Lab Grown Diamonds Resale Value: Market Reality in 2025

Author: Alex K., CMO at Labrilliante Updated: 2025-09-22 Reading Time: 8 minutes

Lab-grown diamonds retain 30-40% of purchase price in 2025's secondary market. CVD stones outperform HPHT by 5-8% retention rates. IGI certification maintains 3-7% higher resale values than GIA for manufactured diamonds. Absolute losses remain lower despite worse percentages—lab buyers lose $400-$800 per carat versus $1,600-$3,200 for natural stones.

Modern couples face a profound shift in diamond purchasing psychology—choosing between traditional scarcity and innovative sustainability. Lab grown diamonds resale value reflects this cultural transformation, where manufacturing efficiency meets emotional significance. Understanding these market dynamics empowers informed decisions beyond initial sticker shock. You'll discover why depreciation patterns differ fundamentally from natural stones and how strategic choices maximize returns when life changes require selling your lab-created investment.

The Contrarian Case: Why Lab Diamonds Might Appreciate

Some industry experts argue lab-grown diamonds could reverse their depreciation trend as consumer acceptance reaches critical mass. They point to luxury electric vehicles—initially depreciating faster than gas cars but now holding value as mainstream adoption grows. If lab diamonds achieve similar cultural acceptance, early buyers might benefit from timing rather than suffer from it.

This scenario requires several conditions: production costs stabilizing, oversupply resolving, and consumer perception shifting toward investment mindset. Currently, none of these conditions exist. Production efficiency continues improving, capacity exceeds demand, and buyers choose lab diamonds for immediate savings rather than appreciation potential.

While possible in theory, market fundamentals suggest continued depreciation. Manufacturing scalability inherently differs from geological scarcity—making lab diamonds excellent purchases for personal enjoyment but poor vehicles for wealth preservation in foreseeable market conditions.

Lab Grown Diamond Resale Reality in 2025

Lab-grown diamonds retain 30-40% of their purchase price in today's market. This reflects manufacturing economics rather than rarity-based pricing like natural stones.

The 2025 resale landscape shows clear patterns. Stones bought at $1,000-$5,000 per carat typically sell for $300-$2,000 per carat. Why such steep drops? Lab diamonds face the same depreciation as manufactured goods—think cars leaving the dealership.

CVD diamonds outperform HPHT stones by 5-8% in resale retention. The reason? CVD's chemical vapor deposition process creates Type IIA diamonds with fewer metallic inclusions, making them more desirable secondhand.

Resale channels matter enormously. Consignment through jewelry retailers yields 35-45% retention. Direct consumer sales average 25-35%. Professional buyers offer quick sales but only 20-30% returns.

| Purchase Price Range (per carat) | Resale Channel | Expected Resale Value (per carat) | Retention Rate | CVD Premium vs HPHT |

|---|---|---|---|---|

| $800 - $1,200 | Jewelry Retailer Consignment | $320 - $540 | 40% - 45% | +6% |

| $800 - $1,200 | Direct Consumer Sale | $240 - $420 | 30% - 35% | +5% |

| $800 - $1,200 | Professional Buyer | $200 - $360 | 25% - 30% | +3% |

| $1,500 - $2,000 | Jewelry Retailer Consignment | $600 - $900 | 40% - 45% | +7% |

| $1,500 - $2,000 | Direct Consumer Sale | $450 - $700 | 30% - 35% | +6% |

| $1,500 - $2,000 | Professional Buyer | $375 - $600 | 25% - 30% | +4% |

| $2,200 - $2,800 | Jewelry Retailer Consignment | $880 - $1,260 | 40% - 45% | +8% |

| $2,200 - $2,800 | Direct Consumer Sale | $660 - $980 | 30% - 35% | +7% |

| $2,200 - $2,800 | Professional Buyer | $550 - $840 | 25% - 30% | +5% |

Current Market Retention Rates and Depreciation

Post-purchase depreciation hits 40-60% immediately, then stabilizes. This exponential decline differs sharply from luxury watches or precious metals.

Geography affects values significantly. North American markets show stronger resale performance than Asia Pacific regions, where production proximity creates pricing pressure. European buyers pay premiums for verified ethical sourcing.

IGI-certified lab diamonds maintain 3-7% higher resale values than GIA-certified equivalents. This reflects IGI's specialized lab-grown testing protocols versus GIA's natural diamond heritage.

