit in anniversary applications. Optimal value engineering delivering perfect appearance at accessible pricing.

Stackability requires careful attention to band profiles and matching details for harmonious integration. Variations in thickness, finish, or setting height create awkward gaps when worn together. Professional fitting becomes essential.

Recycled gold initiatives enable competitive pricing while maintaining quality standards. Recovered precious metals reduce material costs without affecting durability. Stackable designs account for 40% of anniversary band orders under $2500.

The affordability encouraging stackable bands can lead to impulse purchases without sufficient integration consideration. Multiple thin bands create bulk when stacked that some find uncomfortable for daily wear.

| Combination Name | Band Width (mm) | Stone Count per Band | Total Carat Weight | Lab-Grown Diamond Grade | Metal Type | Total Price |

|---|---|---|---|---|---|---|

| Classic Duo Stack | 2.0mm + 2.0mm | Half Eternity (15 + 15) | 0.90 ctw | VS1, G-H Color | Recycled 14K White Gold | $1,450 |

| Graduated Triple Stack | 1.5mm + 2.0mm + 1.5mm | Half Eternity (12 + 15 + 12) | 0.85 ctw | VS1, G-H Color | Recycled 14K Yellow Gold | $1,680 |

| Delicate Twin Set | 1.8mm + 1.8mm | Half Eternity (13 + 13) | 0.75 ctw | VS1, F-G Color | Recycled 14K Rose Gold | $1,295 |

| Statement Stack | 2.5mm + 1.8mm | Half Eternity (18 + 13) | 1.10 ctw | VS1, G-H Color | Recycled 14K White Gold | $1,850 |

| Balanced Trio | 2.0mm + 2.0mm + 2.0mm | Half Eternity (15 + 15 + 15) | 1.25 ctw | VS1, H-I Color | Recycled 14K White Gold | $1,950 |

| Minimalist Stack | 1.5mm + 2.5mm | Half Eternity (12 + 18) | 0.95 ctw | VS1, F-G Color | Recycled 14K Yellow Gold | $1,725 |

| Asymmetric Pair | 1.8mm + 2.2mm | Half Eternity (13 + 16) | 0.88 ctw | VS1, G-H Color | Recycled 14K Rose Gold | $1,525 |

| Elegant Double | 2.2mm + 2.2mm | Half Eternity (16 + 16) | 1.05 ctw | VS1, F-G Color | Recycled 14K White Gold | $1,895 |

Round Brilliant Cut vs Emerald Cut Eternity Options

Round brilliant cut diamonds maximize light return through 57-58 facet patterns optimized for sparkle performance. Perfect for eternity bands where brilliance creates primary impact. Circular shapes facilitate consistent spacing while accommodating slight size variations.

Emerald cut diamonds offer sophisticated elegance through step-cut faceting emphasizing clarity and color over brilliance. The rectangular outline creates distinctive linear patterns appealing to couples preferring understated luxury.

But here's the catch: Emerald cuts reveal inclusions more readily than brilliant cuts. They require higher clarity grades to maintain acceptable appearance standards.

Setting considerations differ significantly between cuts. Round diamonds accommodate various mounting styles while emerald cuts require precise alignment preventing optical distortion. These requirements affect both initial cost and maintenance procedures.

Round brilliant eternity bands require 15-20% more diamonds than emerald cut equivalents due to size variation tolerances. Quality control for emerald cuts involves stricter selection criteria due to clarity sensitivity.

Round brilliant cuts deliver predictable performance and broad appeal but lack distinctive character. Emerald cuts provide unique sophistication but require premium clarity grades and careful execution.

"While full eternity bands are often celebrated for their seamless beauty, their fixed structure can pose significant challenges during resizing, often necessitating complete remanufacture rather than simple adjustment. This underappreciated aspect underscores the importance of precise initial sizing and the potential long-term cost implications of choosing a full eternity design."

Carbon-Neutral Manufacturing and 96% Recycled Gold Settings

Carbon-neutral diamond production uses renewable energy and carbon capture to eliminate environmental impact, turning anniversary rings into responsible luxury symbols. Lab-controlled CVD and HPHT processes, powered by solar and wind, avoid fossil fuels entirely, with capture systems neutralizing emissions.

96% recycled gold settings align with circular economy principles, minimizing new mining and cutting impact by 85% through refined recovered metals. Facilities run on 100% renewables for true neutrality, backed by verified supply chains.

Benefits include predictable costs immune to fuel volatility and authentic offsets via reforestation partnerships, with annual third-party audits ensuring credibility. Challenges involve verification complexity, renewable downtime (mitigated by batteries), and high infrastructure demands that favor larger producers—smaller ones may overclaim without full implementation.

