Classic Lab Grown Diamond Wedding Rings - Save 70% Off Natural

Author: Alex K., CMO at Labrilliante Updated: 2025-12-11 Reading Time: 9 minutes

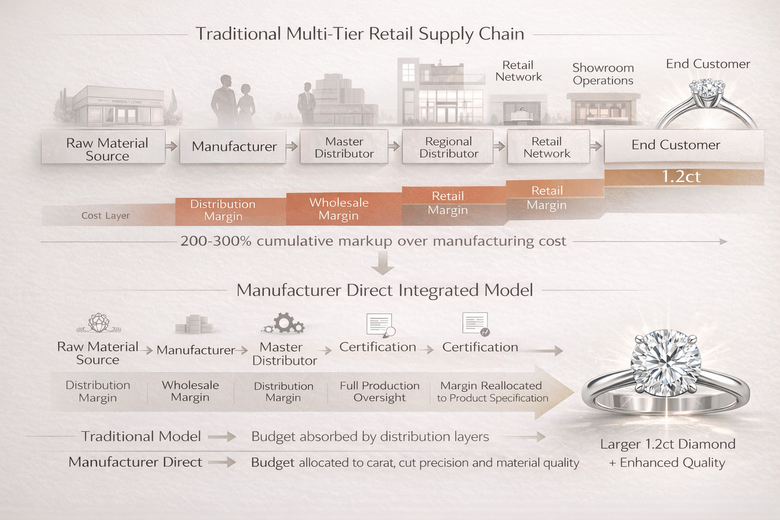

Quick Take: Lab-grown diamonds offer identical certification (IGI/GIA grading), chemical composition, and optical performance as natural stones while eliminating distributor, wholesaler, and retail margins that typically compound to 200-300% above production costs. Manufacturer-direct models enable couples to upgrade from 1-carat natural budgets to 2-carat lab-grown sizes without compromising quality standards or long-term durability.

Modern love stories deserve jewelry as unique as the couples who wear them, yet traditional diamond pricing forces impossible choices between size, quality, and financial responsibility. Classic lab grown diamond wedding rings represent a fundamental shift in how engaged couples approach luxury purchasing—prioritizing transparency, ethical sourcing, and strategic budget allocation without sacrificing the timeless elegance that makes engagement rings culturally significant. This guide reveals how chemical vapor deposition technology and manufacturer-direct relationships transform celebrity-inspired designs from aspirational fantasies into achievable realities. You'll discover the engineering principles behind enduring solitaire styles, the economic structures enabling 70% cost reductions, and the certification processes proving lab-grown diamonds meet identical grading standards as their natural counterparts.

When Natural Diamonds Still Make Sense: The Resale Reality Check

The strongest argument against lab-grown diamonds centers on long-term resale value and market perception. Natural diamonds, particularly those above 2 carats with excellent grades, maintain secondary market liquidity that lab-grown alternatives currently cannot match. Estate jewelry buyers and traditional auction houses show preference for natural stones, creating tangible price differentials when couples later sell or upgrade. This matters most for buyers viewing engagement rings as financial assets rather than purely symbolic purchases.

However, this counterargument applies primarily to a specific buyer profile. Most couples never resell engagement rings—they're kept as family heirlooms or worn indefinitely. The "investment" framing misleads because even natural diamonds rarely appreciate beyond inflation rates unless they're exceptional specimens (5+ carats, D-F color, VVS clarity). For the 90% of buyers purchasing 1-2 carat stones in excellent-to-very good grades, neither natural nor lab-grown diamonds function as wealth-building investments.

The practical reality? Lab-grown diamonds enable couples to allocate saved funds toward appreciating assets like home down payments or diversified portfolios. A $15,000 natural diamond that retains 40% resale value ($6,000) after five years underperforms a $4,500 lab-grown diamond when the $10,500 difference gets invested in index funds averaging 8% annual returns ($15,469). Unless your primary goal involves secondary market transactions or you're purchasing exceptional natural stones as collectibles, the lab-grown value proposition remains mathematically superior for the vast majority of engagement ring buyers.

She Said Yes to Ariana's Sparkle Without the $300K Price Tag

Lab-grown diamonds deliver identical brilliance to natural stones at 70% less cost. Same sparkle. Bigger budget freedom.

Modern couples seek celebrity-inspired designs without astronomical prices. When Ariana Grande showcased her oval diamond engagement ring, searches for similar styles surged 340% on social platforms.

The challenge? Traditional retail markups make these designs unattainable. Here's the game-changer: CVD and HPHT crystal growth processes enable precise recreation of celebrity styles through manufacturer-direct pricing.