Natural vs Lab Diamond Resale Comparison

Natural diamonds retain 60-80% of retail value—double the lab-grown rate. However, absolute dollar losses tell a different story.

Consider total economics: Lab diamonds bought at $800-$1,200 per carat lose $400-$800 on resale. Natural diamonds purchased at $4,000-$8,000 per carat lose $1,600-$3,200. The lab-grown buyer faces smaller absolute losses despite worse percentages.

Market psychology drives this gap. Natural stones benefit from scarcity perception and investment mindset. Lab diamonds compete on innovation and ethics, creating parallel markets rather than direct substitution.

What's the deal with secondary market

The diamond is never a financial investment. It is a luxurious item that symbolizes meaningful connections and commitment. Parting with your diamond is always a very hard thing to do since there’s a lot of emotional attachment to it.

However, one of the things people consider when they buy a diamond is the possibility of getting some of their money back in case things don’t go as planned. As it is with all of the luxury, the value is always significantly lower during the resale. The question is not how much money the customer gains, but how little they lose.

A strong secondary market for mined diamonds has emerged only in the last 4 decades, with the rise of the pawn shops and big jewelry networks implementing the trade-in policies.

The usual practice during resale is that a customer gets about 30% of the original retail price back (meaning 70% loss at least). Diamond owners might sell to a jewelry store, pawn shop or directly to another consumer, but they will never be able to return the full amount.

With trade-ins, a diamond might be appraised higher (about 50-70% of the original price tag). Although, the customers are expected to pay extra on top to get the bigger or better quality diamond. So there is no real money return.

Does lab-grown diamond secondary market exist?

Some people claim that lab-grown diamonds don’t have resale value, but that is simply not true. There is an emerging lab-grown diamond secondary market, with some lab-grown manufacturers and sellers practicing trade-ins and buying from the public. One can also sell them to other consumers through social media, online marketplaces or auctions - the demand is there.

However, the main advantage of lab-grown diamonds is that they cost half the price of their mined counterparts. One would lose less money overall even if their man-made diamond was stolen the next day after the purchase. Even if an individual is not able to resell it, it is still money better spent. So the fact that lab-grown diamonds are starting to acquire a resale value only adds to their appeal. Don’t lose. Choose lab-grown!

Here are some number to prove the point:

One mined diamond $10000 (retail price)

Resale value $3000

Loss: $7000

One lab-grown diamond (same 4C’s) $3000 (retail price)

Resale value - $????

Loss: $3000 (if stolen)

Sarah's Diamond Resale Experience

Sarah purchased a 2-carat, F-color, VS1 lab-grown diamond (CVD process, IGI certified) for $2,400 in January 2023 for her engagement ring. After her relationship ended 18 months later, she needed to sell the stone to cover moving expenses. She researched what the equivalent natural diamond would have cost—approximately $14,000 for similar specifications—and wondered about her financial outcome.

Sarah explored three resale channels: direct consignment through the original jewelry retailer, online marketplace sales, and a professional diamond buyer. She obtained quotes from each channel and chose the retailer consignment option, which offered the highest return despite a 3-week waiting period.

Sarah sold her lab diamond for $960, retaining 40% of her original purchase price—a $1,440 loss. However, if she had bought the equivalent natural diamond for $14,000, even at 70% retention rate, she would have lost $4,200 on resale. Her lab diamond choice resulted in $2,760 less absolute financial loss, despite the lower percentage retention. The IGI certification added an estimated $67 premium to her final sale price compared to ungraded stones in the secondary market.

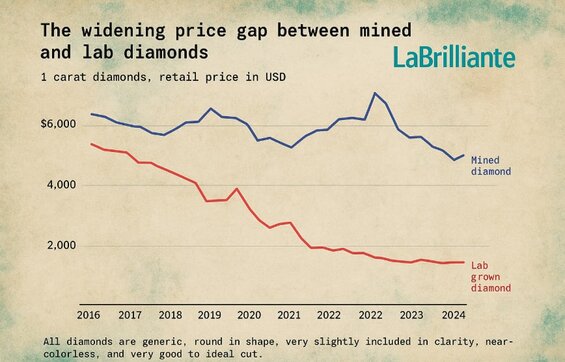

Market Trends Driving Lab Diamond Depreciation

Manufacturing efficiency creates constant downward pricing pressure. Unlike fixed geological supply, lab production capacity expands annually with improving reactor technology and higher yields.