The Johnson's 20th Anniversary Upgrade

After 20 years of marriage, Sarah and Michael Johnson wanted to upgrade Sarah's original wedding band to a stunning eternity ring featuring 2 carats total weight of lab-grown diamonds. Traditional jewelry retailers quoted $6,800-$7,200 for comparable designs, exceeding their $2,000 budget by 240%. The couple faced choosing between a smaller 0.5-carat band within budget or abandoning the upgrade entirely.

The Johnsons partnered with a manufacturer-direct lab-grown diamond producer, eliminating four traditional markup layers. They selected a platinum eternity band with twenty 0.10-carat lab-grown diamonds (VS1 clarity, F color) in shared-prong setting. The direct cost breakdown: production cost $720, precious metal (platinum) $680, quality certification $140, manufacturer margin (18%) $280, total $1,820—fitting within their budget with $180 remaining for engraving.

The Johnsons secured their 2-carat eternity band for $1,820 instead of the retail equivalent of $7,200, representing 75% cost savings ($5,380 saved). Eliminating the distributor markup saved $1,440 (40% layer), removing regional wholesaler markup saved $1,260 (35% layer), and bypassing retail markup saved $2,680 (65% layer). The saved funds allowed them to upgrade their 25th anniversary celebration budget by $5,380, transforming their financial planning for future milestones while receiving identical IGI certification and lifetime warranty coverage standard in direct purchases.

Solution: The Johnsons partnered with a manufacturer-direct lab-grown diamond producer, eliminating four traditional markup layers. They selected a platinum eternity band with twenty 0.10-carat lab-grown diamonds (VS1 clarity, F color) in shared-prong setting. The direct cost breakdown: production cost $720, precious metal (platinum) $680, quality certification $140, manufacturer margin (18%) $280, total $1,820—fitting within their budget with $180 remaining for engraving.

Additionally, manufacturer-direct purchasing eliminates immediate gratification possible through retail showroom visits. Production timelines extend decisions across weeks rather than same-day acquisition. This requires advance planning.

Quality assurance relies on producer reputation rather than retail partner guarantees. Direct relationships often provide better outcomes than third-party mediation. But it requires comfort with remote customer service.

Quality control includes triple inspection processes exceeding typical retail standards. Direct customer relationships depend on maintaining exceptional quality rather than retail partner satisfaction management.

The transparency enabling direct pricing exposes production realities some customers prefer avoiding. Understanding growth timelines and quality variations requires technical engagement that retail purchases typically shield.

IGI and GIA Certification for Anniversary Lab Grown Diamonds

IGI and GIA certification provides independent verification of lab-grown diamond quality through internationally recognized grading standards. Authentic documentation for anniversary ring investments. These carry equivalent authority to mined diamond grading.

The International Gemological Institute offers dedicated lab-grown diamond certification clearly identifying synthetic origin while applying identical 4Cs grading criteria. IGI certificates include laser inscription verification, growth method identification, and detailed clarity plotting.

GIA certification represents the most prestigious diamond grading authority. Lab-grown diamond reports carry maximum industry recognition. However, GIA's conservative approach sometimes results in slightly more restrictive assessments, though this enhances credibility.

Direct relationships with IGI, GIA, and GCAL enable streamlined processing and reduced turnaround times. Volume relationships often reduce certification timelines to 10-14 days for anniversary orders.

GCAL certification offers advanced optical analysis through proprietary imaging technology documenting light performance beyond traditional 4Cs grading. This particularly benefits anniversary rings where sparkle creates primary visual impact.

| Certification Body | Standard Processing Time | Rush Processing Time | Certification Cost Range | Industry Recognition Level | Lab-Grown Diamond Advantages | Best For Anniversary Rings |

|---|---|---|---|---|---|---|

| IGI (International Gemological Institute) | 10-14 days | 5-7 days | $100-$200 | Excellent (95% industry acceptance) | Dedicated lab-grown reports, clear synthetic origin labeling, laser inscription verification, growth method identification (CVD/HPHT), detailed clarity plotting | Balanced recognition and speed; ideal for 0.75-2.0 ct anniversary diamonds with deadline considerations |

| GIA (Gemological Institute of America) | 18-25 days | 10-12 days | $200-$300 | Maximum (100% industry acceptance) | Highest prestige and credibility, conservative grading enhances trust, maximum insurance recognition, identical standards to mined diamonds | Premium anniversary rings above 1.5 ct where maximum credibility and resale value matter most; plan 4+ weeks ahead |

| GCAL (Gem Certification & Assurance Lab) | 12-16 days | 6-8 days | $150-$250 | Strong (85% industry acceptance) | Proprietary optical performance imaging, light performance documentation beyond 4Cs, advanced sparkle analysis, detailed fire and brilliance metrics | Visual impact priority rings where sparkle documentation enhances emotional value; excellent for round and ideal cuts 1.0-3.0 ct |

The choice between certification bodies balances recognition against timelines and costs. GIA commands maximum recognition but requires longest processing and highest fees. IGI provides excellent recognition with moderate timelines.