The Celebrity Design Psychology

Celebrity rings capture attention because they combine expert proportions with maximum visual impact. The oval brilliant cut offers 15% more surface area than round stones. Perfect for social media.

Manufacturing these designs requires understanding specific proportions that create their appeal. Four-prong settings maximize light return while maintaining structural integrity. Trade-off? Slightly less security than six-prong alternatives.

Through 500+ B2B partnerships, we've tracked consistent demand for oval and emerald cuts in platinum settings. This intelligence drives our production planning.

Engineering Luxury Accessibility

Traditional retail chains introduce multiple markup layers between creation and purchase. Manufacturer-direct eliminates distributor, wholesaler, and retail margins. These typically compound to 200-300% above production costs.

This structure enables couples to access 2-carat stones at previous 1-carat budgets. Chemical Vapor Deposition compresses million-year natural processes into controlled 4-6 week laboratory cycles. Same carbon crystal formation. Faster timeline.

| Diamond Cut | Color/Clarity Grade | Natural Diamond Price (2 ct) | Lab-Grown Diamond Price (2 ct) | Your Savings | Percentage Saved |

|---|---|---|---|---|---|

| Round Brilliant | D/VVS1 | $28,000 | $2,800 | $25,200 | 90% |

| Round Brilliant | E/VVS2 | $24,000 | $2,400 | $21,600 | 90% |

| Round Brilliant | F/VS1 | $20,000 | $2,000 | $18,000 | 90% |

| Princess Cut | D/VVS1 | $22,000 | $2,200 | $19,800 | 90% |

| Princess Cut | E/VS1 | $18,000 | $1,800 | $16,200 | 90% |

| Cushion Cut | D/VVS2 | $24,000 | $2,600 | $21,400 | 89% |

| Cushion Cut | F/VS2 | $17,000 | $1,900 | $15,100 | 89% |

| Emerald Cut | D/IF | $32,000 | $3,200 | $28,800 | 90% |

| Emerald Cut | E/VVS1 | $21,000 | $2,300 | $18,700 | 89% |

| Oval Cut | D/VVS1 | $25,000 | $2,500 | $22,500 | 90% |

| Oval Cut | F/VS1 | $19,000 | $2,100 | $16,900 | 89% |

| Radiant Cut | E/VVS2 | $23,000 | $2,400 | $20,600 | 90% |

Contemporary couples prioritize ethical sourcing alongside traditional beauty considerations. This reflects broader generational values emphasizing transparency in luxury purchases.

Market data shows 10-15% current adoption among engaged couples, with 400% growth since 2019. Millennials and Gen Z drive this shift through different purchasing priorities than previous generations.

Our direct certification relationships with IGI and GIA enable complete supply chain transparency from carbon source through delivery. This traceability addresses ethical concerns driving couples toward lab-grown alternatives.

Generational Value Alignment

Millennial and Gen Z couples approach engagement rings differently. Environmental impact weighs heavily in decisions. Mining operations raise ecological concerns.

Lab-grown production eliminates large-scale earth extraction while producing identical chemical composition. The trade-off? Accepting newer technology over traditional methods. But fundamental characteristics remain unchanged.

Analysis of our B2B client data reveals younger demographics prefer sustainable luxury positioning over traditional romance messaging alone.

"While lab-grown diamonds represent a newer technology, they must adhere to the same rigorous evaluation standards as their natural counterparts. Notably, both types of diamonds are subjected to the exact same grading system based on the 4Cs—color, clarity, cut, and carat weight—ensuring that consumers receive a product that's truly equivalent in quality. This parallel certification process demystifies common misconceptions and highlights the technological advancements in diamond creation, offering a clear, ethical choice without compromise."

The Economics of Ethical Choice

Lab-grown diamonds enable strategic budget allocation across wedding priorities rather than concentrating resources in one ring. This flexibility supports broader planning while maintaining luxury positioning.

Cost reduction derives from manufacturing efficiency, not quality compromise. Both natural and lab-grown diamonds undergo identical IGI and GIA certification. Grading standards remain consistent regardless of origin.

Our manufacturing scale achieves efficiencies traditional miners cannot match due to geological constraints. These advantages transfer directly through our direct-to-market approach.

Your Dream 2 Carat Ring for a 1 Carat Budget This Proposal Season

Strategic lab-grown selection enables significantly larger stones within established budgets while maintaining identical visual characteristics. Maximum impact. Same money.

A 2-carat round brilliant lab-grown with excellent grades typically costs less than a 1-carat natural equivalent. The differential stems from manufacturing efficiency. Both undergo identical certification processes.