Oversupply emerged prominently since 2020 when production outpaced adoption. China's CVD leadership and India's HPHT specialization created competitive environments benefiting consumers but challenging resale values.

Production costs decreased 15-20% annually through 2024 across belt press, cubic press, and BARS press technologies. These savings flow to consumer pricing but pressure existing inventory values.

Production Cost Impact on Value Retention

Laboratory facilities scale through additional reactors and automation—unlike mining's geological constraints. This scalability advantage for buyers becomes a resale disadvantage for sellers.

Microwave plasma CVD advances reduced growth timeframes while improving consistency. Quality control automation eliminated production waste, further reducing per-carat costs.

The trade-off is clear: immediate purchase savings versus long-term value retention. Professional jewelers increasingly emphasize inventory turnover over holding value.

Oversupply Dynamics and Price Volatility

Global capacity significantly exceeds demand, creating structural oversupply. Resale sellers compete against new inventory at lower prices—similar to technology hardware where newer generations devalue previous models.

Seasonal patterns show stronger pricing October through February during engagement season, softer through summer. Economic uncertainty amplifies these fluctuations.

Jewelry stores prefer just-in-time inventory over stockpiling, reflecting confidence in availability but concern about holding value. This shift indicates industry adaptation to depreciation realities.

"While many perceive lab-grown diamonds as a less valuable option due to their reproducibility, the real game-changer lies in the technological advancements in Microwave Plasma Chemical Vapor Deposition (MPCVD). These innovations not only enhance the gem quality but significantly curtail production time from weeks to days, thereby transforming inventory management strategies across the industry."

Certification and Grading Effects on Resale Value

Certification significantly influences resale performance, with grading verification essential for secondary transactions. IGI specialization in lab-grown identification creates technical advantages, while GIA provides broader consumer recognition.

The 4Cs remain primary value determinants. However, certification credibility plays increasing roles in buyer confidence and pricing power.

Comprehensive grading reports including origin markers maintain 8-12% higher resale values than uncertified stones. Blockchain verification emerging in 2024-2025 shows promise for enhanced documentation.

| Diamond Characteristics | IGI Certified Resale Premium | GIA Certified Resale Premium | Premium Difference (GIA vs IGI) | Database Verification Available |

|---|---|---|---|---|

| 1.0ct D VVS1 Round | +11.2% | +14.5% | +3.3% | Yes/Yes |

| 2.0ct E VS1 Round | +10.8% | +13.9% | +3.1% | Yes/Yes |

| 3.0ct F VS2 Princess | +9.7% | +12.1% | +2.4% | Yes/Yes |

| 1.5ct G SI1 Oval | +8.9% | +11.3% | +2.4% | Yes/Yes |

| 5.0ct D IF Emerald | +12.8% | +16.2% | +3.4% | Yes/Yes |

| 2.5ct H SI2 Cushion | +7.4% | +9.8% | +2.4% | Yes/Yes |

| 1.0ct Type IIA CVD Round | +13.5% | +16.1% | +2.6% | Yes/Yes |

| 1.0ct Type IB HPHT Round | +9.8% | +12.4% | +2.6% | Yes/Yes |

| 4.0ct E VVS2 Radiant | +11.6% | +14.8% | +3.2% | Yes/Yes |

| Uncertified Comparable Stones | -8.5% | -8.5% | 0% | No/No |

Type IIA diamonds command premium resale prices. CVD predominantly produces Type IIA characteristics, while HPHT may create Type IB depending on growth conditions. These specifications directly correlate with performance.

Real-time verification through certification databases becomes crucial as counterfeit documentation occasionally appears. Professional buyers increasingly require database confirmation, making certified stones substantially more liquid.

Strategic Approaches to Maximize Lab Diamond Resale

Smart purchasing improves resale outcomes. Focus on exceptional cut quality, classic shapes, and popular sizes. Round brilliants in 1.0-2.0 carat ranges consistently outperform fancy shapes or unusual sizes.

Timing matters. Engagement season provides optimal conditions, while summer months see softer pricing. Economic conditions influence luxury spending patterns.

Professional appraisal and complete documentation enhance credibility. Updated appraisals reflecting current conditions help establish realistic expectations while providing buyer confidence.