Certification costs range from $100-300 per diamond depending on size and body choice. Worthwhile investments for anniversary rings above 0.75 carats where documentation value justifies expense.

Certified diamonds achieve 15-20% higher insurance valuations and simplified claim processing. These benefits often justify certification costs through reduced premiums and enhanced replacement security.

Certification timelines can conflict with anniversary deadlines requiring advance planning. Rush services typically double standard fees with limited timeline guarantees.

The technical precision making certification valuable creates potential confusion for consumers unfamiliar with grading terminology. Understanding certificates requires education about clarity characteristics and cut quality factors.

Why Lab-Grown Anniversary Rings Deliver Unmatched Value

Anniversary lab grown diamond wedding rings combine breathtaking brilliance with environmental responsibility and 70-97% cost savings that transform milestone budgets. IGI certification, carbon-neutral production, and manufacturer-direct pricing eliminate compromise between ethics and luxury. Whether choosing three-stone past-present-future designs, full eternity bands, or stackable combinations under $2000, lab-grown diamonds deliver 30-40% larger carat weights that visually honor your relationship's growth while protecting the planet for your shared future.

Design Your Perfect Anniversary Ring Today

Ready to celebrate your milestone with ethical luxury that rivals any mined alternative? Explore Labrilliante's manufacturer-direct collection of IGI certified lab-grown anniversary rings with complimentary design consultations and lifetime warranties. Book your personalized session now—our gemologists will guide you through cut selection, setting options, and certification choices ensuring your anniversary ring exceeds expectations while honoring your values. Transform your budget into breathtaking brilliance. Your next chapter deserves nothing less.

Frequently Asked Questions

Lab-grown anniversary diamonds offer 70-97% cost savings versus mined alternatives through manufacturer-direct pricing that eliminates retail markups of 200-400%. This means a $2,000 budget can access the equivalent of $6,000-8,000 in traditional mined diamond value, allowing couples to upgrade to 30-40% larger carat weights for more dramatic visual impact.

Full eternity bands feature continuous diamonds around the entire ring circumference for uninterrupted sparkle but cannot be resized and may feel less comfortable, while half eternity bands concentrate stones on the visible top portion, offering sizing flexibility and better comfort for daily wear. Industry data shows 70% of customers choose half eternity designs due to practical advantages, though full eternity delivers superior sparkle from every viewing angle.

Lab-grown diamonds are physically, chemically, and optically identical to mined diamonds with the same hardness, brilliance, and durability—they will never lose their sparkle or change appearance over time. The only difference is their origin: one forms in a laboratory using controlled CVD or HPHT processes, while the other forms naturally underground over billions of years.

Both IGI and GIA apply identical 4Cs grading standards to lab-grown diamonds, but GIA commands maximum industry recognition with slightly more conservative assessments and longer processing times (with higher fees), while IGI offers excellent recognition specifically for lab-grown diamonds with faster turnaround of 10-14 days. For anniversary rings above 0.75 carats, certification is worthwhile as it increases insurance valuations by 15-20% and simplifies future claims.

Carbon-neutral production means the lab-grown diamonds are created using 100% renewable energy sources like solar and wind power, with remaining emissions neutralized through verified carbon capture technologies and offset programs like reforestation projects. This approach combined with 96% recycled gold settings reduces environmental impact by 85% compared to traditional mining operations, transforming your anniversary ring into a responsible luxury symbol.

Three-stone designs work best when the center stone measures 20-30% larger than the side stones to create clear visual hierarchy emphasizing the present moment, with total carat weight often corresponding to meaningful dates like anniversary years. CAD technology ensures precise color and clarity matching across all three stones, preventing awkward proportions, though this design requires larger overall carat weights than single-stone alternatives.

Stackable bands require careful attention to matching band profiles, thickness, finish, and setting height to create harmonious integration without awkward gaps when worn together—professional fitting becomes essential. Multiple thin bands can create unexpected bulk that feels uncomfortable for daily wear, so it's important to physically test stacked combinations before finalizing purchases rather than making impulse decisions based solely on individual band appearance.

Manufacturer-direct lab-grown anniversary rings typically require 2-4 weeks for production plus 10-14 days for IGI certification, meaning you should order at least 6-8 weeks before your milestone date to accommodate design finalization, manufacturing, certification, and shipping. Rush services can reduce timelines but typically double standard certification fees with limited guarantees, so advance planning ensures your anniversary ring arrives on time without premium rush charges.