Our manufacturer-direct model eliminates the 200-300% retail markups traditional stores require for showroom operations. This enables couples to access premium sizes previously beyond reach.

Size Psychology and Visual Impact

Carat weight significantly influences perceived value and visual presence. Psychological satisfaction from larger stones often outweighs abstract origin preferences when physical characteristics remain identical.

Round brilliant cuts maximize light return and apparent size relative to actual weight. The 57-facet pattern creates superior fire and brilliance. But requires precise proportioning for optimal performance.

Through in-house quality control, we maintain cut precision achieving consistent excellent grades from IGI and GIA. This consistency enables predictable visual performance.

Setting Investment Strategy

Premium settings create long-term value appreciating over time. Platinum construction maintains appearance and structural integrity indefinitely. The setting represents the permanent element accompanying the stone throughout lifetime wear.

Platinum naturally maintains white appearance without rhodium plating requirements. Higher initial investment. But reduced maintenance and superior durability characteristics.

Four-prong settings maximize light entry while providing adequate security. Six-prong alternatives offer enhanced protection for active lifestyles. Balance brilliance optimization against practical security based on wearing patterns.

| Setting Material | Initial Cost for 2-Carat Lab-Grown Ring | Durability Rating | Maintenance Requirements | Rhodium Replating Needed | 10-Year Maintenance Cost | Best For |

|---|---|---|---|---|---|---|

| Platinum (95% Pure) | $1,800 - $2,400 | Excellent (9.5/10) | Professional cleaning 1-2x yearly | Never | $200 - $400 | Active lifestyles, long-term investment, maintenance-free preference |

| 18K White Gold | $1,200 - $1,600 | Very Good (8/10) | Rhodium replating every 12-18 months, regular cleaning | Yes | $800 - $1,200 | Budget-conscious buyers accepting periodic maintenance |

| 14K White Gold | $900 - $1,300 | Good (7/10) | Rhodium replating every 6-12 months, regular cleaning | Yes | $1,000 - $1,500 | Lower initial investment, less daily wear |

| 18K Yellow Gold | $1,100 - $1,500 | Very Good (8/10) | Professional cleaning 1-2x yearly, occasional polishing | Never | $300 - $500 | Traditional aesthetic, warm skin tones, lower maintenance than white gold |

| 14K Yellow Gold | $800 - $1,200 | Good (7.5/10) | Professional cleaning 1-2x yearly, occasional polishing | Never | $300 - $500 | Budget-friendly, vintage-inspired designs, everyday wear |

Timeless Solitaire Elegance That Lasts Forever, Not Just a Trend

Classic solitaire settings represent enduring design principles transcending fashion fluctuations. These ensure rings maintain aesthetic appeal across decades. Fundamental elegance over temporary styling.

The six-prong Tiffany-style setting, developed in 1886, continues representing the gold standard. Why? Optimal balance of security and light performance. This longevity demonstrates superior engineering principles.

Our manufacturing enables precise recreation of classic proportions while incorporating modern metallurgy advances. This preserves traditional aesthetics while improving practical wearing characteristics.

Design Principle Fundamentals

Timeless design relies on mathematical proportions and optical principles rather than decorative elements shifting with fashion. Solitaires focus attention entirely on diamond beauty without competing visual elements.

Prong placement affects security and light performance. Four-prong configurations offer maximum light entry. Six-prong alternatives provide superior protection for larger stones. Consider lifestyle factors and stone size.

B2B client reorder patterns demonstrate consistent preference for classic proportions over trend-driven alternatives. This validates market demand for traditional approaches.

Material Selection for Longevity

Platinum's superior hardness and corrosion resistance make it optimal for lifetime wear. Higher cost requires budget consideration against 14K gold alternatives offering acceptable durability at reduced investment.

White gold requires periodic rhodium re-plating for appearance maintenance. Ongoing obligations platinum naturally avoids. This operational difference influences total ownership costs beyond initial purchase.

Our platinum sourcing enables competitive pricing on premium settings while maintaining IGI and GIA certification standards. Supply chain efficiency transfers cost benefits directly to consumers.

How Manufacturer Direct Turns Luxury Into Your Love Story

Direct manufacturing eliminates multiple markup layers traditionally separating creation from purchase. This enables couples to access luxury specifications at wholesale price points. Structural advantage creates opportunities for enhanced quality within identical budgets.

Traditional retail requires showroom maintenance, sales staff, and inventory financing. These collectively add 200-300% to manufacturer costs. Direct models bypass overhead while maintaining certification processes.