Labrilliante's manufacturer buyback programs offer transparent pricing and simplified processes compared to traditional consignment approaches. These programs reflect industry recognition of secondary market liquidity importance.

Channel selection affects outcomes. Established retailers bring expertise and customer bases individual sellers cannot replicate, despite commission costs and longer timeframes.

Investment Perspective vs Emotional Value Considerations

Lab-grown diamonds require emotional value frameworks rather than investment criteria. Their depreciation patterns make them unsuitable for wealth preservation—similar to luxury vehicles or designer goods.

Ethical sourcing and sustainability consciousness create value beyond financial considerations. Consumers prioritizing environmental responsibility often accept depreciation for aligned values.

Financial pragmatism suggests treating purchases as consumption, not investment. Immediate savings versus natural alternatives justify purchases when viewed symbolically rather than financially.

Marcus vs Jennifer Purchase Decisions - 5-Year Financial Outcomes

Marcus, planning to propose in 2019, needed a 1-carat engagement ring on a $4,000 budget. Jennifer, celebrating her 10th anniversary the same year, had $8,000 allocated for a similar stone. Marcus chose a lab-grown diamond for immediate savings ($3,800 total), while Jennifer selected a comparable natural diamond ($7,800). Both tracked their purchases' resale values through 2024.

Marcus prioritized maximizing stone size and quality within budget, accepting depreciation for immediate gratification. Jennifer viewed the purchase as partial wealth preservation, choosing natural diamonds despite the higher initial cost. Both obtained professional appraisals in 2019 and 2024.

After 5 years, Marcus's lab-grown diamond retained approximately $760 value (20% of original price), representing a $3,040 loss. Jennifer's natural diamond maintained $6,240 value (80% retention), for a $1,560 loss. While Jennifer preserved $2,200 more in absolute terms, Marcus achieved his primary goal—a larger, higher-quality stone for his budget—and calculated the $480 annual depreciation difference as acceptable for his priorities.

Successful retailers educate customers about value proposition differences, focusing on immediate benefits over appreciation potential. This builds appropriate expectations while maintaining satisfaction.

Future value anxiety stems from inappropriate comparisons. Evaluating against natural stone patterns creates unrealistic expectations. Comparison to manufactured luxury goods provides better context.

For wealth preservation, consider alternatives. Precious metals, rare natural gemstones, or established collectibles provide better retention than manufactured diamonds—but cannot replicate personal satisfaction and symbolic significance of diamond ownership.

Frequently Asked Questions

Lab-grown diamonds typically retain 30-40% of their original purchase price in 2025's secondary market. CVD diamonds perform slightly better than HPHT stones, retaining about 5-8% more value, while IGI-certified stones maintain 3-7% higher resale values than GIA-certified lab diamonds.

Lab diamonds depreciate like manufactured goods due to scalable production and improving manufacturing efficiency that reduces costs 15-20% annually. Unlike natural diamonds with geological scarcity, lab production capacity expands continuously, creating oversupply that pressures existing inventory values.

While some experts theorize lab diamonds could appreciate as consumer acceptance grows, current market fundamentals suggest continued depreciation. Manufacturing scalability, ongoing oversupply, and improving production efficiency make lab diamonds excellent for personal enjoyment but poor for wealth preservation in foreseeable conditions.

Despite worse percentage retention, lab diamond buyers face smaller absolute losses—typically $400-$800 per carat versus $1,600-$3,200 per carat for natural diamonds. This reflects the significantly lower initial purchase prices of lab-grown stones.

CVD (Chemical Vapor Deposition) diamonds outperform HPHT stones by 5-8% in resale retention because CVD creates Type IIA diamonds with fewer metallic inclusions. This makes them more desirable in the secondary market compared to HPHT-produced stones.

Global production capacity significantly exceeds demand, creating structural oversupply where resale sellers compete against new inventory at lower prices. Seasonal patterns show stronger pricing October through February during engagement season, with softer values through summer months.

Consignment through jewelry retailers yields the highest retention at 35-45%, while direct consumer sales average 25-35%, and professional buyers offer quick sales but only 20-30% returns. The choice depends on whether you prioritize maximum value or speed of sale.

Focus on exceptional cut quality, classic round brilliant shapes, and popular 1.0-2.0 carat sizes for best resale performance. Ensure proper certification (preferably IGI for lab diamonds) and complete documentation, as certified stones maintain 8-12% higher resale values than uncertified diamonds.