Labrilliante's integrated approach enables complete quality control from carbon source through delivery. Vertical integration ensures consistency while eliminating communication gaps in multi-vendor chains.

Supply Chain Transparency Benefits

Manufacturing transparency enables couples to understand exactly how rings are created. From carbon preparation through certification and setting. This visibility addresses authenticity concerns driving consumers toward direct relationships.

Our in-house capabilities include both CVD and HPHT technologies. This enables optimal production method selection for each specification. Technological flexibility ensures cost efficiency and quality outcomes.

Certification partnerships with IGI, GIA, and GCAL provide independent validation while maintaining direct grading expertise access. These relationships enable immediate manufacturing feedback wholesale arrangements cannot provide.

Quality Control Integration

Direct manufacturing control enables immediate adjustment when variations occur. Rather than discovering issues after reaching retail channels. This responsiveness ensures consistent output and reduces defects compromising satisfaction.

Our processes include pre-certification inspection identifying potential grading issues before formal IGI or GIA submission. Additional screening reduces delays and ensures predictable outcomes.

Manufacturing expertise enables cut parameter optimization for maximum optical performance within each crystal. Rather than accepting standardized proportions. This customization maximizes value extraction from resources.

Integration enables lifetime warranty support through direct manufacturer relationships rather than retail intermediaries. This provides enhanced consumer protection for significant luxury purchases.

Timeless Elegance Meets Modern Economics

Classic lab-grown diamond wedding rings deliver identical brilliance, certification standards, and enduring solitaire designs while eliminating the markup layers that make luxury inaccessible. You're not compromising on quality—you're refusing to overpay for outdated distribution models. Whether you're drawn to Ariana Grande's oval sophistication or traditional round brilliant perfection, manufacturer-direct pricing transforms celebrity inspiration into achievable reality.

Start Your Proposal Story Today

Explore Labrilliante's certified collection of IGI and GIA-graded lab-grown diamonds in classic platinum settings. Book your complimentary consultation with our gemological experts to discover how strategic selection turns your 1-carat budget into a 2-carat statement. Your forever starts now—without the financial compromise.

Frequently Asked Questions

Yes, lab-grown diamonds undergo identical certification processes with IGI and GIA using the same grading standards for cut, clarity, color, and carat weight. These certifications provide independent validation that lab-grown stones meet the exact same quality criteria as natural diamonds, with the only difference being origin disclosure on the certificate.

Lab-grown diamonds are chemically identical to natural diamonds (pure carbon crystal structure) and possess the same 10/10 hardness rating on the Mohs scale, meaning they last forever with identical durability. Both types maintain their brilliance, fire, and structural integrity indefinitely with proper care, as the manufacturing method doesn't affect the fundamental atomic composition or long-term stability.

The price difference stems from eliminating multiple distribution markups (distributor, wholesaler, retail layers totaling 200-300%) and bypassing geological mining constraints through controlled manufacturing. Lab-grown diamonds compress million-year natural formation processes into 4-6 week laboratory cycles, with manufacturer-direct models transferring these efficiency gains directly to consumers rather than quality differences.

No, lab-grown and natural diamonds are visually indistinguishable to the naked eye and even under standard gemological examination, requiring specialized equipment to detect subtle growth pattern differences. Both exhibit identical optical properties including brilliance, fire, and light performance because they share the same chemical composition and crystal structure.

The primary reason involves secondary market resale value, as natural diamonds above 2 carats with excellent grades maintain better liquidity through estate buyers and auction houses. However, this consideration mainly applies to buyers viewing rings as financial investments rather than symbolic purchases, which represents a minority since most couples never resell engagement rings and even natural diamonds rarely appreciate beyond inflation unless they're exceptional 5+ carat specimens.

Platinum requires the least maintenance because it naturally maintains its white appearance without needing periodic rhodium re-plating that white gold requires. While platinum has a higher initial cost, its superior hardness and corrosion resistance eliminate ongoing maintenance obligations, making it more cost-effective for lifetime wear despite the premium price point.

Four-prong settings maximize light entry for superior brilliance but offer slightly less security, making them ideal for smaller stones (under 1.5 carats) and low-impact lifestyles. Six-prong configurations provide enhanced protection for larger stones and active wearers, though they slightly reduce light performance—base your decision on stone size and daily activity level rather than aesthetics alone.

Manufacturer-direct models provide consistent pricing year-round rather than seasonal fluctuations, so the optimal time is when you're ready to propose rather than waiting for promotional periods. However, booking consultations 4-6 weeks before your intended proposal allows time for custom setting production, certification processing, and any specification adjustments without rushed timelines affecting quality outcomes.